After several years of the global nitrogen complex being balanced to long, 2018 saw a distinct shift. Chinese urea exports whittled down to a fraction from their heyday while Iranian product came under US sanctions.

Urea prices started to rally in May and remained firm until end-October. The price floor in 2018 was above the previous two years and the rally sent prices to highs last seen in 2015.

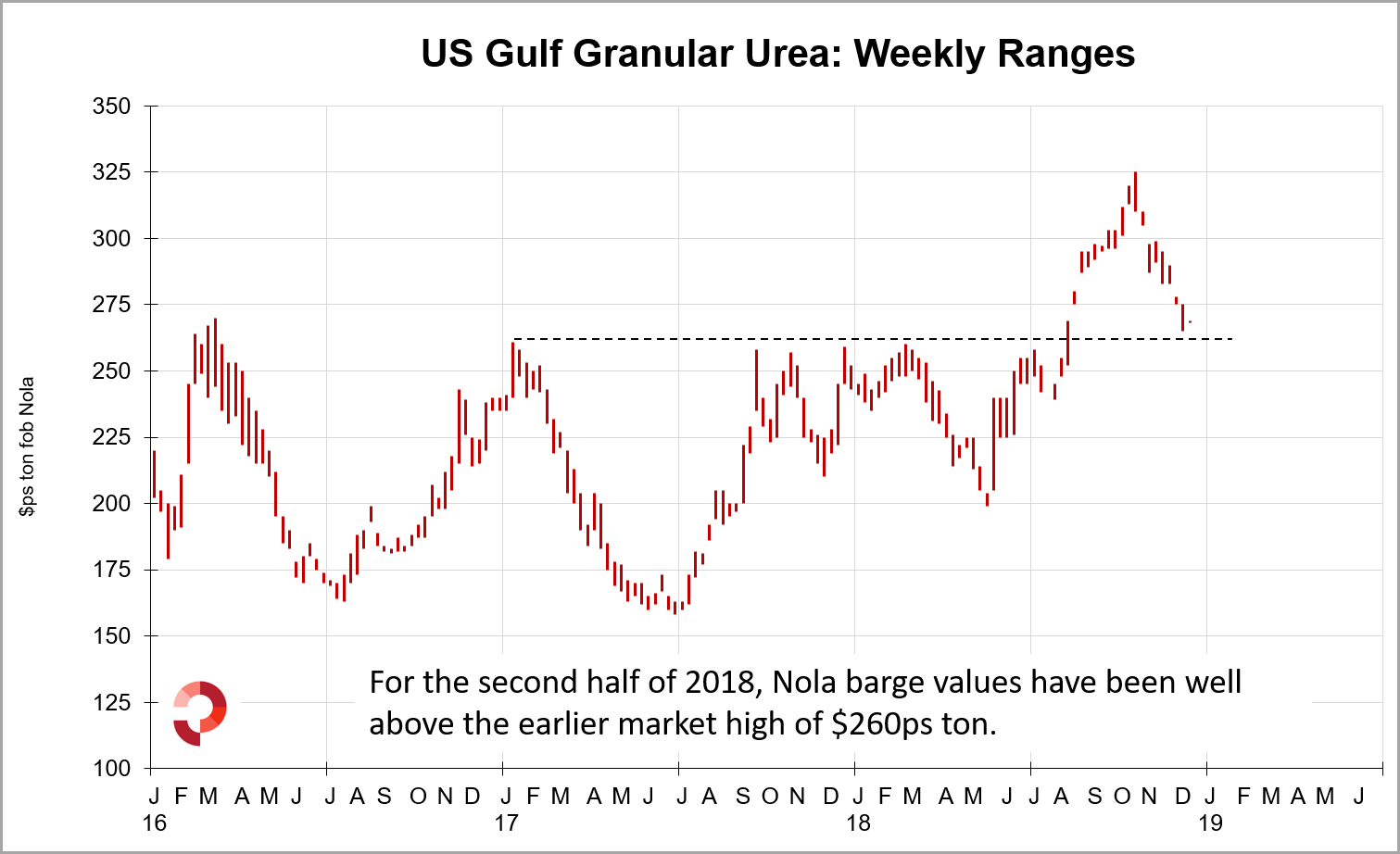

This was amongst the most evident in the US Gulf where urea values have been well above the $260ps ton fob Nola mark since August climbing from a year low of $199ps ton. Indeed, by mid-October urea barges had traded at a year high of $325ps ton. As evidenced in the graph above, in 2016 and 2017, US Gulf prices barely broke above the $250ps ton mark.

Similar price moves were seen in almost all regions with an Omani cargo sold around $340pt fob Arab Gulf during the rally. In Egypt, prices hit a low of $222pt fob in May and a high of $345pt fob in October.

However, it was also a year of two halves. Higher prices led to push back from buyers with purchases often deferred as much as possible. Having supported a run-up in urea values through Q3, Brazilian buyers stepped back in October. This at a time when imports gained pace with a significant 638,000t arriving in October and 982,000t in November. The high availability of product quickly turned sentiment and offers quickly declined. Last week, Profercy report business concluded down to $280-285pt cfr.

The extent of the length in the global market was exposed in the 14 November Indian purchasing. 3.6m. tonnes of urea were offered, double the offered volumes in the previous two tenders. However, this led to a record 1.8m. tonne purchase but any hope that this would absorb much of the length in the market was shattered when it became clear that around 1m. tonnes of the tender was to be supplied from Chinese ports.

Since then markets have continued an accelerated decline but nonetheless remain well above year on year. Profercy’s World Nitrogen Index currently stands at 135.69 points, up 15.40 points year on year.

By Michael Samueli, Nitrogen Market Reporter

E: Michael.Samueli@profercy.com