Urea markets have made further sharp gains this week with Egyptian granular urea prices hitting $350pt fob for the first time since February 2015.

The wider market fundamentals continue to converge including rising grain prices and feedstock gas prices. In terms of urea demand, despite a slow start to the week US buyers continued to move to secure product with the import line-up still lagging the previous year. Buyers in Brazil and Latam appear to have accepted that deferring demand will not help supress values and are also actively securing product as early as possible in the rising market. Indeed, Brazilian prices hit $350pt cfr, loosely in line with US Gulf values.

Other western buyers have also been active with at least three granular urea cargoes booked for Canada, two for Chile and several more for Central America. European buyers have been accepting February and March shipments from North Africa at only a modest discount to replacement values.

As a result of the surge in demand, the supply situation continues to tighten further and producers worldwide have good order books well into March. In the southern Mediterranean and Turkey, prilled urea is scarce. Ukrainian producers are focused on the domestic market, taking out a significant part of the supply in the region.

In addition, the gains in the international urea values are only generated soft interest out of China where granular urea values reached the mid-$320s pt fob.

High urea prices bolster demand and values for other nitrogen products

The firm urea market has benefited other nitrogen products. Ammonium nitrate prices gained by around $15pt week on week in the Baltic. In France and Germany, Yara increased list prices by €25pt on all nitrates. This is the single biggest week on week increase since December 2016. The price increase was not without merit with the availability from European producers limited.

UAN prices made similar gains. In France, prices jumped by nearly €50pt to over €200pt fca. A sales tender in the Baltic for 25,000t saw bids surpass the reserve price by nearly €40pt. In the US, CF Industries has raised prices by almost $50ps ton at river terminal locations since the beginning of the year. Despite this, UAN remains good value on a nutrient basis relative to urea.

Ammonia prices also surged with Yuzhnyy fob values increasing by around $25pt with strong demand noted from both eastern and western markets.

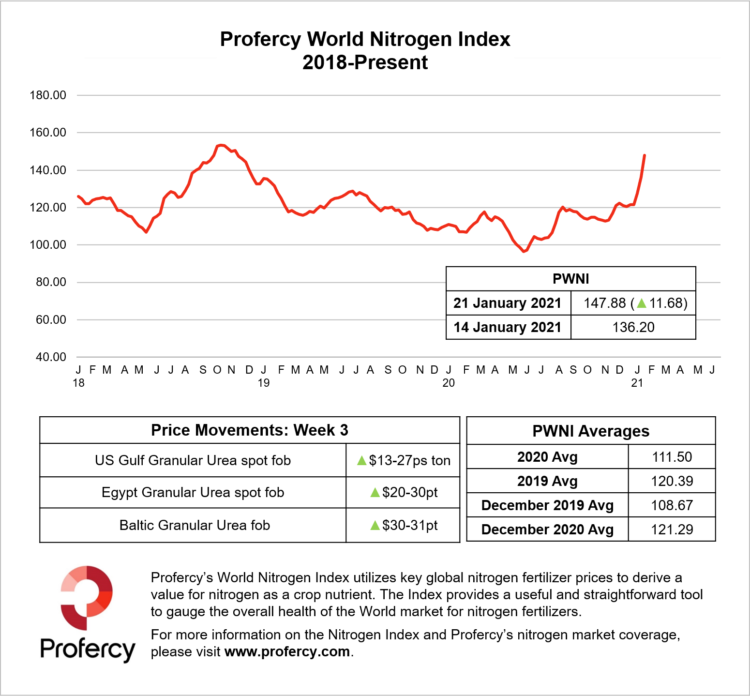

With nitrogen markets firm, the Profercy World Nitrogen Index is up by more than 11 points, surpassing last week’s record increase.

By Michael Samueli, Nitrogen Market Reporter