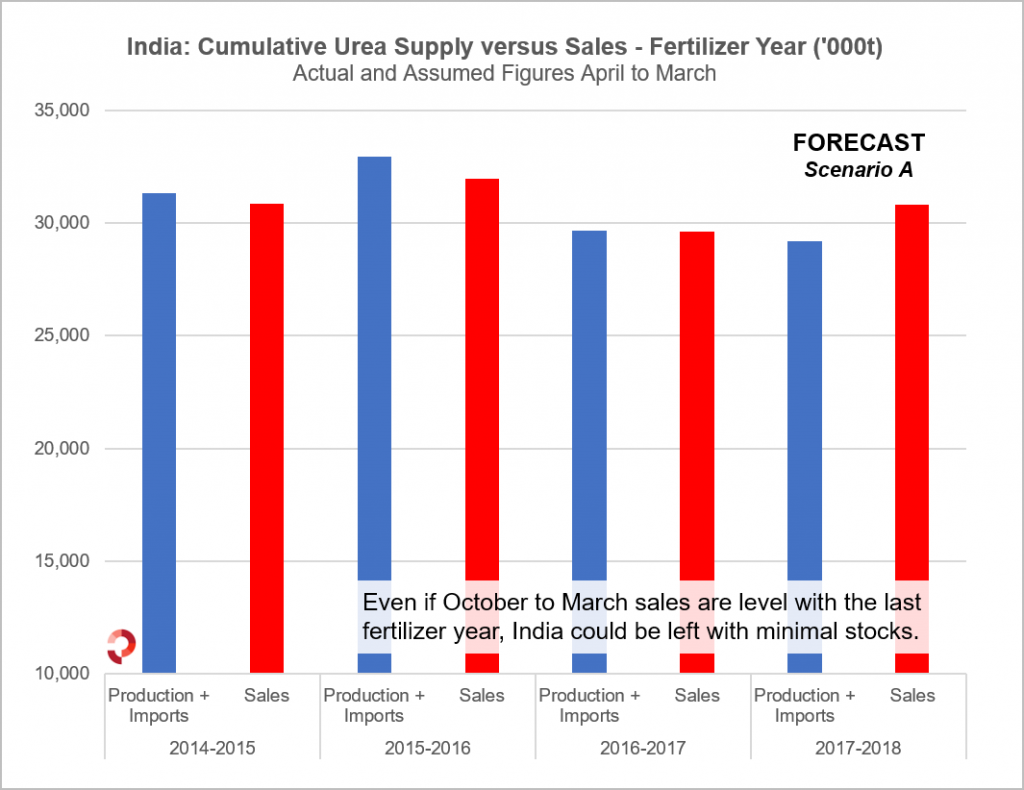

India has re-entered the urea market this week with a fresh purchasing tender scheduled for 31 October for shipments through to 20 December. Over 1.3m. tonnes have been booked since early September with each of the three major tenders resulting in higher prices. Despite these purchases, the latest supply, production and sales statistics suggest that demand could heavily reduce domestic stocks if monthly production or imports do not increase in the coming months. Both cumulative production and imports lag those of the previous fertilizer year (basis April-March) while sales are ahead.

In summary:

- Sales: September urea sales totaled 2.50m. tonnes, bringing cumulative sales for the current fertilizer year (April onwards) to 14.74m. tonnes versus 14.41m. tonnes in the 2016-2017 fertilizer year.

- Production: April to September production was 11.53m. tonnes versus 11.94m. tonnes in the previous fertilizer year.

- Imports: September imports of 0.45m. tonnes were ahead of those in the previous year and bring the April to September total to 3.20m. tonnes, behind the comparable 2016-2017 figure of 3.59m. tonnes and the 2015-2016 figure of 3.85m. tonnes.

- Closing stocks: Closing stocks at the end of September were 1.11m. tonnes, down 0.43m. tonnes on the end September 2016 level of 1.54m. tonnes.

- Total Available Supply End-September: Total available supply for the current fertilizer year at the end of September was 15.84m. tonnes compared to 17.07m. tonnes in the previous campaign. This includes closing stocks.

Forward Supply/Demand Position: Is a supply squeeze possible?

The above chart assumes urea production is consistent with the final six months of the last fertilizer year at over 12.2m. tonnes. It also factors in contracted imports of only 150,000t/month from Oman beyond November. Import purchases via the IPL and RCF tenders up to end-November shipment are considered.

- Sales Scenario A: If sales for the remainder of the fertilizer year are level with the five-year average, totalling 16.1m. tonnes, then this would bring total sales for the 2016-2017 fertilizer year to 30.8m. tonnes. This would be above the previous year sales total of 29.6m. tonnes, but in line with the five-year average of 30.6m. tonnes. This would eradicate all stocks with the states and leave a deficit of over 500,000t if no further imports are booked via tender.

- Sales Scenario B: If sales for October 2017 to March 2018 match the low level of the previous fertilizer year, just 15.19m. tonnes, total sales for the current fertilizer year would be 29.91m. tonnes, almost 700,000t below the five year average. This would leave stocks at just below 0.4m. tonnes if no further imports are booked via tender.

Sales figures for the coming months are clearly important, as well as domestic production rates. In October 2016 sales were hit by the demonetisation of high value currency notes. The current supply and demand balance indicates that further major inquiries for urea shipments through to year end would be necessary to guarantee a buffer stock.