China’s return to the international urea market this week ended the bull run that began end-April. The sale of around 650,000t of urea from China aided India in securing 1.2m. tonnes of product in the latest purchasing tender, the largest single purchase since December 2020. Netbacks in the tender for suppliers were healthy, around $485pt fob Middle East, sub-$475pt fob China. August availability in the Middle East and the FSU is now essentially committed, but the increased supply from the markets swing supplier year has undermined sentiment.

China’s return to the international urea market this week ended the bull run that began end-April. The sale of around 650,000t of urea from China aided India in securing 1.2m. tonnes of product in the latest purchasing tender, the largest single purchase since December 2020. Netbacks in the tender for suppliers were healthy, around $485pt fob Middle East, sub-$475pt fob China. August availability in the Middle East and the FSU is now essentially committed, but the increased supply from the markets swing supplier year has undermined sentiment.

In the east and west, China’s greater presence in the international market has encouraged importers elsewhere to defer, or target much lower prices. In Brazil, lowest value business this week took place down to $481pt cfr, with Alkagesta, a new entrant to the market, committing 12,000t of FSU granular urea at this level. Just two weeks ago, suppliers were targeting $520pt cfr for August shipments.

Many producers are comfortable for August, but traders have also shown little interest in booking product forward for September. With freight markets firm and cfr values soft, fob values are likely to be softer near-term. In a sign of the possible challenges facing producers, one trader with an August Egyptian position committed this to India at a netback sub-$460pt fob, more than $10pt below current producer asking prices for end-August onwards shipments.

However, export availability from China in the coming months is far from guaranteed, especially given recent policy statements. At the same time, Latin American demand will build in Q3, while India still has major volumes to book for arrival through to January next year. Further, restocking will be necessary in Europe.

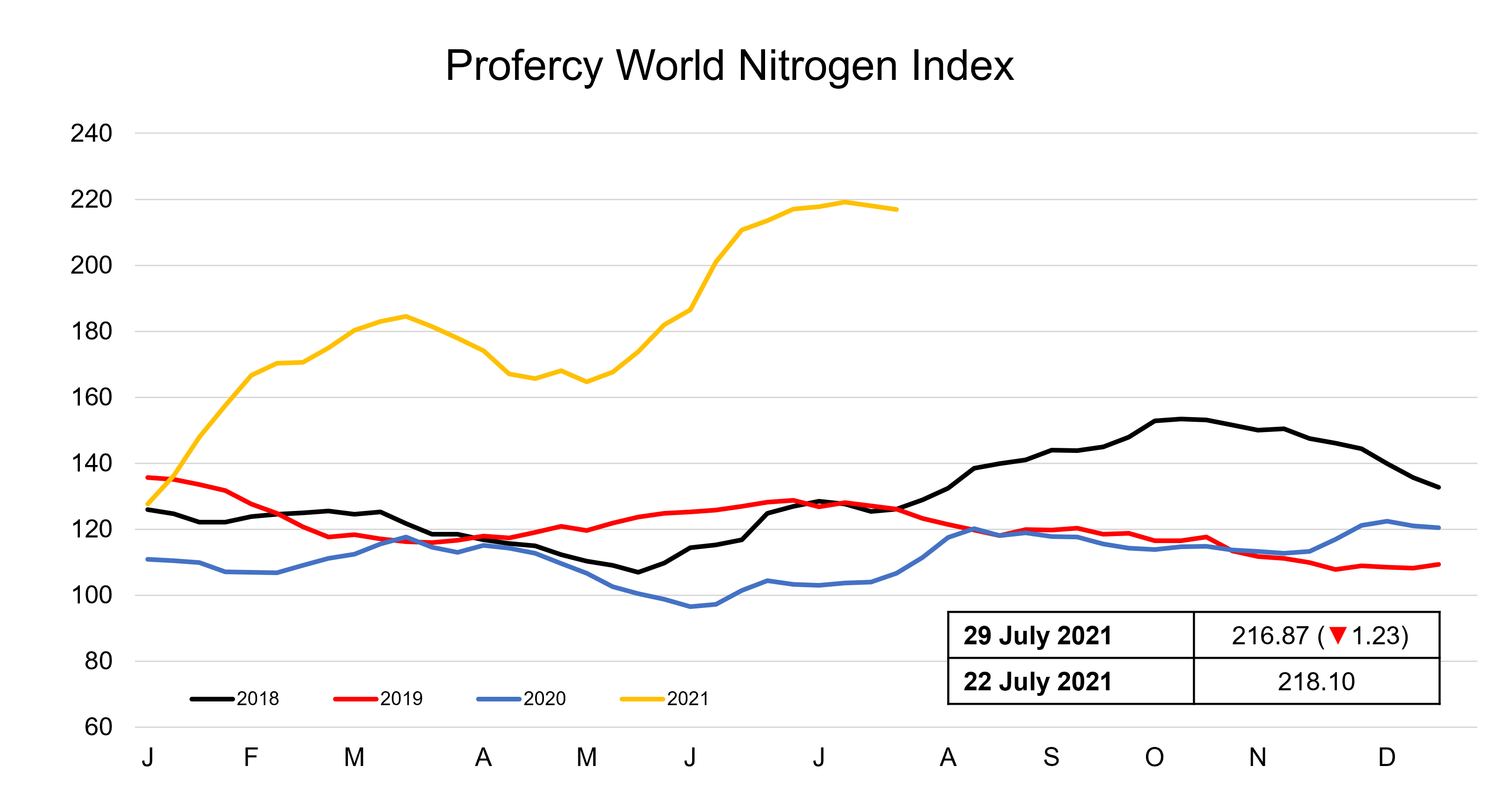

The Profercy World Nitrogen Index dropped 1.23 points this week to 216.87.