Urea

Urea, boasting a nitrogen content of 46%, holds a prominent position in the realm of fertilizers due to its efficacy in providing essential nutrients to plants, making it a preferred choice for farmers aiming to enhance crop yield and quality. According to the International Fertilizer Association the product represents 56% of the world market. The standard crop-nutrient rating (NPK rating) of urea is 46-0-0.

It stands as the most concentrated solid nitrogen fertilizer, typically marketed in the prilled form, offering advantages such as water solubility, ease of application, and relatively low cost compared to other nitrogen fertilizers.

Annually, over 180 million tonnes of urea are produced globally, with supply largely influenced by key producers in Middle East, Russia, USA, SE Asia, North Africa and in China.

The majority of urea capacity additions in recent years produce granular urea, as opposed to prilled urea. Many of these regions benefit from abundant natural gas reserves, serving as primary feedstock for urea production, although some utilise coal.

Recent significant additions in the past decade include those in North America, Algeria, Nigeria, SE Asia and Malaysia. Major producers include CF Industries, Yara, Sabic, Qafco, Fertiglobe, MOPCO, Petronas and Indorama.

The uneven global disruption of feedstock reserves, alongside the inherent seasonality of global fertilizer demand ensures considerable international trade and shifting trade patterns. Major import markets include those in India and Brazil. The latter has imported over 7m. tonnes/year of urea alone in recent years while India has reduced import dependence slightly of late through the investment in several world-scale urea plants.

Similarly, the United States, once the second-largest importer, has experienced a decline in imports since 2015 due to substantial capacity expansions within the country. This wave of new projects has bolstered the US’s urea production capacity by nearly 5 million tonnes per year, reshaping global import dynamics.

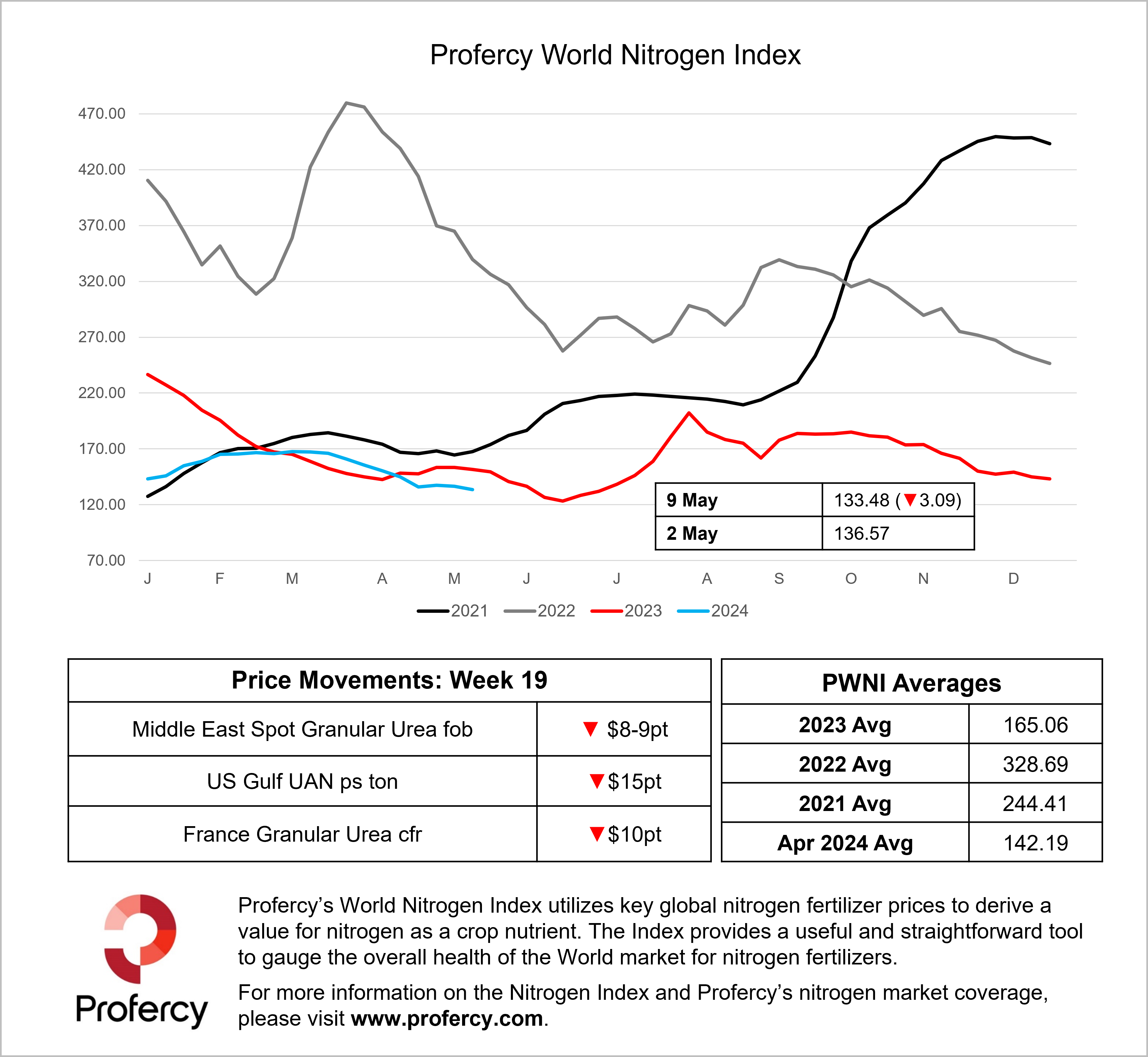

Through the Profercy Nitrogen Service, Profercy provides expert market analysis of global granular urea markets. This includes weekly price assessments for all major pricing points, such as:

- Arab Gulf fob: spot values, US and Brazil netbacks

- SE Asia fob – granular

- China fob – prills and granular

- SE Asia cfr – prills and granular

- Baltic fob – prills and granular

- Nigeria fob – granular

- Egypt fob – granular

- Algeria fob – granular

- North Africa full range fob – granular

- France (Atlantic) cfr – granular

- US Gulf pst fob prompt/7 days – granular

- US Gulf pst fob to 30 days – granular

- US Gulf metric cfr to 30 days – granular

- Brazil cfr – granular

Full price history going back over several years is available to subscribers via the Profercy Hub.