- Urea prices bottoming out

- Large volumes booked in Egypt and Middle East, with Europe attracting further tonnage

- India announces urea purchasing tender

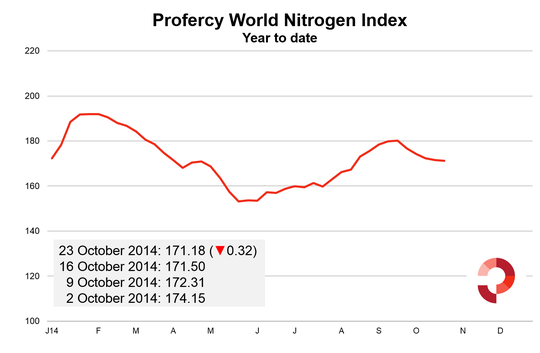

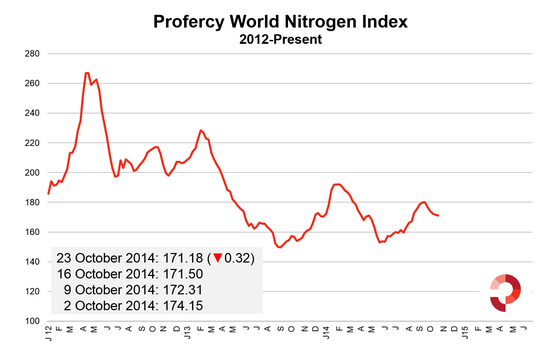

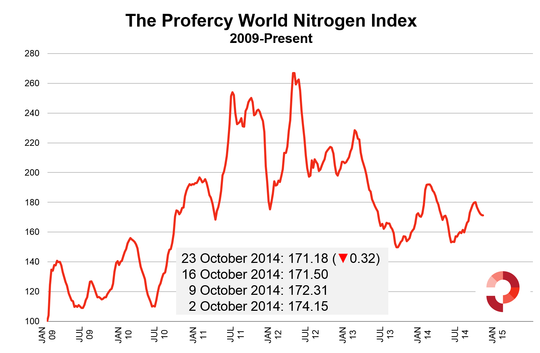

It has been a pivotal week for urea, with only one of the three benchmarks utilised by the Nitrogen Index registering a lower price average. Quoted prices for Yuzhnyy prilled urea and Egyptian granular urea saw little or no change. However, for the latter the low end of the price range was established earlier in the week, with higher prices achieved yesterday. This positive news for producers follows four consecutive weeks of urea price depreciation that has wiped nearly 10 points off the index. However, the Index has only dropped by 0.31 points this week.

As our weekly report noted last week “buyers are still waiting to see the real price floor, but the fundamentals suggest this is not far away.” In the West, price decline has slowed significantly in key markets and demand has begun to surface. It is noteworthy that following weeks of slim sales of Egyptian product (also affected by supply constraints) that over 25,000t of granular urea has been booked this week. Further tonnage from other origins has also been booked for Europe.

Indian tender taking place next week – Chinese export tax a key factor

In the East, positive news for producers came with the announcement of a further Indian purchasing tender. The last major purchasing tender was held at the end of September and led to a massive 1.8m. tonnes being booked. Due to be held next week, India will most likely be targeting a slightly lower volume through the tender.

As is often mentioned on this blog, the major supplier to India is China. A key price shaping factor in the forthcoming tender will be the end of the low-tax window on 31 October. As opposed to the modest tax on urea shipments from China at present, a high tax of 15% + Rmb 40pt will apply. Traders and suppliers do have an option to place product in bonded store in advance to avoid exposure to tax, but this comes at a cost.

With global grain prices still low, the evolving urea market will undoubtedly be a dominant theme of the forthcoming International Fertilizer Association Conference in Singapore next week. The key question for delegates will be whether demand can sustain an increase in global prices.

[tabs] [tab title=”Profercy Nitrogen Index – Year to date”]

[/tab] [tab title=”Profercy Nitrogen Index – 2012 Onwards”]

[/tab][tab title=”Profercy Nitrogen Index – 2009 Onwards”]

[/tab][/tabs]

Profercy World Nitrogen Index: Methodology

The Profercy World Nitrogen Index is published every week and is based on price ranges provided by the Profercy Nitrogen Service. This includes prilled and granular urea, UAN, AN, ammonium sulphate and ammonia. A full methodology can be found here.

Free Trials of the Profercy Nitrogen Service

Profercy’s Nitrogen Service includes daily news, weekly analysis and monthly forecast reports. For more detailed information on specific products and individual markets, please sign up for a free trial or for more information on the Profercy Nitrogen Service, please click here.