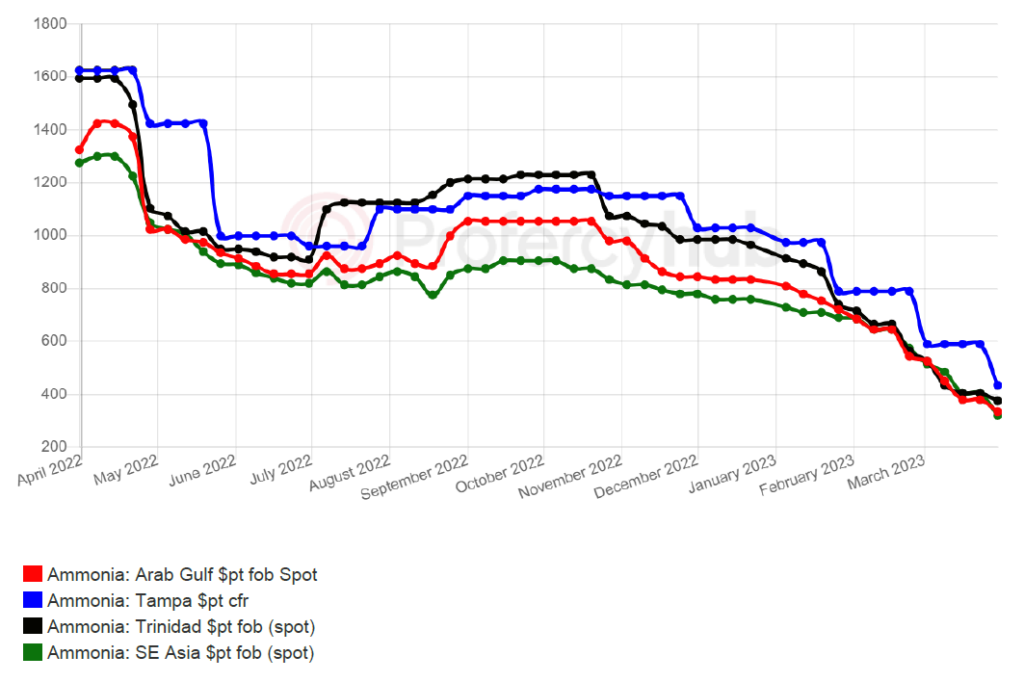

In a hectic week and against the backdrop of a fresh fall in the Tampa contract, plenty of spot deals were concluded as lower prices tempted buyers back into the market after months of demand destruction.

While the $155pt plunge in the US benchmark to $435pt cfr for April loading was broadly in line with expectations, it was overshadowed by two sales out of Indonesia to China at huge discounts.

Both involved Mitsubishi, with the trader selling an early April cargo to Henan Energy at $310pt fob Luwuk, and a later cargo to Sailboat at a netback around 10% higher than that featured in the earlier sale.

While those prices were not popular with other suppliers either side of the Suez, the flip side is they provided further evidence of a rebound in Chinese import demand, with several spot cargoes heading to the country of late.

In the Middle East, Mitsui has been linked to possible discounted deals in Qatar and Oman for April loading, with a tanker last used by the Japanese supplier arriving at Salalah in the past 24 hours to lift up to 25,500t sourced from OQ Trading.

For now, major producers in Saudi Arabia are concentrating on contract commitments, with Ma’aden looking to load 150,000t across six shipments in April, all but one of which will stay East of Suez.

West of Suez, Trammo sealed a quartet of sales for around 50,000t in total. The trader concluded deals in several regions, including a formula-priced sale to EuroChem in Belgium and fob deals with two producers in North Africa.

While the market remains long for now, there is growing confidence that lower prices will prompt buyers to return and soak up the surplus.

Prices may yet have to fall even lower for a floor to emerge, with a wave of orders from Turkey and India likely to materialise as the new quarter develops.

By Richard Ewing, Head of Ammonia/Deputy Editor