Source: Profercy Nitrogen

PT Petrokimia Gresik (Pupuk) held a tender for a combined 75,000t of capro amsul in three equal lots for early January onwards shipment earlier today against a backdrop of falling values in the region.

The tender was inevitably going to be a major test for Chinese and SE Asian capro amsul markets with substantial implications for international markets.

The lowest offers into the tender were around $120pt cfr with some reports putting the lowest quote at $121.80pt cfr. Prior to the tender, Pupuk is reported to have been targeting below $120pt cfr.

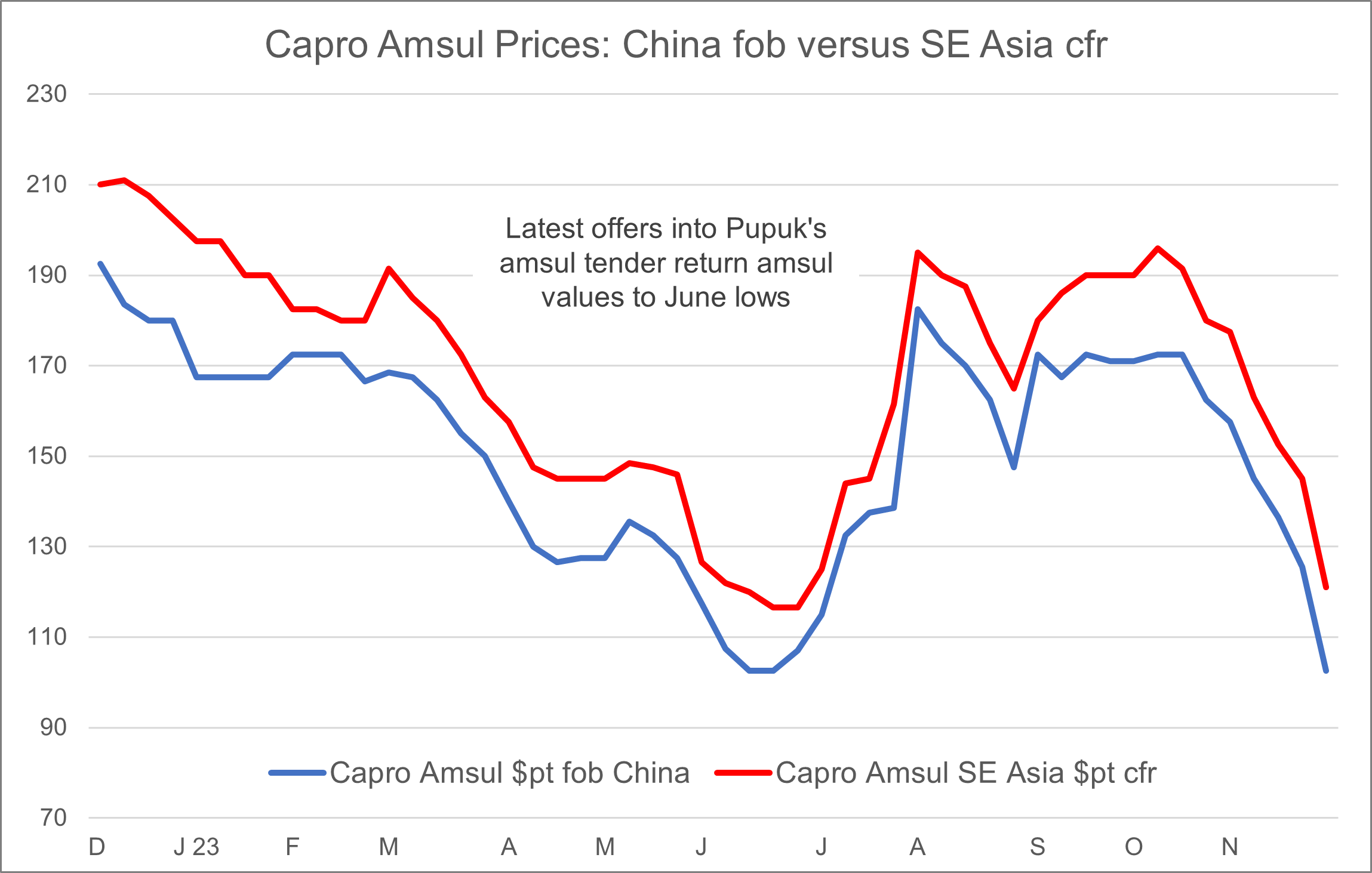

Despite the freight advantage owing to the higher volume sought than other regional tenders, the price marks at least a $20pt decline on recent SE Asian cfr levels. Indeed, the cfr price is at an outright parity or even discount to Chinese fob prices for capro amsul from last week.

Freight from China to Indonesia for a 25,000t shipment is put in the high-$10s pt with netbacks equating to $100-105pt fob before trader margin. The netbacks are around $22-24pt below prevailing Chinese fob values last week.

With the Pupuk offers factored in, SE Asian cfr values have declined by around $80pt since mid-October when prices hit $200pt cfr for capro amsul.

By Michael Samueli, Daily Nitrogen Editor