Source: Profercy Nitrogen

A series of spot deals were concluded in a hectic week for the merchant ammonia market, a positive trend underlining the far healthier global supply situation, despite production headaches in Algeria persisting and feedstock price volatility in Europe triggering some uncertainty.

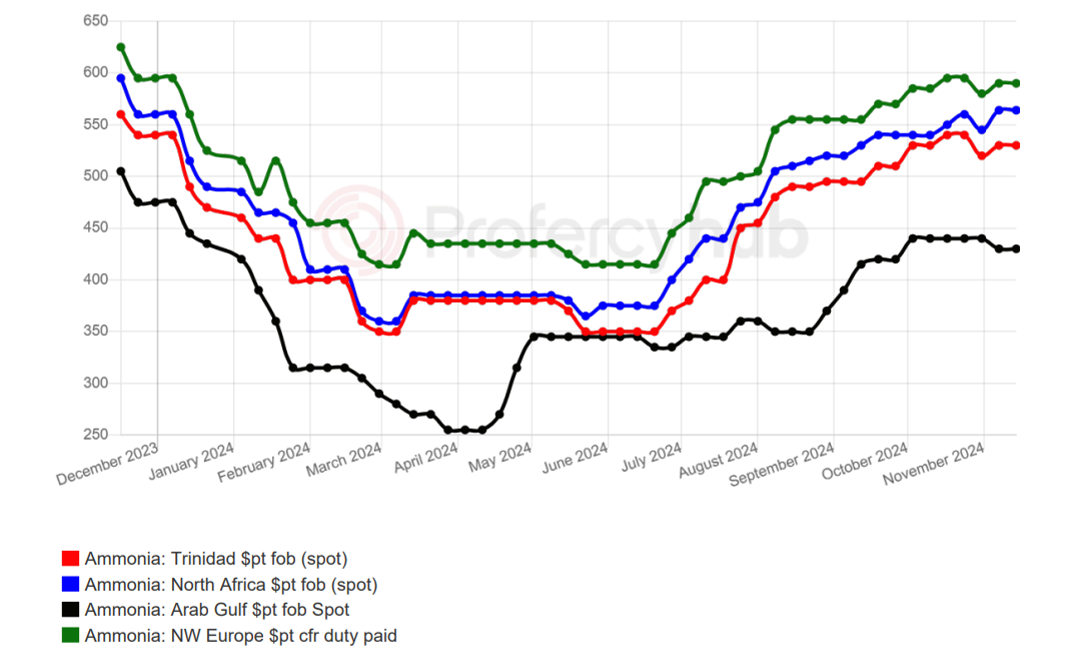

Towards the end of a year scarred by lengthy periods of capacity curtailments in the Americas, Middle East and North Africa that created bullish sentiment and higher prices for months, the return of key units to normal operation has been greeted with relief across the supply chain.

Traders were involved in the majority of the latest business as they secured tonnes on a fob basis to satisfy term requirements, though some end user cfr purchases also took place, albeit at undisclosed prices.

Given the strong performance of plants in Trinidad and the US Gulf, the impact of deep output cuts in Algeria – where two producers are fully offline – is likely to be cushioned to a degree, particularly as Turkish producers are exporting again.

Burst of spot sales also seen in Asia Pacific

In the East, there has been a significant loosening of the supply/demand balance on the back of robust run rates at plants throughout Southeast Asia and the Middle East.

With industrial demand subdued on seasonal factors, a weaker pricing environment is now emerging, as illustrated by spot sales out of China and the rare emergence of a re-export cargo from South Korea.

Away from the spot market, the main news was Mosaic’s announcement of the signing of two new ammonia offtake deals, with a third also nearing completion.

While the US phosphates giant did not provide further details of those 2025 agreements or the impact on well-established supply arrangements with CF Industries and Yara, the disclosure came ahead of the commissioning of new plants in Texas – Gulf Coast Ammonia (GCA) and Woodside.

At present, Mosaic produces its own ammonia, sources domestic volume from CF’s operations in Louisiana and Trinidadian product from Yara.

By Richard Ewing, Head of Ammonia/Deputy Editor at Profercy