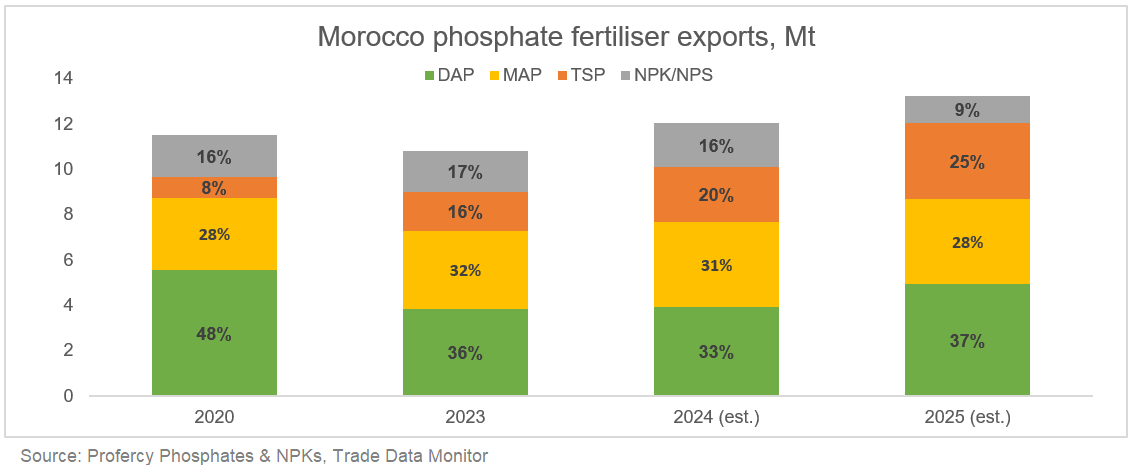

Morocco’s fertilizer exports in 2024 reached a record 12.37Mt, up 13% yr-on-yr from 10.95Mt and roughly 1Mt above the previous record of 11.3Mt in 2020, according to latest Office Des Changes data. Notable volume increases were seen on MAP/NP/NPS but particularly on TSP, which rose as much as 750,000t and increased its share of OCP fertiliser sales to 20% from just 8% in 2020.

With OCP already increasing comparative exports in Jan/Feb and capacity rising to roughly 16.5Mt through 2025, OCP is forecast to produce 14.0-14.2Mt phos ferts in 2025 (85-88% of capacity) and export 13.4-13.5Mt (up roughly 1.1Mt). The expected 2025 total exports reflect as much as a 4.0Mt rise in availability from OCP over three years.

Combined DAP/TSP exports are forecast to rise as much as 1.9Mt due to the absence of 800,000t NPS sales to Ethiopia (as the buyer switches to DAP imports) and a likely decline in Brazil’s MAP imports as the country increases its switching to SSP/TSP and other NP grades.

Despite the steep rise in likely DAP/TSP availability, demand for these products is expected to see significant jumps this year with India needing to replenish crisis-level stocks, Ethiopia targeting 1.27Mt DAP imports in latest tenders, and increased discounts for TSP drawing out demand in a number of markets.

Reports suggest OCP is finalising a deal for as much as 2.5Mt DAP/TSP to India, up from total volumes to the market at 1.6-1.7Mt in 2024. European DAP/TSP/NPK sales could also be another option for OCP to increase sales in 2025 if the EU’s proposed tariffs on Russian fertilisers takes hold.

As a result, the product mix from OCP is expected to see notable changes in 2025. While DAP/MAP volumes are overall set to increase, these are likely to still remain below the DAP/MAP exports seen in 2020 and should remain around 64-65% of the overall total, as with 2024. TSP is forecast to take as much as 25% of OCP’s overall product mix, rising to as much as 3.4Mt from 925,000t TSP exports in 2020.

NPK/NPS volume growth has been somewhat stagnant over recent years from OCP, with the 2024 total of 1.95Mt slightly above the 1.86Mt exported in 2020. In 2025, these volumes are expected to slump in the absence of Ethiopia NPS sales, though this may be offset somewhat by increased NPK sales.

The current timeline for next stage developments is set to bring OCP fertiliser capacity to at least 20Mt/yr – the company’s target – by 2027. Further developments are currently set to bring production up to at least 29Mt/yr by 2030.