Source: Profercy Nitrogen Daily

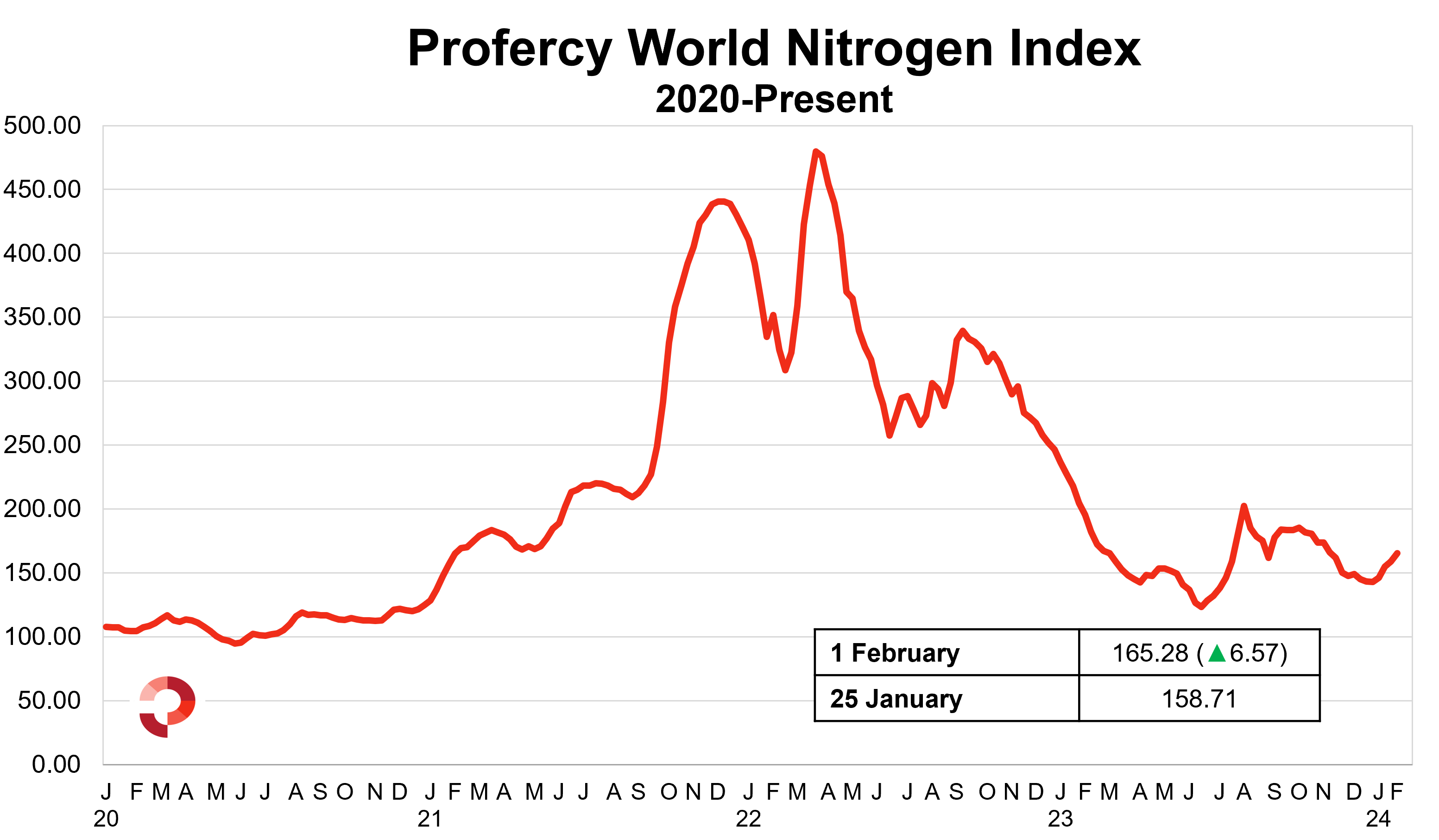

In stark contrast to Q4 2023, global urea markets have been buoyant over the past month. Key global benchmarks in both the east and west have rallied by more than 20%, matching levels last seen in early-November 2023.

