New CIQ applications for DAP/MAP exports from China were halted from 1 December. Whilst a number of key details are becoming clearer, still multiple grey areas remain on the implementation of the latest controls.

New CIQ applications for DAP/MAP exports from China were halted from 1 December. Whilst a number of key details are becoming clearer, still multiple grey areas remain on the implementation of the latest controls.

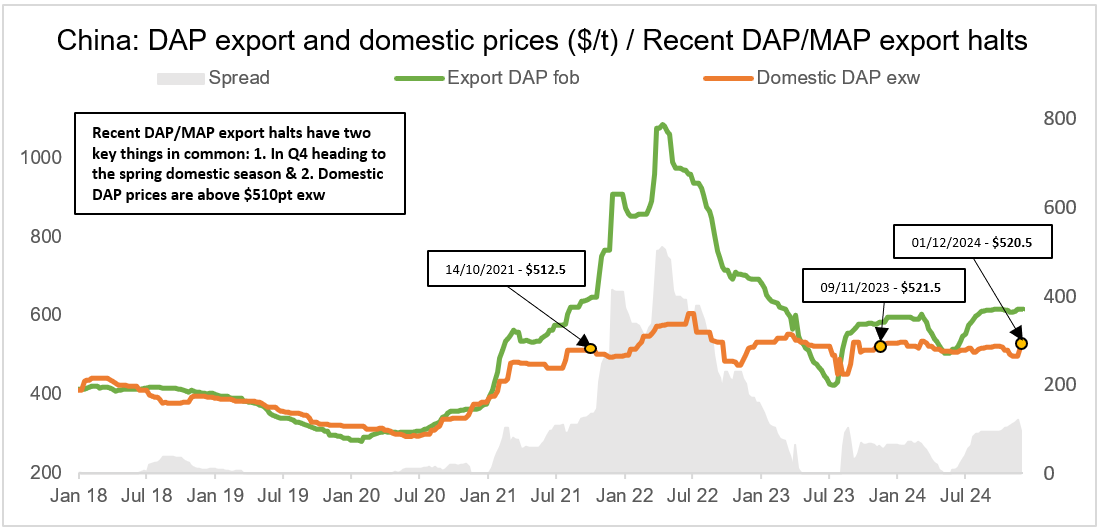

The halt in exports comes as domestic DAP/MAP prices surged in China over recent weeks due mainly to jumps in raw material prices, particularly sulphur. Domestic DAP prices are now reported up to CNY3,750-3,800pt exw ($517-524pt), with the high end and latest offers reflecting as much as a $40pt rise in the two-to-three weeks ending November. MAP11-44 prices in the domestic market are seen at $455pt exw equivalent, up $30 through November. Despite the gains, latest domestic DAP prices are still as much as $90pt below the return from ongoing exports and $100pt below latest export offers.

Grey area over pre-approval allowance: Mixed views remain over what will be allowed to move from China in the coming weeks. Despite some views that only cargoes which passed full customs clearance by 1 December will be allowed to be exported, a number of sources indicate that the go-ahead will be provided for cargoes with pre-approvals secured in November. One trader indicated that customs clearance has now been provided for a DAP cargo planned for December export which had pre-authorisation. Still, in one case an exporter reportedly had pre-clearance for December export but after applying for customs clearance 1-2 December was told by authorities to wait for confirmation. As such, full clarity over what will allowed to move needs more time.

If the new export stoppage follows the pattern set out last year when China announced the export halt from 9 November 2023, then previously concluded cargoes which passed pre-approval will be allowed to secure CIQ clearance. In 2023, despite the 9 November halt, 1.1-1.2Mt DAP/MAP still moved from China between mid-November 2023 and mid-January 2024 before exports effectively dried up until April 2024.

Multiple Chinese suppliers report that a number of DAP/MAP cargoes planned for December from China have now been cancelled or are under negotiations to be delayed until January, if this is given the go ahead.

Cargoes at risk: Chinese suppliers and traders with Chinese tonnes had already lined up as much as 750,000t DAP/MAP for loading December through April 2025. DAP/MAP cargoes already agreed for December/January loading to markets like Brazil and Australia from China are now at risk depending on their levels of CIQ approval, whilst DAP lots awarded in the recent Ethiopia tender which run right through until April 2025 are also at risk, especially the six or seven lots from January onwards. If a number of these are cancelled then it is likely Ethiopia’s EABC will expand its expected late December/early January tender for 600,000t DAP to 1MT DAP or more. There are no indications of export controls for other phosphate fertilizer products like SSP, TSP or NPK, but rather just DAP, MAP and possibly water-soluble MAP at this point.

No clarity over timeline of controls past December: Chinese suppliers indicate that the notice of DAP/MAP controls at this point only applies to December with ‘further advise thereafter’. This leaves another grey area, with attempts ongoing to delay some cargoes until January pending a further announcement. Buyers will likely be reticent to delay until January without clear confirmation cargoes will then be given clearance, particularly with the Chinese New Year on 29 January. One major supplier noted that if domestic supply is tight and inland prices again increase sharply that the ban will remain in place through January.

Latest DAP/MAP deals already had left Chinese availability tight: Multiple medium and large-scale Chinese DAP producers had already indicated they were sold out for the remainder of the year before the December announcement.

Along with previous sales for November, recent DAP sales to India, Ethiopia and Southeast Asia, and MAP cargoes lined up for Australia and Brazil, total November-April DAP/MAP sales already concluded from China were seen at roughly 1.0Mt. January through October DAP/MAP exports officially totalled 5.4Mt, leaving the total sales already concluded for January 2024 through April 2025 as high as 6.4Mt.

The full China DAP/MAP quota for this period was reported at 6.5Mt earlier this year, meaning that further Chinese DAP/MAP availability under the quota may now have been as little as 100,000t for the next five months if previously agreed cargoes are allowed to move.

However, if the new controls stop all cargoes previously planned from 1 December which have not passed customs then the total drops to roughly 6.0Mt receiving inspection clearances from January through end November 2024, leaving 500,000t DAP/MAP availability from China under the reported quota system until the end of April 2025. It’s also worth noting that previous years have seen yearly exports surpass reported quotas in some cases, but not by more than 300,000t.

By Tom McIvor, Joint Head of Phosphates, Potash & NPKs