Ammonia demand remains sluggish both sides of the Suez heading into May, with the bearish tone illustrated by the latest slide in the Tampa contract.

The $55pt month-on-month fall was not as severe as expected in some quarters and a subsequent spot sale for prompt delivery into Northwest Europe at a premium price was welcomed by suppliers, although it raised plenty of eyebrows.

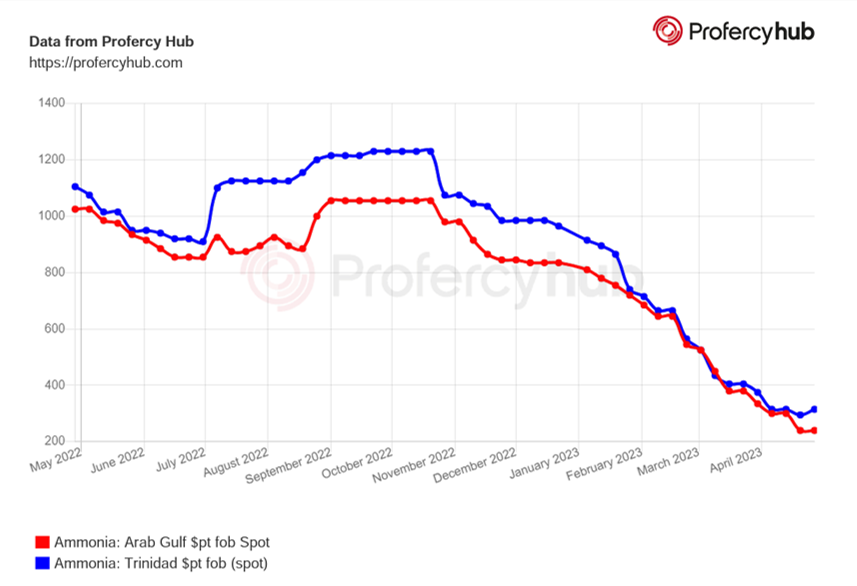

Yara and Mosaic’s settlement at $380pt cfr pushed the US benchmark to a level last seen just over two years ago, with the slip likely lessened by capacity curtailments in the Caribbean and firming demand from the US agricultural sector.

Across The Pond, the main talking point was Fertiglobe’s sale of 12,000t to Borealis at $425pt cfr for mid-May delivery to northern France; a deal that certainly took many players by surprise.

The chemicals group had been seeking such a cargo for late May discharge at Rouen, with offers at sub-$390pt cfr heard on the table.

As such, it appears the buyer paid a hefty premium to secure tonnes for prompt delivery, sparking talk of inventory or production issues at its own ammonia plant.

The price is not considered reflective of current market conditions, although capacity curtailments in Algeria and Trinidad have boosted producers’ price targets West of Suez.

In the East, the market favours buyers due to limited import demand in Northeast Asia and decent supply out of the Middle East.

Amid just a handful of sales, Trammo sold a parcel into West Africa and an Algerian cargo into Antwerp. The trader also secured 15,000t in Indonesia from Mitsubishi, but activity East of Suez was limited because of religious holidays in many nations.

Heading into a new month, a clear divide in sentiment along geographical lines has appeared, meaning some arbitrage opportunities may appear on the near horizon for East to West business.

By Richard Ewing, Head of Ammonia/Deputy Editor at Profercy

Source: Profercy Ammonia Weekly Report