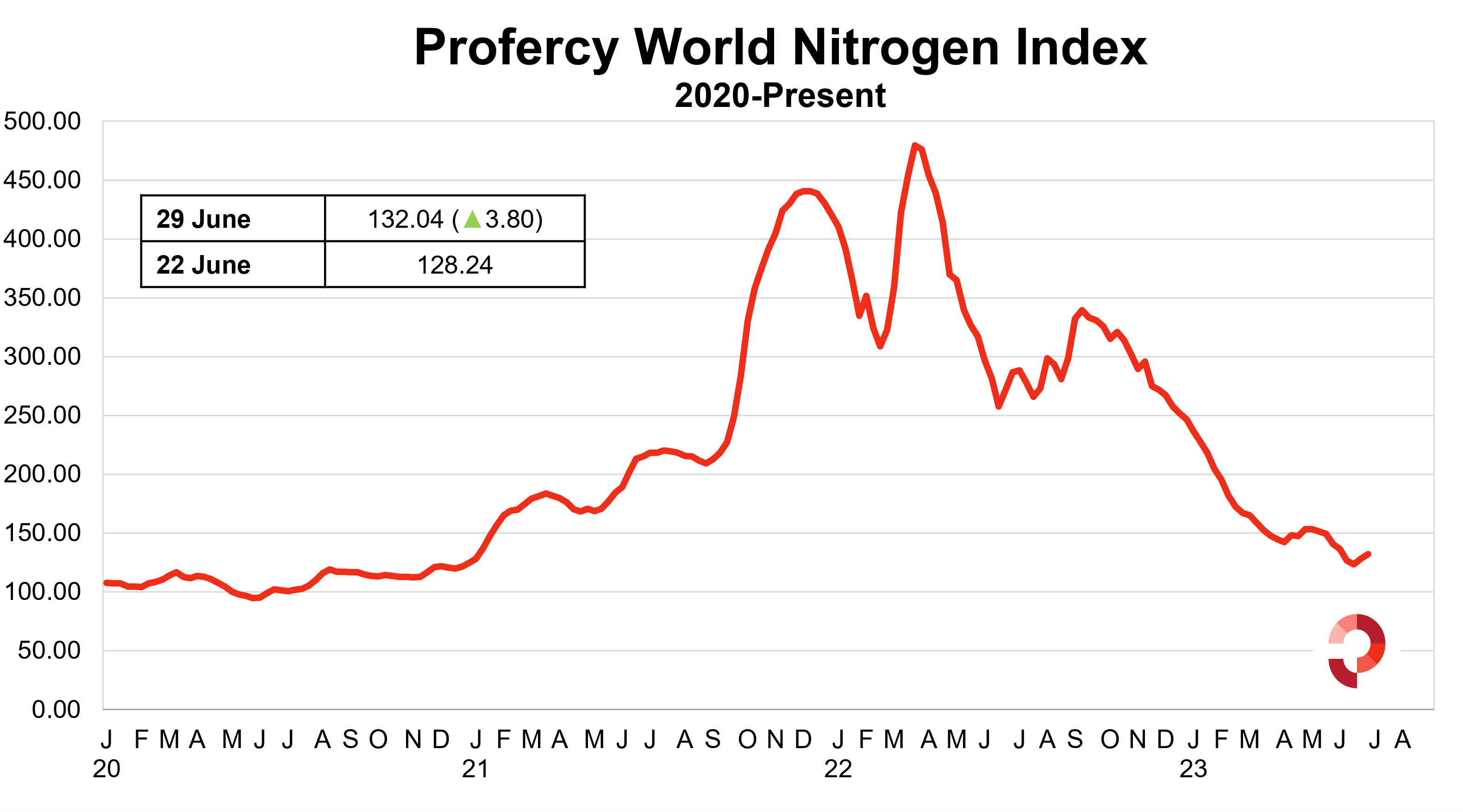

The recovery of Profercy’s Nitrogen Index from the mid-June lows extended for a further week on the back of price gains in urea, ammonium sulphate and nitrate markets. The ongoing challenges in the global ammonia market, as reflected in the sharp drop in the Tampa contract price, were insufficient to hold back gains.

The Index, a barometer of global nitrogen prices, is now at 132.04, having registered a 3.8 point increase.

Profercy World Nitrogen Index

Urea: Importers targeting July struggle to solicit offers

As documented in our earlier coverage, supply cutbacks in SE Asia, alongside Chinese export restraint have presented major challenges for those requiring July shipments in Asia Pacific. While Chinese granular exports have increased of late, those requiring end-July movement have been forced to pay up to $312pt fob for Middle East cargoes.

Demand east of Suez has not been buoyant, yet Australia has snapped up several spot cargoes in recent weeks owing to strong domestic demand in June and low stocks.

