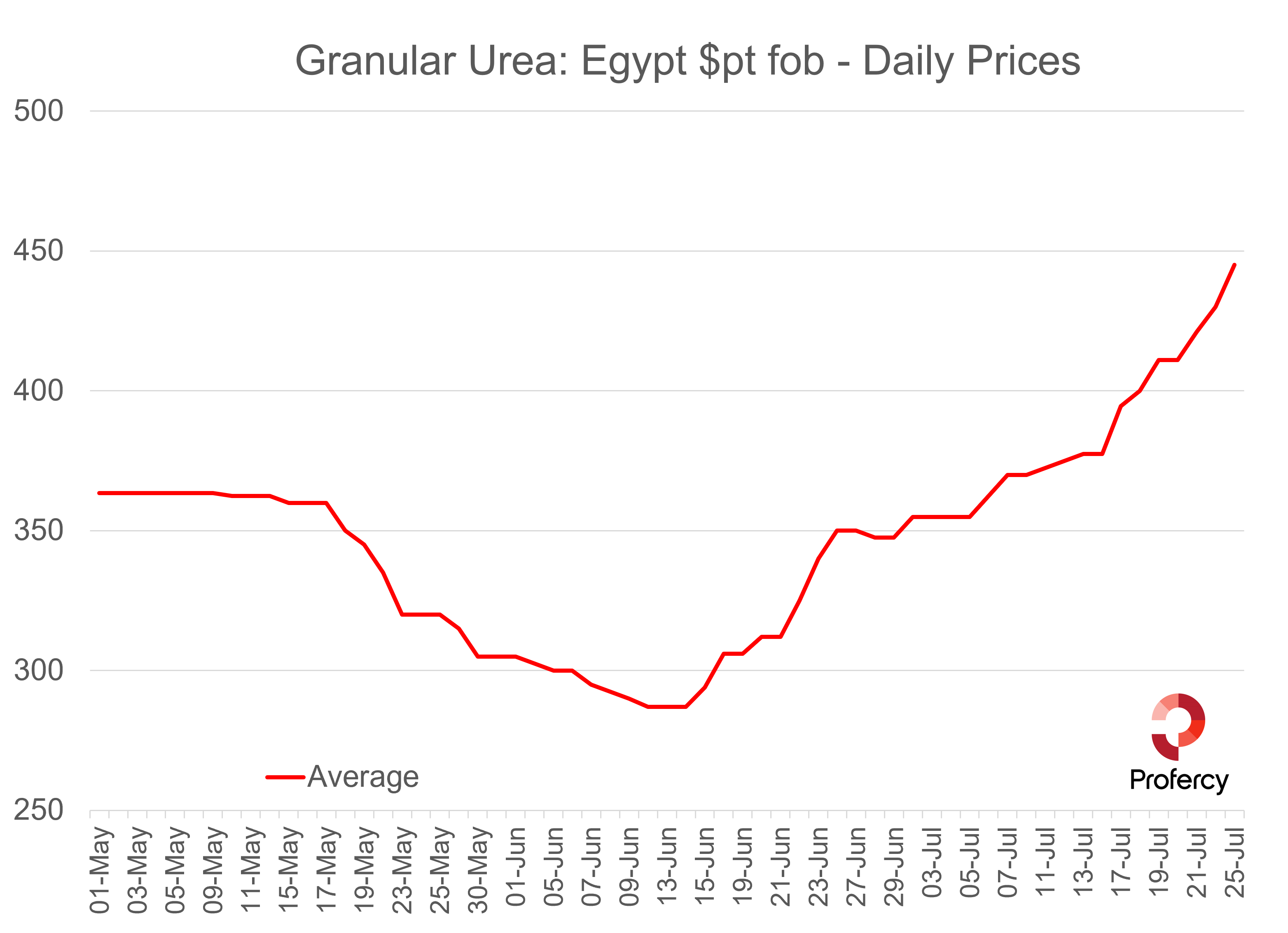

Urea values stepped up another level in trading early this week, prolonging a rally that began mid-June and shows no signs of easing in the near-term.

In latest business, Egyptian granular urea has traded at $450pt fob, up more than $165pt in a little over six weeks. Producer price ideas have now moved on with some sold out for August.

Brazilian granular urea values have hit $400pt cfr and loaded barge values in the USA moved to above $400ps ton.

Egyptian granular values rally $165pt since mid-June / Source: Profercy Nitrogen

Producers in the driving seat

Urea producers have been in control for some time. As noted previously, a combination of supply cutbacks in SE Asia, Nigeria and Russia, as well as China’s absence from international trade (at least in any meaningful way) ensured those elsewhere were able to benefit from the resurgence in Latam demand and late Oceanic inquiry.

Most suppliers have not struggled to place the next 30 days’ worth of production, with some even extending order books into September of late. Traders with positions have confidently been raising offer levels with most rewarded each week.

EU gas prices have stepped up, with front month Dutch TTF values returning from sub-€25/MWH to the low €30s/MWH. With gas markets broadly less volatile, European production is now running at increased rates relative to last year.

Yet, with forward gas values implying far higher costs of production for EU manufacturers and urea firm, nitrate values have been advancing with healthy volumes placed by regional producers.

Duties and tariffs; a catalyst for firming N African values

Trader inquiry has supported the most recent $30-40pt increase in Egyptian values, albeit with pending Indian demand also a factor. Importantly though, the march to $400pt fob – the level achieved last week – was a consequence of emerging Argentinian demand.

Ahead of a three-week turnaround at the Profertil unit, earlier Argentinian inquiry saw up to four vessels of Egyptian granular sold at ever improving levels for July and August shipment.

This followed several months of major forex and macroeconomic challenges, as well as the earlier drought, that hindered import demand. Crucially, Egyptian producers benefit from a significant duty advantage over other suppliers.

Alongside modest production cutbacks in Egypt, this wave of demand has left many European buyers exposed with warehouse offers across the continent firming in response to North African price gains.

India playing catch up; tender set to define Eastern trade balances

IPL will close a purchasing tender on 9 August for an unspecified volume of prilled or granular urea for shipment by 26 September. This followed the early-June inquiry through which a meagre 560,000t of urea was booked, almost exclusively from Russia and the Middle East.

Despite major additions to domestic production in recent years, India needs to secure greater volumes in the coming months.

Subscribers to Profercy’s fertilizer market reports have been receiving regular market updates throughout the latest price rally. The Service offers timely market updates and analysis, alongside both daily and weekly price assessments. Profercy also offers forecasting services.

For more information and to receive a free trial, please click here.