The below entry draws heavily on Profercy’s latest Nitrogen Market Forecast. To obtain a copy, you can register for a free trial of Profercy’s Nitrogen Service here.

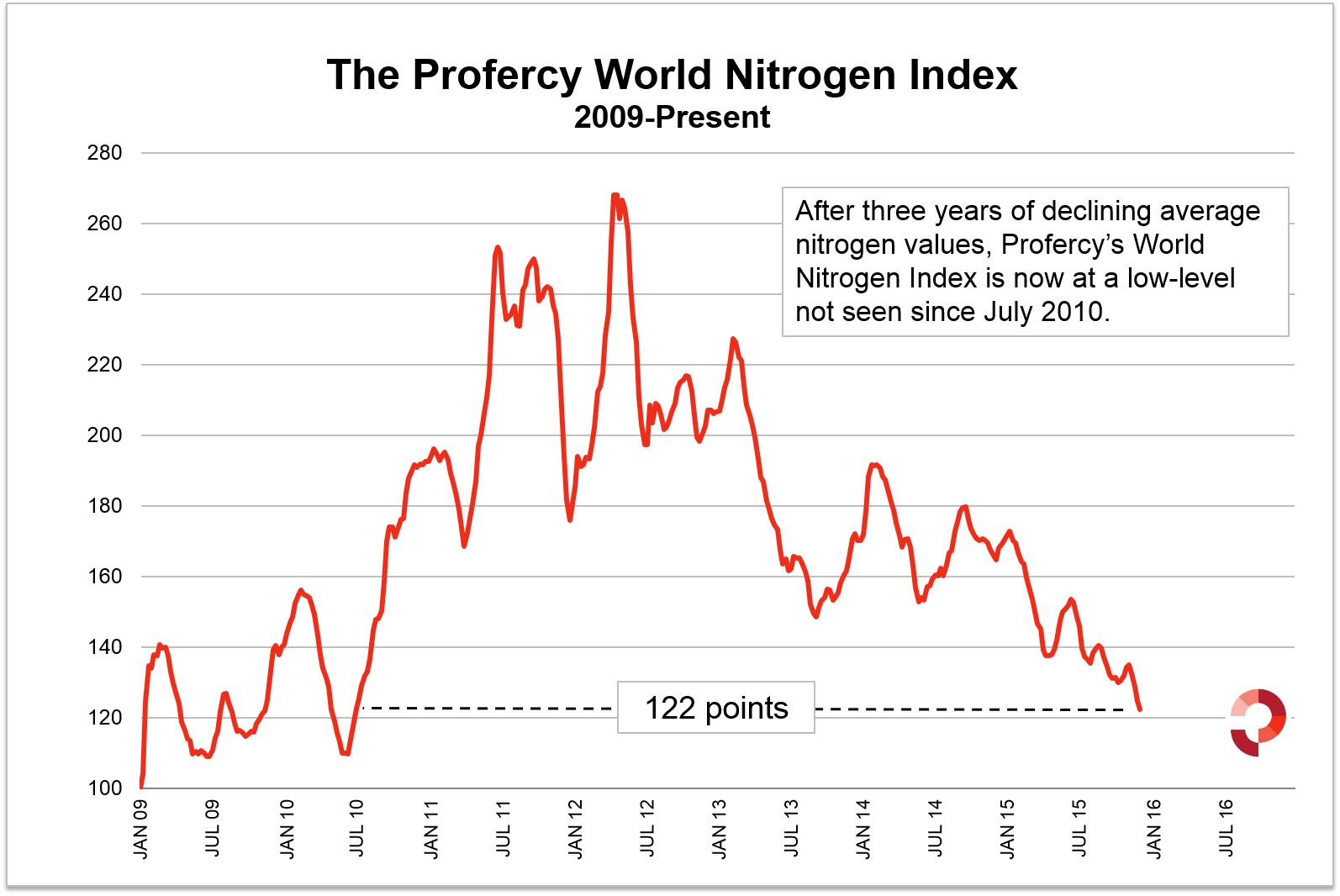

It has been another challenging year for urea. As evidenced by the graph below, average nitrogen values prices have fallen for three years. Indeed, the Nitrogen Index, heavily influenced by urea values, is at at a five-year low of 122 pts having lost over 50 points since the January 2015 peak.

During this period, nitrogen prices have fallen as follows:

- Black Sea Prilled Urea – Down $95pt

- Egyptian Granular Urea – Down $105pt

- Black Sea Ammonia – Down >$135pt

- Black Sea Ammonium Nitrate – Down $80-90pt

2016 is expected to be another year of low prices. Urea is not in short supply with any gains from Q1 seasonal demand likely to be lost in Q2 as major market demand eases.

Q4 2015: October run-up short lived

Consistent with Profercy’s mid-October Nitrogen Forecast, urea values staged a modest recovery for November shipments. From 1 October to 5 November, Middle East spot prices gained $15pt and Yuzhnyy prills $10pt fob, while Egyptian granular urea traded over $300pt fob for the first time since June. The run-up was primarily driven by traders covering in short sales in markets such as India, Europe and Turkey.

However, prices soon came under pressure once this demand was covered or alternative supply became available (for example, through improved Egyptian production levels). Prices in the East and West soon dipped. By the end of November, Egyptian granular urea prices had lost $40pt. During this period, returns in major markets for granular urea slipped, knocking returns for contract cargoes.

For granular urea producers in the Middle East, some relief was afforded in early December by major Indian demand, which offered Arab Gulf producers returns $10-15pt higher than possible in the West while also providing an outlet for 1m. tonnes of Chinese urea.

Where next for urea in 2016?