A supply squeeze in the east, compounded by early demand in Oceania, as well as a round of short covering in the west for Turkey and Europe has ensured many producers are well sold for the next 30-45 days.

The Profercy World Nitrogen Index increased by 15.69 points over the course of January to 158.71 points. Further gains were witnessed this week.

Indian tender and Egyptian reaction

Indian tender and Egyptian reaction

India is typically absent from the market for January and February shipments, but a desire to rebuild stocks saw National Fertilizers Limited (NFL) close an inquiry on 4 January. NFL managed to secure just 647,000t of urea, well below the anticipated target of 1m. tonnes or more.

A sharp west coast offer played a role in dissuading many Middle East suppliers from committing at levels that reflected either side of $300pt fob. Just five cargoes were committed.

Russian prilled urea suppliers actively backed the business with around 400,000t of the total.

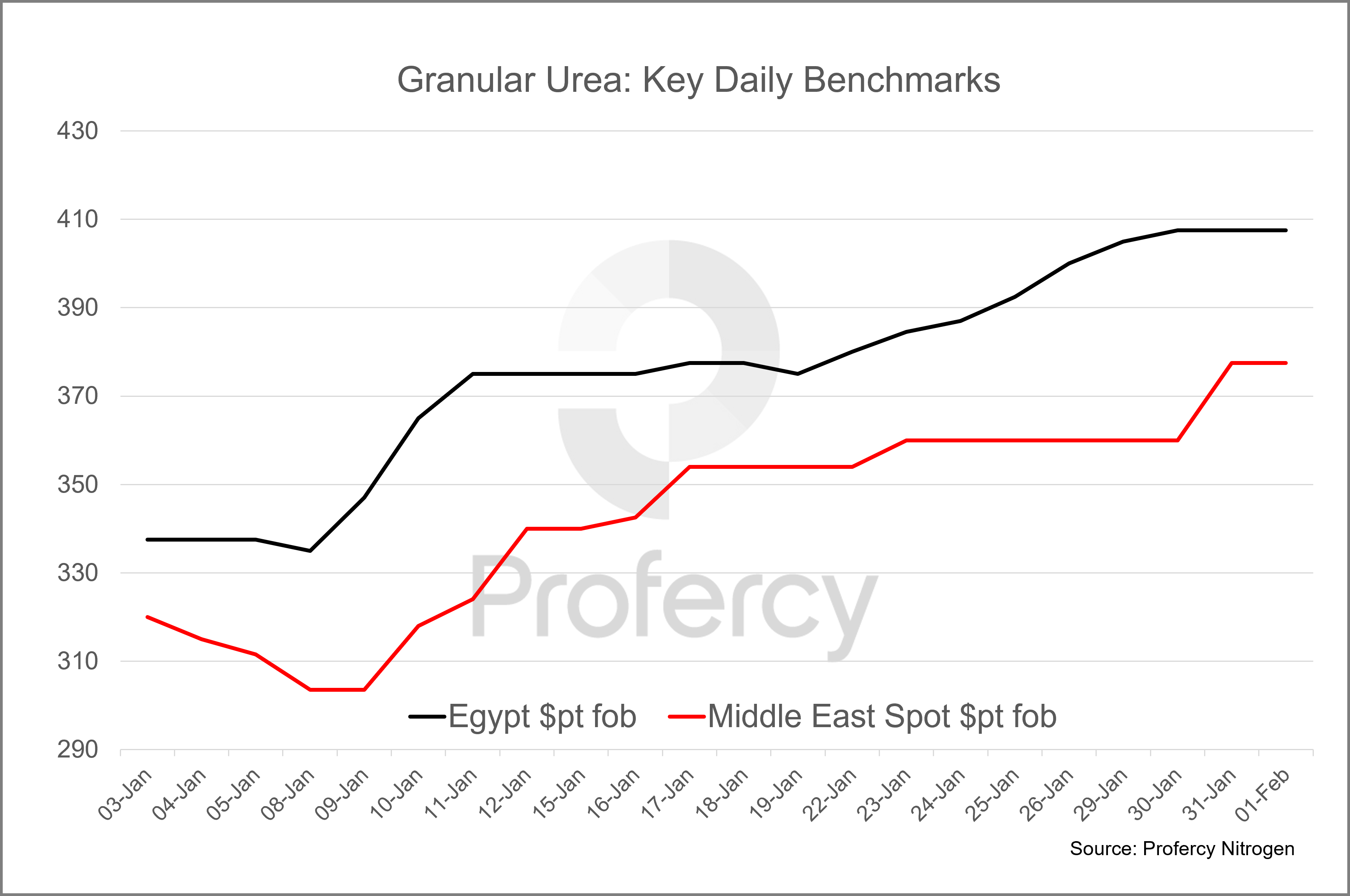

Speculation of a quick retender was sufficient to push traders into covering short positions, primarily in Turkey, but also in Europe. The extent of earlier short positions, some of which had only been taken in the first week of January, became clear with a major round of Egyptian business taking place. Prices advanced from the mid to high-$330s pt fob to the mid-$370s pt fob within a few days.

North African values ran ahead of other regions and demand shifted away from Egypt in the following week to other fob regions including the Middle East, Nigeria and SE Asia. Once these regions caught up, focus returned to Egypt with another round of sales taking place end-January prices surpassing $400pt fob for the first time since early November.

Eastern production and export cutbacks lead to regional supply squeeze

Availability in SE Asia quickly disappointed buyers as turnarounds in Malaysia and a delay to export licences in Indonesia meant only smaller producers had product.

The Petronas ammonia-urea facility at Bintulu has been down for some time while the Gurun unit began a turnaround from 1 February for up to 60 days.

Indonesia typically supplies multiple 10-45,000t shipments of granular urea per month to the international market, as well as prilled urea for nearby markets.

This was against the ongoing backdrop of China being absent from export markets, primarily owing to export restrictions ahead of peak seasonal domestic demand. Turnarounds also took place in other regions, further limiting supply, while seasonal gas diversions in Iran have significantly reduced operating rates there.

