Urea fob values rapidly advanced in some regions this week, with concerns growing amongst market participants over supply disruptions from Russia in the event of further sanctions being placed on the country.

Russian urea exports last year were at 7m. tonnes, representing just under 14% of global trade, significant enough to spark a reaction in the market.

Traders immediately stepped-up inquiries as they looked to take positions from other markets. This was to the advantage of Egyptian producers, with over 50,000t sold for March shipment from the region yesterday, up to $130pt fob higher than deals that had taken place earlier in the week.

Meanwhile, demand for Russian material is reported to have dissipated as participants continue to assess the impact of potential sanctions on exports.

In the US Gulf, another key region for Russian urea exports, barge values rapidly advanced with March trading as high as $705ps ton fob Nola, up over $150ps ton on the previous day. However, values then dipped slightly lower towards the end of the day, with traders taking a step back from the market.

In Europe and Brazil, many have now pulled offers while they assess the situation. This comes during a time when firming grain markets are set to bolster end-user demand for product. Should the situation continue to persist, this could bring a frenetic few weeks in the global urea market.

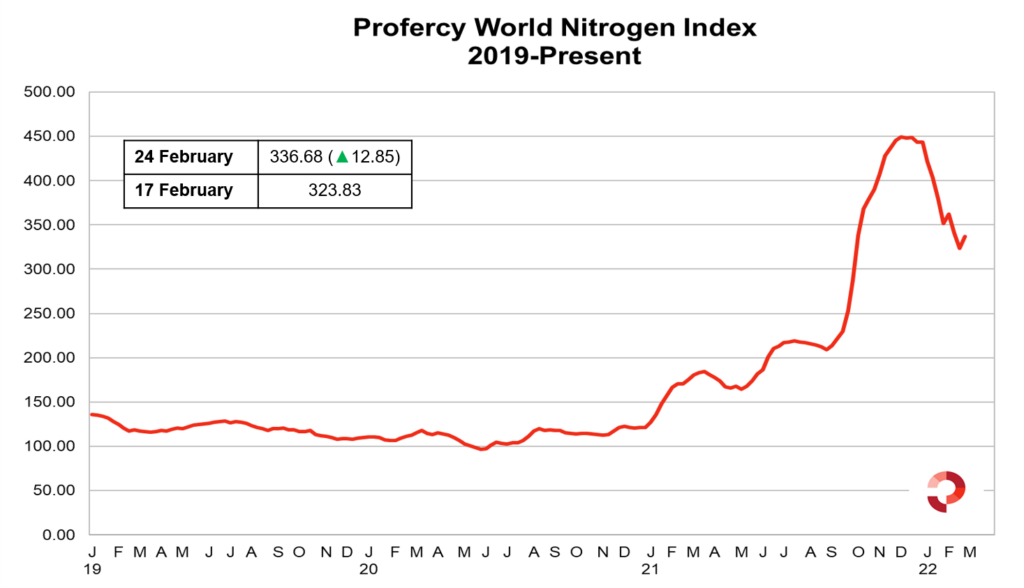

Owing to firming fob urea values, the Profercy Word Nitrogen Index climbed by 12.85 points to 336.68 this week.

By Neha Popat, Nitrogen Market Reporter