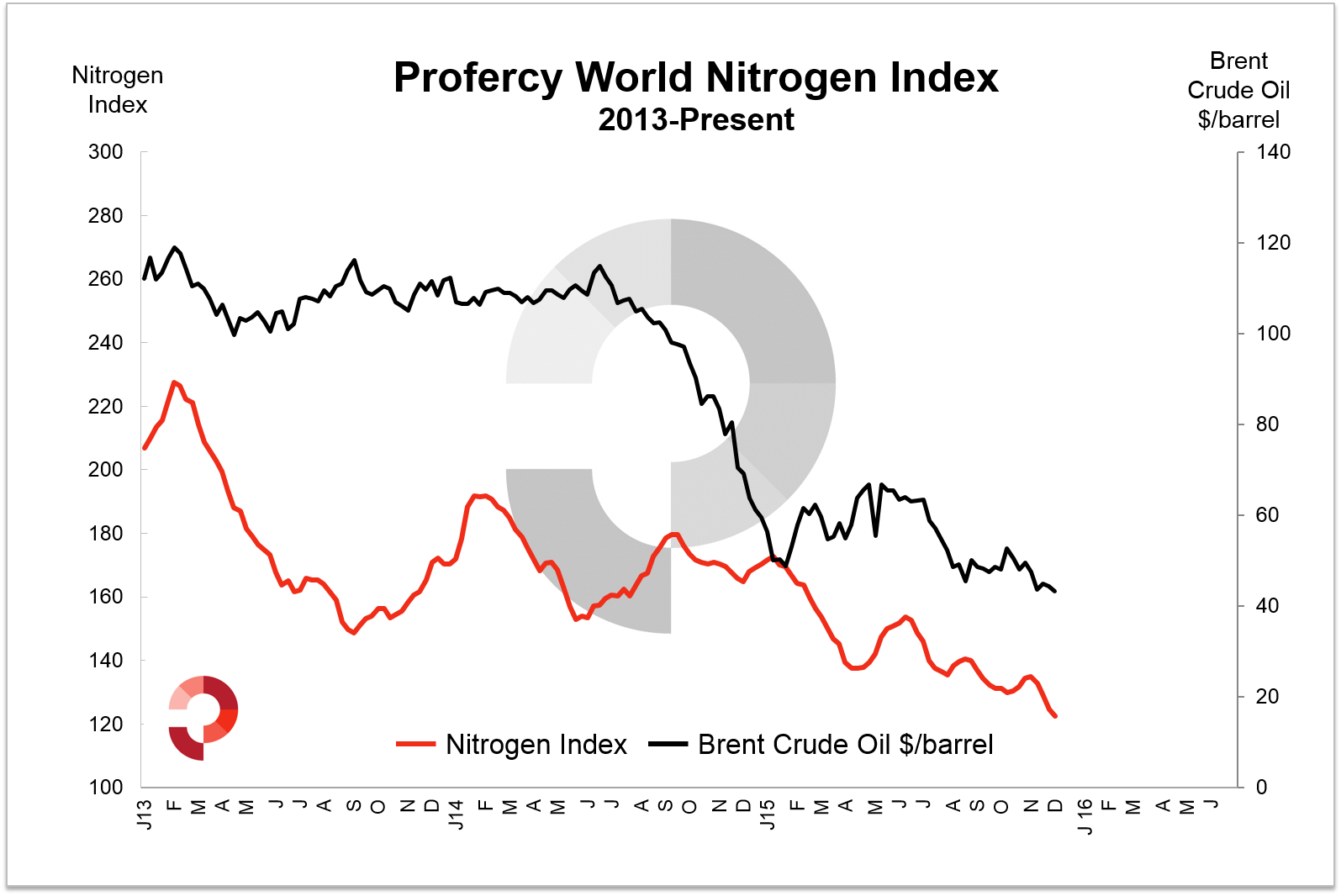

As noted in our latest Nitrogen Forecast, the urea market is not in short supply medium term and 2016 is expected to be a difficult year. In a year where supply additions are expected in the US, Asia and Africa, low energy values will continue to play a key role in supporting production at ever lower prices for swing producers, particularly in Russia and Ukraine.

In the East, the focus will be on China, the single largest exporter of urea, and the cost of coal, the main feedstock for its nitrogen industry. Coal prices have declined this year and there are no signs of this trend reversing in the near term. On the demand side, low agricultural commodity prices are providing farmers worldwide with little confidence.

In terms of the short-term prospects for the market, in Q1 granular urea producers’ hopes will be firmly pinned on major market demand in the US, Europe and, to a lesser degree, Brazil. Seasonal demand in these markets has traditionally supported a run-up in urea prices in Q1, although it should be noted that this year, the peak was witnessed in the first half of January. The prospects of a run-up and the potential implications are assessed in our latest forecast, available through the Profercy Nitrogen Service.

However, for prilled urea, there are fewer positives on the horizon, particularly for Chinese prilled urea producers who have been reliant on major Indian demand to support prices above $240pt fob. Even in the West, the prospects of a Q1 price run-up appear limited.

Receive our latest forecast: For Profercy’s latest detailed Nitrogen market forecast, including supply and demand analysis, please register for a no-obligation trial of the Profercy Nitrogen Service.

[clear_floats]

Free Trials of the Profercy Nitrogen Service

Profercy’s Nitrogen Service includes daily news, weekly analysis and monthly forecast reports. For more detailed information on specific products and individual markets, please sign up for a free trial or for more information on the Profercy Nitrogen Service, please click here.

Profercy World Nitrogen Index: Methodology

The Profercy World Nitrogen Index is published every week and is based on price ranges provided by the Profercy Nitrogen Service. This includes prilled and granular urea, UAN, AN, ammonium sulphate and ammonia. A full methodology can be found here.