The global urea market is eagerly awaiting the outcome of the latest purchasing tender in India, with this set to define market values and availability well into November.

The global urea market is eagerly awaiting the outcome of the latest purchasing tender in India, with this set to define market values and availability well into November.

Rashtriya Chemical Fertilizers (RCF) closed a tender yesterday (3 October) for shipments to 20 November.

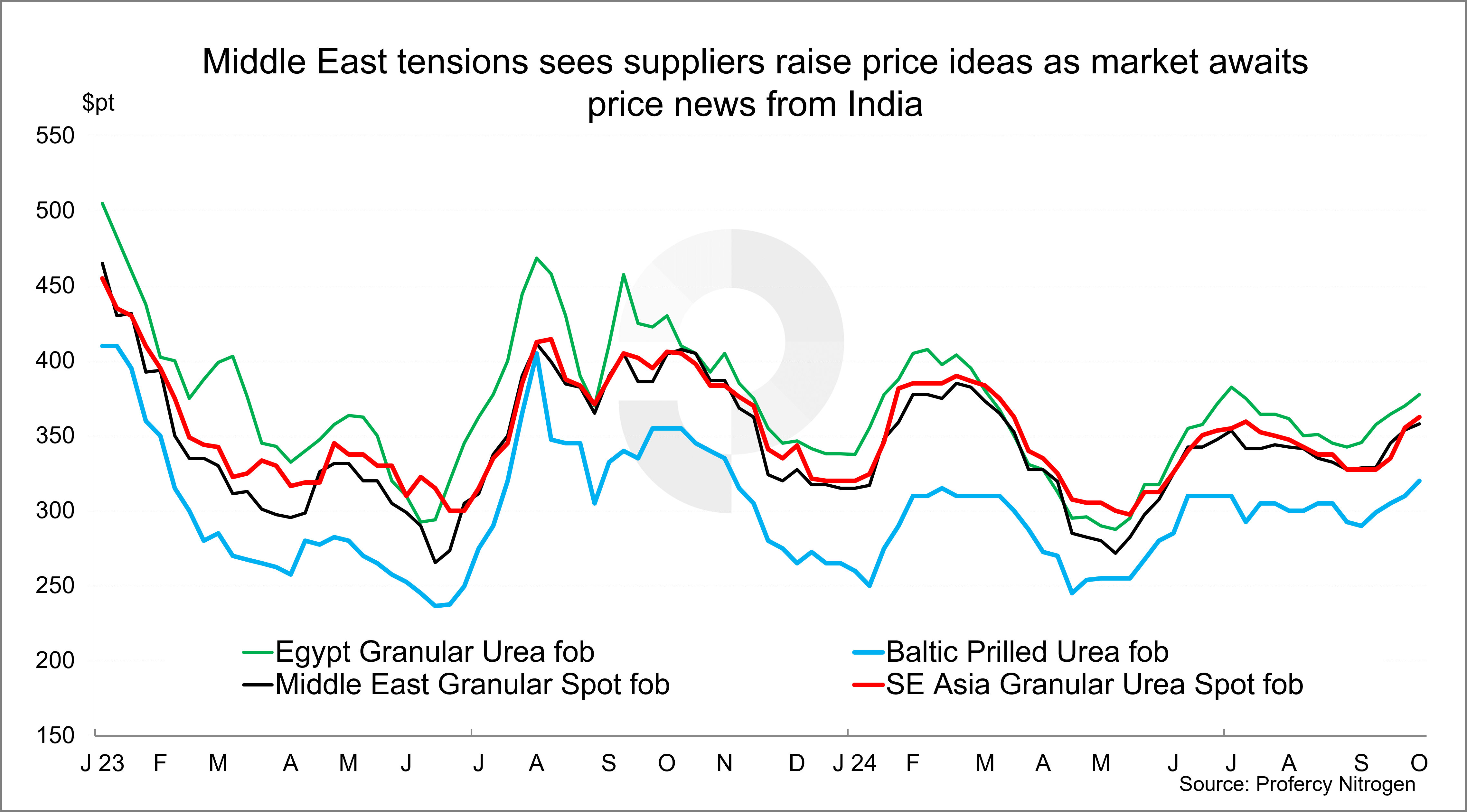

In the 48 hours prior to the tender, escalating tensions in the Middle East saw derivatives values rally while physical offers were lifted quickly in most regions.

With India’s tender concluded right in the middle of these events, the key question now is whether these developments will discourage suppliers from backing Indian business if they feel that prices are set to increase.

Indeed, elsewhere in the market Egyptian granular urea values advanced $17pt in less than five days with product placed up to $387pt fob. In the US Gulf barge values surpassed $330ps ton fob Nola for the first time since June.

Importantly though, there has been no supply disruption in the east to date, but many in the market are mindful that Middle East suppliers have been the primary suppliers to India recently.

In the 29 August National Fertilizers Limited (NFL) tender, 1.127m. tonnes were booked for shipment by 31 October.

Vessel nominations midweek were just shy of 1m. tonnes, with 70% of all product lined up from the Middle East. This includes five cargoes each from Saudi Arabia and Oman, three from the UAE and just one each from Qatar and Bahrain. Iranian material does not typically make its way directly into India.

Shipments from Russia and SE Asia are negligible by comparison, even if the former are regular participants in such inquiries.

China’s continued absence limits options

With China absent from the international market, the latest supply uncertainty in the east has raised the stakes in India.

India received 1.8m. tonnes from China alone in Q4 2023. Few expect any major role for China in the coming months in international trade, despite high operating rates and low domestic values there.

As is well documented, India’s reliance on imports has reduced in recent years owing to significant capacity additions.

Yet, a strong monsoon and high sales in August and September have seen stocks drawn down quickly. Most anticipate an import requirement, outside of regular contract volumes, of 2m. tonnes or more for shipment by mid-January.

The outcome of the latest inquiry will no doubt dictate whether India will need to return to the market quickly. With a shipment window extending just 20 days beyond that of the latest tender, few felt a major volume purchase was possible even prior to latest events.

The market is watching closely. Price bids in the latest tender are yet to emerge with RCF in the process of evaluating technical bids.

By Chris Yearsley, Editor, Profercy Nitrogen

For updated news and analysis, trial subscriptions to the Profercy Nitrogen Service are available.