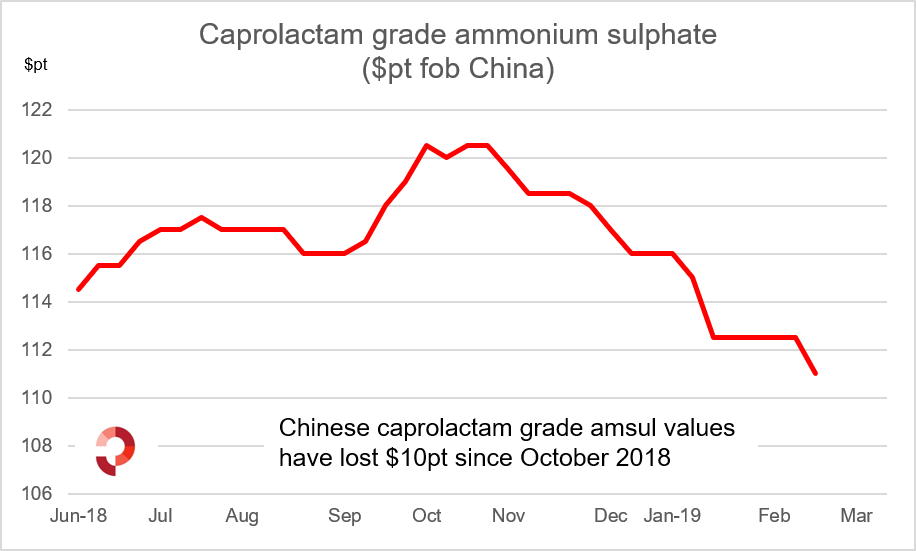

Ammonium sulphate markets have been under steadily increasing pressure since January. Last week, Chinese producers finally accepted $110pt fob for standard caprolactam grade amsul which spurred buying following several weeks of stagnation.

The price is down $6-7pt from December amid a drop off in demand following the conclusion of the Brazilian season. However, the primary reason for the decline has been the increased production rates of by-product standard grade amsul among Chinese producers, mainly caprolactam and steel grade producers.

At the start of December, production of caprolactam grade amsul was around 50% of capacity. By the end of January, it had increased to around 90% where it has more or less remained since. The higher production rates follow solid returns on the main products including caprolactam, steel and nickel with amsul the poor relation. The price of nickel, for example, is around $13,000 per tonne.

Meanwhile, only Turkey has been a major spot buyer of both standard and compacted/granular amsul over the last two months. The seasonal Brazilian spot purchases concluded in January with cfr prices declining since then. Further price declines are expected in March.

In the coming weeks and months, significant demand is anticipated for standard grade amsul from Mexico with as much as 100,000t required in the next 4-6 weeks. South Korean product has a duty advantage and will likely win out. This would remove potential Korean supply into Turkey and reduce competition for Chinese suppliers. Central American demand is also noteworthy with buying already concluded, albeit at the lower $110pt fob China levels for standard caprolactam grade amsul.

In all, demand is anticipated around the corner, however until it materialises further downward pressure and price declines are expected.

By Michael Samueli, Nitrogen Market Reporter

E: michael.samueli@profercy.com

NB: All prices quoted basis Profercy Nitrogen Weekly Report.