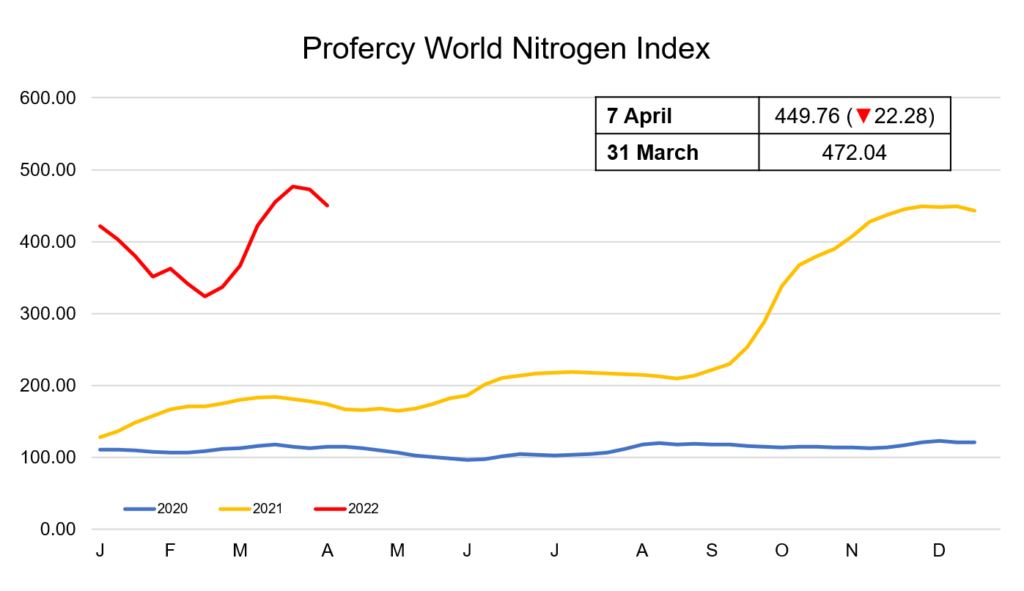

The Profercy World Nitrogen Index (PWNI) has made its first significant decline in nearly two months, dropping by over 20 points this week, with the illiquidity currently seen in the urea market bringing with it lower cfr values.

Market participants continue to wait for India’s IPL to announce a fresh purchasing inquiry for shipments into mid-May. As a result, buyers have been reluctant to gamble on the high urea prices currently being quoted in the market ahead of the Indian inquiry.

Meanwhile, producers are unwilling to lower price ideas to try and stimulate demand ahead of India, and continue to hold a firm line. In North Africa, Egyptian producers are holding offers around last done levels of $1,130pt fob. While, values in the Middle East and SE Asia have also held up around $945-950pt fob this week.

In Brazil demand is weak as expected in the offseason. Offer levels from eastern shipments have fallen to the mid-$900s pt cfr as a result. Demand elsewhere in the Americas has also cooled.

In the US Gulf, poor weather has stalled peak season buying amongst end-users, and with distributors and traders still holding onto volumes purchased earlier this season, there has been little appetite to make new purchases. Values there have significantly eroded this week.

All eyes are now directed towards India, with many producers understood to be keen to supply under the inquiry and build their order books for May. Meanwhile, the great unknown in the market at the moment is whether (and to what degree if so), Russian urea can be sold to India in the coming tender, with financing and freight remaining the main hurdles.

The PWNI declined 22.28 points to 449.76 this week.

By Neha Popat, Nitrogen Market Reporter