The first quarter of 2023 proved challenging for urea producers worldwide. Few have been able to build order books for more than 15-20 days at a time.

Supply is no longer a global concern, despite China’s absence. Trade flows have adjusted to the sanctions environment affecting certain Russian material.

In markets approaching peak season demand, buyers have been holding high priced stock or reluctant to take length, with market signals generally discouraging all but last-minute purchases.

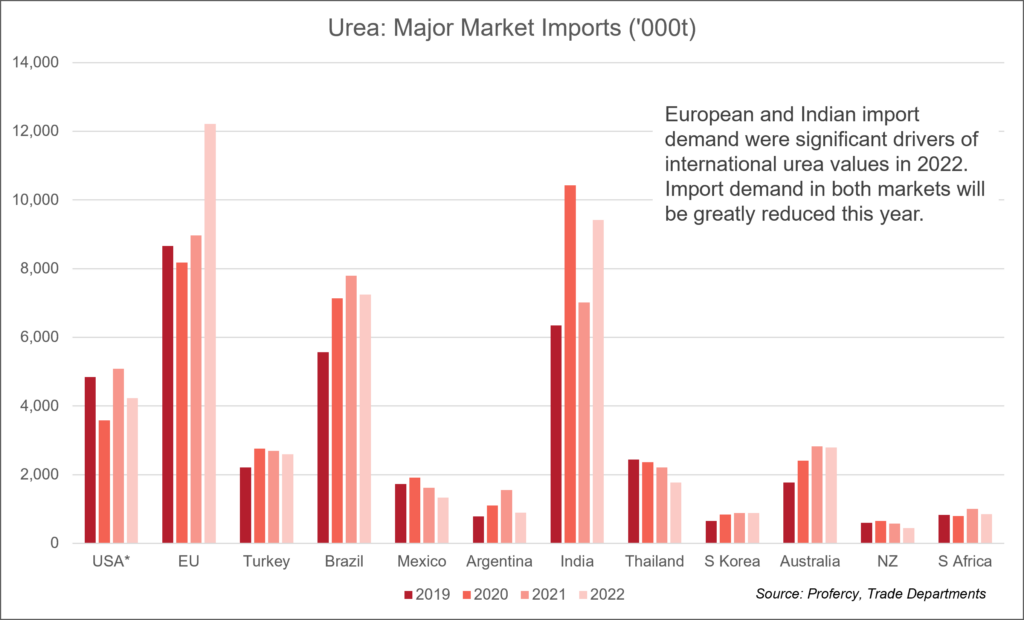

India’s return to the market in early-March was a non-event, doing little to undermine negative sentiment. As a consequence of higher domestic production rates, the Department of Fertilisers has greater flexibility with regard to imports.

Via the 3 March import tender, IPL was able to wrongfoot many with a long shipment window, and ultimately, a relatively limited volume purchase. Large volumes have been lined up ex-Russia, as well as from the Middle East. Yet, at the time of writing, not all of the 1.1m. tonnes booked has been covered by traders. There has been no need to rush.

India’s return is anticipated in Q2, but once again, the market will be kept guessing regarding timings and volumes targeted. Put simply, increased production will see annual import demand greatly reduced.

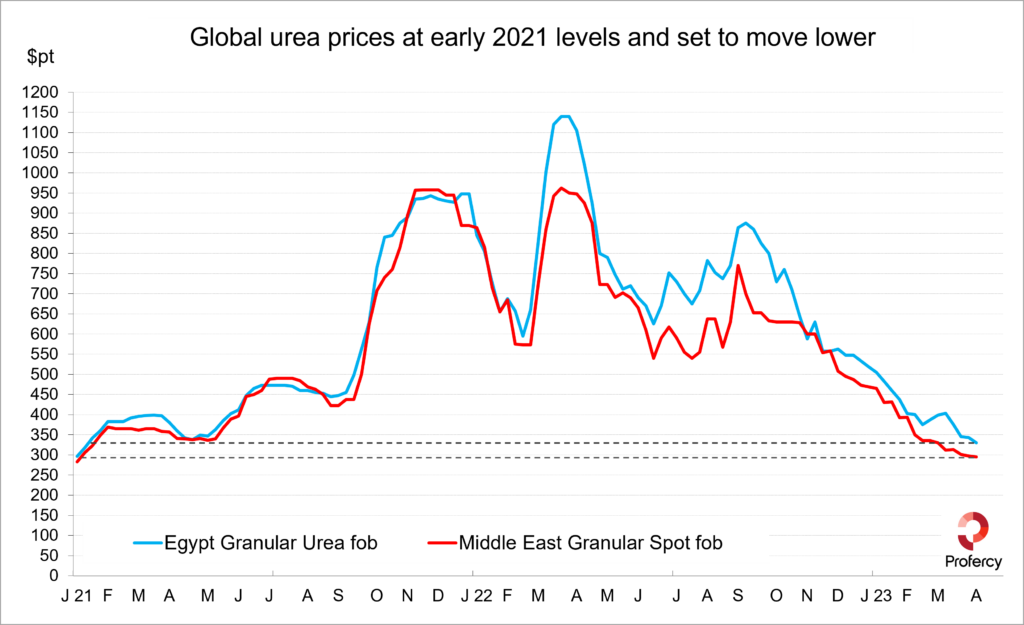

Demand from other eastern markets has been insufficient to keep producers in the Middle East and SE Asia satisfied. Middle East spot prices are now established below $300pt fob, below levels seen in January 2021.

With eastern markets sluggish, producers in the region have been increasingly looking west. Shipments to the USA were strong through to end-March, while cargoes were also committed to Europe, Turkey and Latin America for Q2 arrival.

Increased competition, as well as poor weather, has kept a lid on values in the Nola market ahead of peak season demand, while also weighing on cfr values in Latam.

In Europe, buyers have been paying premiums for small-volume, last minute purchases, or for product in warehouses. This briefly afforded North African suppliers major premiums over counterparts elsewhere, although this premium is now reduced and current fob values are around $330pt.

Notably, European gas prices have been in the low to high-€40s MWh and regional production costs have adjusted from the uncomfortable levels seen last year. Yet, prevailing urea prices still present challenges for producers. Crucially though, nitrate production is viable and is likely to be through the summer, assuming producers can build order books and lock in gas costs. Domestic producers have been aggressively chasing forward business in the UAN market.

Higher gas prices in Q4 could incentivise early stock building of urea, although the challenges of the past year may be fresh in the minds of importers.

With peak-seasonal demand in the west due to conclude in the coming months, minds are already turning to the often-difficult mid-year period. This typically sees the lowest values in the market for the year.

By Chris Yearsley, Director, Profercy Nitrogen

Profercy’s latest forecast report was published late last week. The reports are published every 8 weeks detailing projected trade balances for the next 6 to 9 months, alongside forecast prices. Major macroeconomic factors and trade balance assumptions are discussed, as well as trade flows. More information is available here.