China has thrown a second curveball at the international urea markets in as many months with the renminbi devaluation making Chinese urea $5-15pt cheaper. The availability of the cheaper urea as a result of the unforeseen macroeconomic factors comes at a time when international urea markets are on a downtrend, triggered by high volumes of Chinese urea being made available for export.

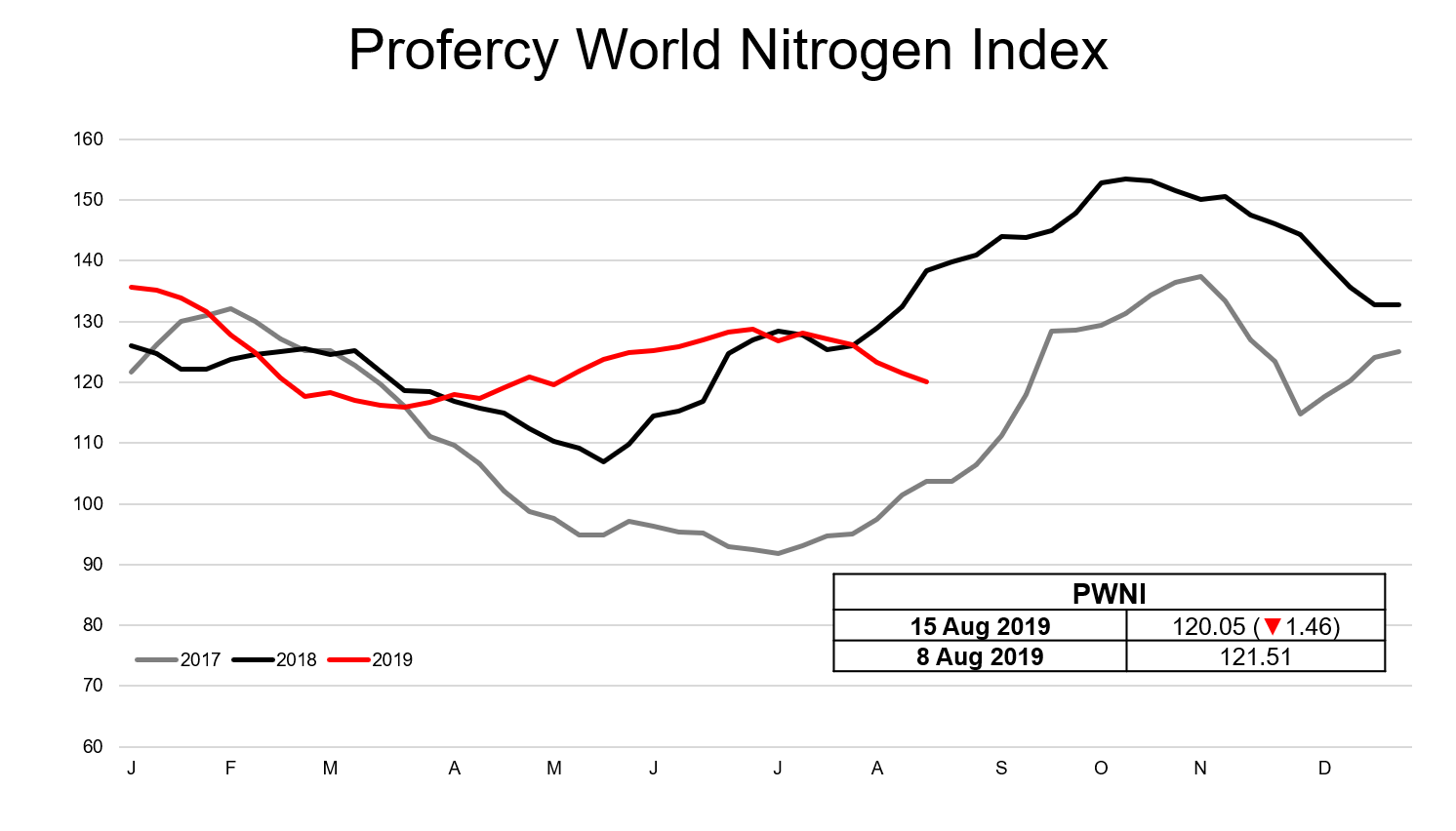

Nitrogen values have declined for five consecutive weeks with the Profercy World Nitrogen Index down a combined 8.01 points over the period to 120.05 points, 18-19 points lower year on year.

The Rmb was downgraded around 2.5% at the beginning of August and was soon trading over Rmb7 to the greenback, for the first time since 2008. Granular urea prices first declined by around $5pt to the low-$270s pt fob and this week fell a further $10pt as international traders pushed for price reductions amid the weakness in the global urea markets.

With producers in nearly all major regions facing at least some supply pressure and needing to sell, suppliers have dropped prices. Arab Gulf and Indonesian producers have been forced to lower prices down to $260pt fob to compete with the Chinese supply for Asian markets while producers in North Africa and the Baltic have been competing for the western markets.

The downturn in the urea markets was on the whole unexpected and came soon after the 1 July Indian MMTC purchasing tender which saw 1m. tonnes of Chinese urea offered against the tender, a far higher volume than expected and far earlier in the year than anticipated.

This was the first curveball. However, and ironically, Chinese suppliers have not been able supply the volumes committed to India on time leaving India potentially short and other suppliers frustrated at the lost opportunity to sell more product.

By Michael Samueli, Nitrogen Market Reporter