Source: Profercy Phosphates & NPKs

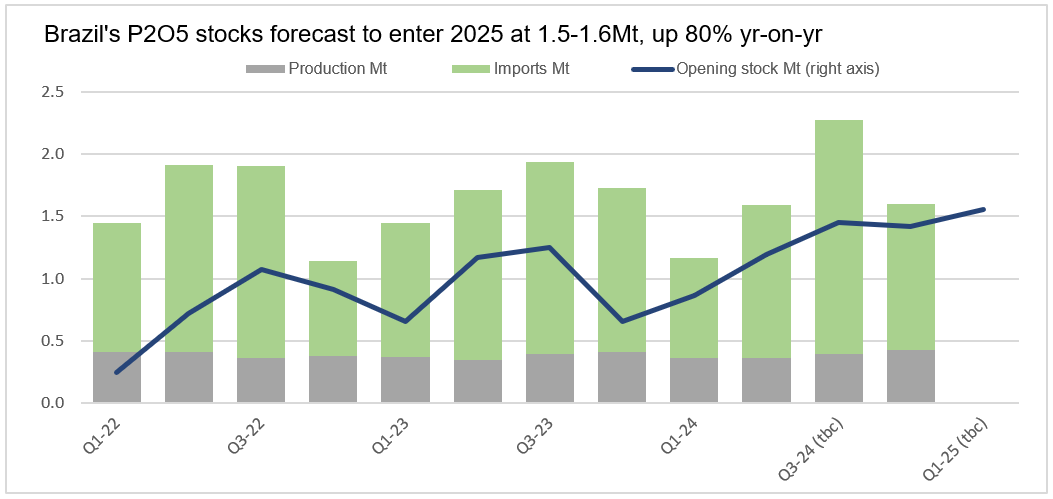

Brazil’s P2O5 stocks have increased significantly throughout 2024 after entering the year at 839,442t. This volume was down 8% on 2022 closing stocks of 912,168t. Stocks have increased despite a considerable drop in Brazil’s year-to-date MAP imports. This is because the decline in MAP imports was offset by significant increases in imports of other lower-P205 phosphate fertilizers while inland demand has lagged behind.

Brazil imported roughly 11.2Mt DAP/MAP/NP/NPK/TSP/SSP in January-October, up 5.1% from the same period of 2023, the latest trade data show.

Imports during the first five months of 2024 had fallen year-on-year but have picked up the pace since June. Brazil’s January-October MAP imports dropped 13% yr-on-yr to 3.76Mt. However, NP/NPK and TSP/SSP imports jumped, with the latter showing particularly strong growth.

TSP imports during the first 10 months climbed 15% yr-on-yr to 1.46Mt, with the volume from Morocco jumping 62% to 1.05Mt in line with OCP’s strategy of significantly raising TSP sales. SSP imports during the period increased 19% yr-on-yr to 2.48Mt.

Latest forward vessel data and expected cargoes suggest that Brazil’s January-December P2O5 imports will reach 5.1Mt, down slightly on 5.3Mt in 2023 but up on 4.9Mt in 2022.

Brazil’s total domestic production rate is set to be largely flat year-on-year for the full year 2024 at 1.5-1.6Mt P2O5 despite the start-up of EuroChem’s new Serra Do Salitre operation earlier this year. However, demand has lagged this year, particularly on the higher-grade phosphate fertilizers, with very weak MAP/soybean barter ratios prevailing in the market and impacting farmer affordability.

Brazil’s total P2O5 demand in the full year 2024 is set to reach 5.7-5.8Mt, down from 6.4Mt in 2023 and largely flat on the low demand rates seen in 2022.

As a result, Brazil’s P2O5 stocks have likely increased over 600,000t so far in 2024, with Profercy estimating stocks entering January 2025 at 1.5-1.6Mt, an increase of as much as 80% year-on-year.

Despite the strong improvement in Brazil’s P2O5 stocks so far this year, MAP prices in the market are holding at $630-635pt cfr. Limited prompt availability and DAP demand in east-of-Suez markets are helping to prevent what would otherwise be usual downwards pressure on Brazil’s MAP prices in Q4.

Significant discounts on other products such as TSP (last assessed by Profercy at $490-500pt cfr) and 18-21% SSP ($170-230pt cfr) have seen demand for these products soar in Brazil this year, supporting overall P2O5 inventories.