The cutbacks in the east have had a global impact. Australian buyers, many of whom have stepped in early due to healthy rains, have been more reliant on Middle East producers. Further, ongoing Panama Canal shipment challenges have forced west coast Latin American markets to look to eastern suppliers. As a consequence, competition for spot cargoes has been fierce with SE Asian business recently concluded up to $390pt fob. In a rare move, Vietnamese producers have recently committed major volumes to the international market.

Further, Middle East producers have been less reliant on western markets, such as the USA, at what is often a difficult time of the year.

Importers remain cautious

Beyond Australia, import demand has not been rampant. US Gulf values climbed around $50ps ton to above $350ps ton fob Nola for January-February barges. Activity has increased but peak seasonal buying has yet to commence. A large portion of demand in the Nola market has been from traders and distributors taking positions ahead of Spring inquiry emerging.

Elsewhere, European demand (the other major region approaching its peak season) has not been strong outside of Italy and some other southern European countries. In northern Europe, sales have been taking place but at modest volumes, in part because regional producers are able to offer competitively due to the decline in European gas values.

In most domestic markets, perhaps with the exception of Italy, activity has been lukewarm as end users do not appear concerned about high prices or not finding product when required.

Crucially, though, traders have not been longer willing to offer from short positions and warehouse offers have steadily advanced. This has led to offers in Europe increasing from below $350pt cfr to well over $400pt cfr. These levels are still below replacement costs.

Prospects for February

Globally, export-oriented producers are in a comfortable position. Given the volumes already committed from the Baltic, North Africa and the Middle East in tandem with the supply constraints in SE Asia/China, the chance of a nearby price reversal appears low.

However, the extent to which prices continue to increase will likely depend on the strength of demand from key import markets, namely Europe and the USA, as well as India. Most in the market are optimistic about the prospects for both western regions as they approach their peak seasons. Indeed, many US players feel the import line-up through to end-March will be light.

Any further inquiry from India for March onwards shipments would greatly tighten up availability in the east. Overall, India’s requirements should be reduced this year, but product will be required for the Kharif season. A major purchasing tender would greatly contribute to market sentiment and almost certainly result in further price gains.

By Michael Samueli, Daily Nitrogen Editor, and Chris Yearsley, Editor