Activity in the global urea market has slowed amidst continued macroeconomic certainty, forex volatility and with supply routes disrupted by efforts to control the spread of coronavirus. The focal point this week has been efforts in India to secure further urea via a fresh import inquiry.

State procurement agency RCF issued a fresh urea tender on 21 March to close this coming Monday 30 March. Shipments are required by 5 May, offering a significant outlet for traders with positions, as well as producers in the east and west yet to place April shipments. The tender is also set to test China’s interest in international business. Chinese product has been absent from the market since late last year.

However, in the days following the tender announcement, Prime Minister Narendra Modi announced that India would enter into lockdown to stem the spread of coronavirus. With several Indian ports subsequently issuing force majeure notices, impacting incoming shipments of fertilizer, and with port activity generally heavily disrupted, the future of the tender was in doubt. The market currently expects the tender to take place as planned.

Against this backdrop, there has been little demand worldwide at the importer or trader level for new shipments of granular urea. Producers in North Africa have been forced to slash prices by $15-20pt in order to find liquidity for first half April movement. Nearby European and Turkish markets have slowed with many focused on executing earlier business. Elsewhere in the West, offers into Brazil slid leaving the Brazilian market at a considerable discount to the US Gulf, where prompt barges have traded as high as $275pt cfr equivalent. May barges have traded at more than a $20pt discount on prompt.

The greatest concern for urea producers over the last week has been the return of China to the international market. With domestic markets slow and operating rates over 70%, Chinese producers have been willing to back business at competitive levels for movement to western markets, as well for possible shipments to India.

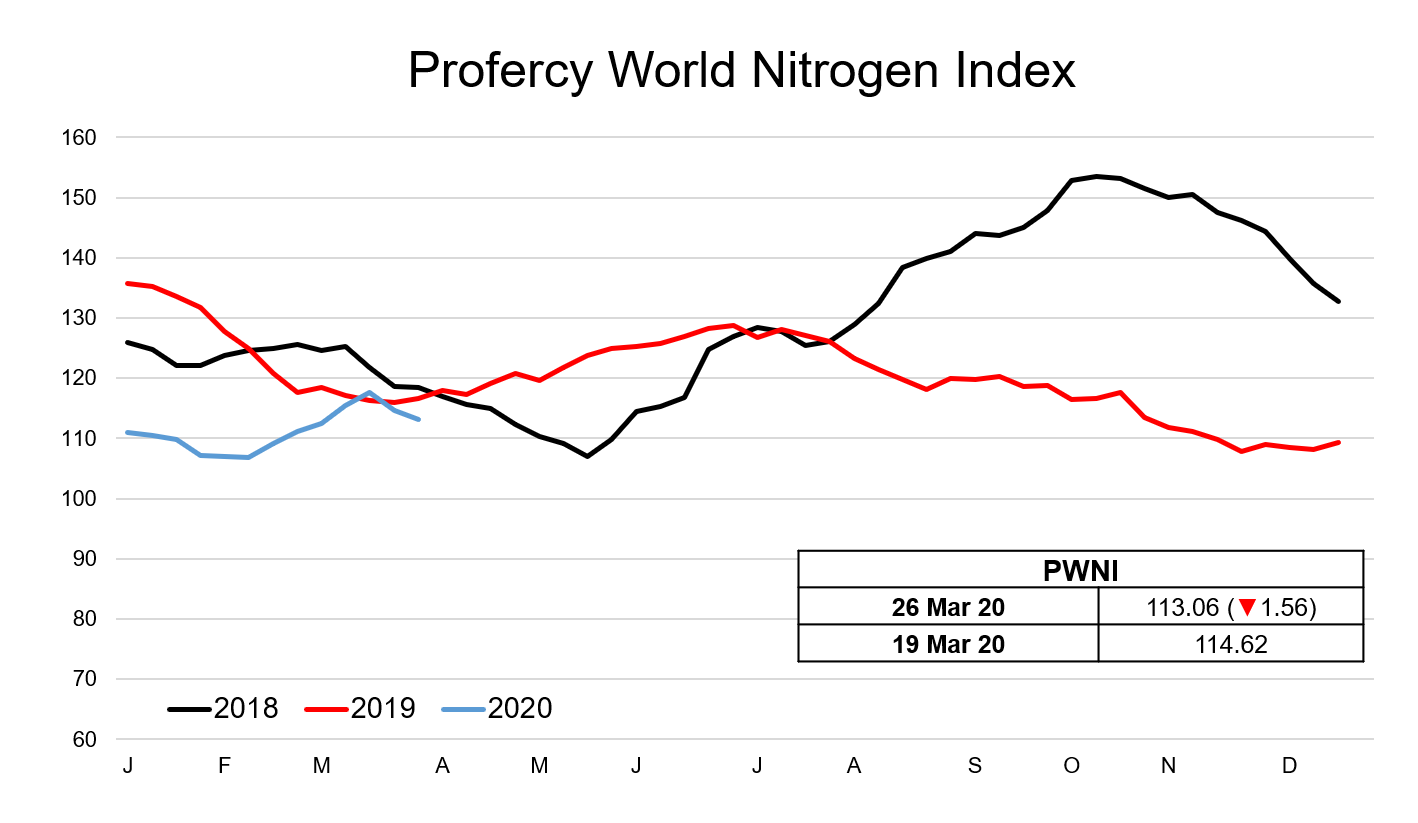

With urea values coming under pressure to varying degrees in the east and west, Profercy’s World Nitrogen Index lost more than 1.5 points this week. This despite positive signs for other nitrogen products, including UAN. After a sustained period of low prices, the emergence of Spring demand in both France and the US Gulf has seen some optimism amongst suppliers. Indeed, Nola UAN values have advanced over $130ps ton.

By Chris Yearsley, Director, Profercy Nitrogen