West of Suez price gains have been less pronounced with most July business concluded earlier. Producers are – unsurprisingly – confident while buyers across Europe are yet to respond en-masse to latest offer levels at least $30pt above those earlier in the month. Russian producers continue to take business at a discount to others.

Canadian inquiry has been left unsatisfied while those seeking vessels for west coast Mexico have been forced to book early-August shipments from eastern suppliers.

The July shipment period is often a difficult time for global producers. Typically, this is a period where few major imports markets are in-season. The extent of recent supply cutbacks and the potential for stronger Indian inquiry for August onwards movement has reasonably led many to conclude that the lowest prices for the year have already been witnessed.

Amsul and nitrate markets firm

Demand from compactors in the Chinese domestic market, itself bolstered by inquiry for Brazil, bolstered capro-amsul offers. Latest offers have been at $110pt fob for July shipments. This has met with price resistance in SE Asia where traders have been offering at much sharper levels.

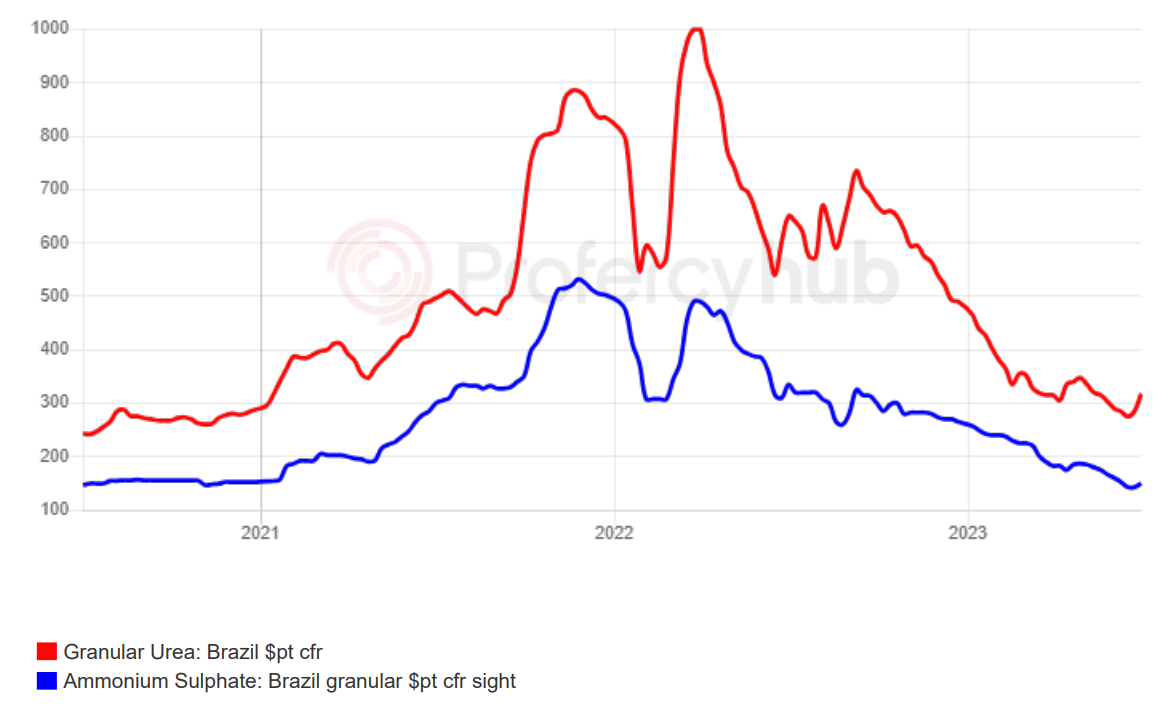

Granular and compacted amsul prices in Brazil advanced rapidly following the sale of one vessel sub-$145pt cfr. Importers have been receiving quotes $10-15pt higher since. This demand is in part driven the rapid escalation in urea prices and the lack of offers for July shipments. Brazilian buyers have some time on their side with peak import demand yet to surface.

Similarly, in Europe nitrate and UAN prices have edged up with producers and offshore suppliers more confident given earlier sales and the firming nitrogen complex.

Brazil: Amsul values firm in response to urea gains / Source: Profercy Nitrogen

Ammonia market in bear territory as buyers show their claws

Heading into the second half of the year, soft demand and decent supply has put ammonia prices under considerable downward pressure West of Suez. This bearish tone was illustrated starkly by the $55pt slide in the Tampa contract for July liftings.

Prices are now at such a level that producer margins will be thin and those without access to competitively priced natgas may decide to reduce run rates or bring forward maintenance.

The situation looks healthier for suppliers East of Suez due to a tighter demand/supply balance on the back of decent demand in India and plant shutdowns in Asia Pacific.