With US President-elect Donald Trump set to be inaugurated on 20 January, the North American potash market is nervously awaiting confirmation on whether tariffs will be implemented on imports from Canada. Trump first threatened to impose 25% tariffs on imports of all goods from Canada and Mexico back in November 2024 and he has repeated the same threat on multiple occasions since. While further clarity may yet take days or even weeks to emerge, it is worth considering the likely impacts these tariffs would have on the potash market if implemented.

(At the time of writing this post, media reports suggested that no new tariffs would be imposed on 20 January).

Source: Profercy Potash

Canada supplies the US with as much as 85% of its overall annual MOP imports and 80% of the volume if you factor out re-exports of Canadian product via Portland, Oregon. The traded volume in January-November 2024 reached more than 7Mt after removing these re-exports, according to the latest available trade data. As such, the potential imposition of tariffs has huge ramifications for supply to the US market.

The likely price impact cannot be ignored. Prices for New Orleans granular MOP barges have already shown signs of rebounding due to fears over the potential imposition of tariffs against Canada. Prices had drifted to as low as $250pst fob Nola on the back of seasonally weak demand but have since firmed to as high as $260pst fob based on Profercy’s latest assessment. Some indications have since been heard closer to $265pst fob. Unless clarity is provided from the US that tariffs will not be imposed, prices in the market will likely climb higher. If the full cost of a 25% tariff was passed along to US consumers, Nola prices would jump from being amongst the lowest globally for gMOP to the highest. Under a 25% price increase, the latest average of $255pst fob Nola (reflecting $274pt cfr US Gulf equivalent) would climb to $343pt cfr US Gulf.

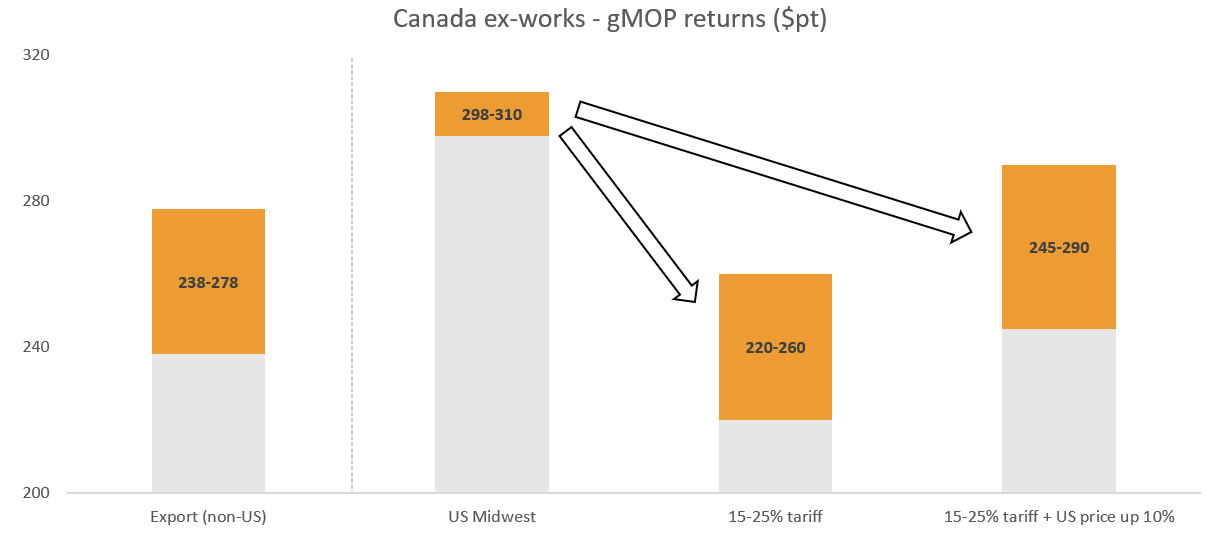

In a second scenario, under a 25% tariff and without any further US market price increases, sales to the Midwest would flip from yielding by some distance the highest gMOP netbacks to the lowest globally for Canadian producers. This scenario would reflect as much as an $80pt hit on returns for millions of tonnes for Canadian suppliers. Based on 2024 trade data, the tariff could imply revenue losses well in excess of $500 million for Canadian suppliers in 2025.

If Trump follows through with his threat, the reality is likely to fall somewhere in between the first and second scenarios, with US prices rising but not quite to the same extent as to match the full cost of a 25% tariff. If Nola prices rose 10% on the back of the implementation of the tariff to be more in line with the latest prices in Brazil, the netback impact for Canadian suppliers would be heavily offset.

Another important consideration for the impact of these tariffs is their potential impact on trade flows. It seems unlikely that Canadian suppliers would significantly shift sales away from the US, assuming the hit to their netbacks is not too substantial. Stage 1 of BHP’s mammoth Jansen project in Saskatchewan is 60% complete and scheduled to be commissioned in late 2026, bringing an initial capacity of 4.15Mt/yr MOP to the market prior to the commissioning of a second stage with a further 4.36Mt/yr in 2029. Incumbent Canadian suppliers would be loathe to cede market share in the US prior to BHP’s entrance, given that roughly 15% of Jansen’s output is planned to be directed to the US. Any Canadian volumes re-directed away from the US would also have the unintended consequence of opening the door to greater imports from overseas, particularly from Russia.

Further analysis on the potential impact of US tariffs against Canada, as well as plenty of other information across global MOP, SOP, and NOP markets, can be found in Profercy’s January Potash Report, which is being published on Tuesday 21 January.

by Logan Collins, Senior Editor – Phosphates, NPKs & Potash