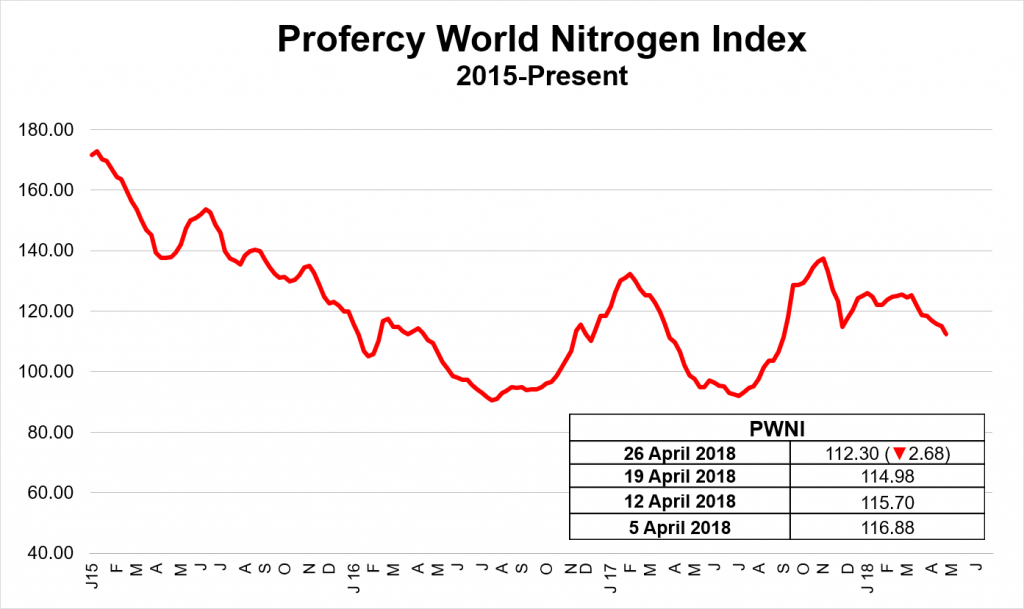

The Profercy World Nitrogen Index hit a low last seen at the beginning of September 2017 but remained comfortably above levels seen this time last year.

The higher price levels come largely thanks to China’s exit from international export markets and their follow-on consequences.

The Index was last put at 112.30 points, down 13.71 from the start of this year with an average level of 121.32 for 2018.

By comparison, at the end of April 2017, the Index stood at 98.72 following sharp declines that month. The Index was down 22.97 points from the beginning of the year and 33.44 points from the February 2017 high. The year-to-date average for 2017 was 119.73.

This year, prices and the Index have faired better, both in terms of the outright level and market volatility with fewer sharp changes in direction.

In 2018, the biggest movement was a 3.39 point decline in mid-March. Over the same period in 2017, the Index moved by a larger variable than the 2018 high six times with the sharpest being a 4.99 point end-March decline.

The higher prices and wider stability have followed China’s pullback from the international export markets.

The lack of product flowing out of China has allowed Middle Eastern producers in particular to step in and supply markets previously covered by Chinese product.

India is perhaps where this change has been most evident. Previously, Indian purchasing tenders were almost solely supplied with Iranian and Chinese product. However, over the last few tenders, around 30-40% of the urea has come from the Middle East.

This change in product flows has removed extra supply from the Middle East to Western markets which, inevitably, has helped support prices.

The current trend is expected to continue with nitrogen fertilizer prices set to maintain their seasonal decline but remain at higher levels than in 2017 as well as move in a more tempered manner.