Source: Profercy Nitrogen

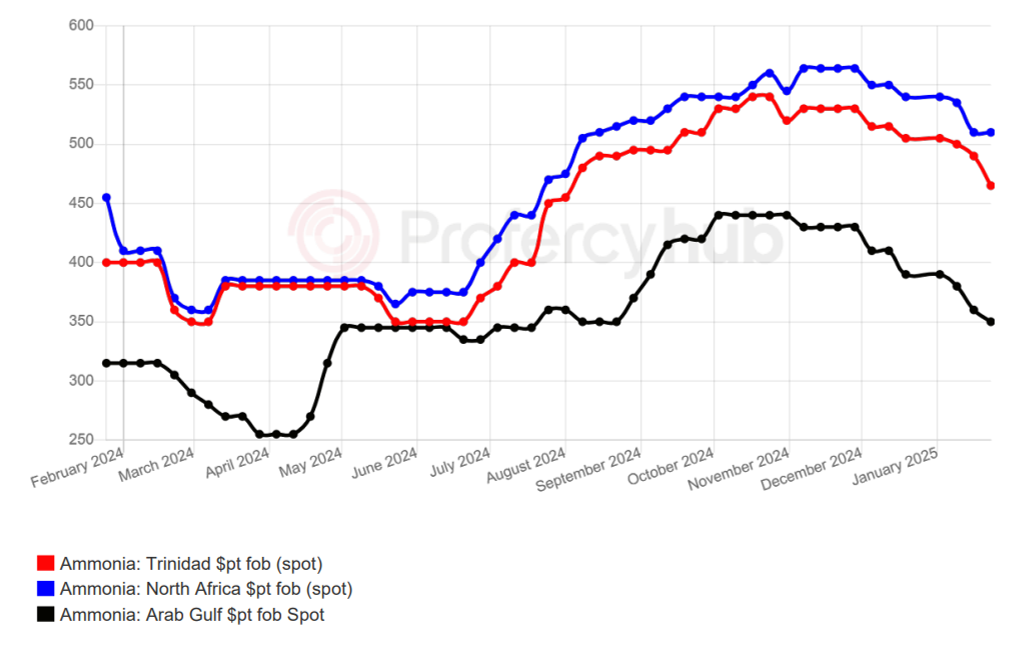

The bearish tone of the merchant ammonia market that has been evident so far this year was clearly underlined by the early settlement of the Tampa contract for February loadings at a $38pt discount to this month, with the $500pt cfr figure heard prompted by a spot purchase at the same price.

While confirmed details of the delivery to the Florida port are still awaited, the purchase of a spot cargo widely said to originate from the Middle East starkly illustrated the notable supply/demand imbalance of recent weeks.

With plants at key export hubs running well and seasonal factors suppressing demand from industrial and agricultural users, negative price pressure, particularly East of Suez, has seen shipments from Southeast Asia and the Middle East head to Europe and the Americas with increasing regularity.

High natural gas prices in Europe and firming nitrogen prices have created some limited support West of Suez, but even if European manufacturers idle plants and switch to offshore volume, the market is not expected to absorb all of the surplus forecast for the current quarter.

Such a bearish picture had also been expected this time last year, but 2024 was quickly characterised by unscheduled plant shutdowns and feedstock cuts in the Americas and Middle East that removed a significant number of cargoes from the market.

In addition, the launch of the much anticipated 1.3m. tonne/year Gulf Coast Ammonia (GCA) project in Texas never materialised, a delay that forced offtake major OCP Group in Morocco to source term and spot cargoes from other suppliers and regions.

Talk of an imminent export cargo from that new facility is wide of the mark for now, but once the project completes commissioning, it will throw 100,000t per month of material onto the market and reshape supply chains redrawn in 2022 with the loss of Black Sea volume amid the conflict in Ukraine.

January spot activity brisk yet again

So far this year, spot deals for January loading have totalled around 240,000t according to Profercy data, versus around 250,000t in the year-ago month.

In latest confirmed spot business, Turkey’s Gemlik sold 25-40,000t combined to a pair of traders, while at least one Baltic cargo is now heading to Turkey. Iranian suppliers are heard long for the next couple of months, meaning further sales into Turkey should be concluded soon.

With import activity in India and Northeast Asia likely subdued until late Q1, bearish sentiment and lower prices are expected to persist for several more weeks.

By Richard Ewing, Head of Ammonia/Deputy Editor at Profercy