- Prilled urea prices fall further in China

- US prices hold while all other markets for both granular and prilled urea drop back

- Gulf between Yuzhnyy ammonia and Yuzhnyy prills widens.

The final week of Q1 maintained the bearish mood of previous weeks, with prices falling for both prilled and granular urea in all markets except the US. For the lower grade prilled urea, Yuzhnyy netbacks dropped while latest deals in China saw prilled urea sold over $100 lower than March last year. Chinese product will have a significant impact on global urea markets in the second half of the year and the current low prices in China are notable given that these include a high export tax that will not apply beyond Q2.

For granular urea, tenders in Egypt saw a long anticipated price fall, although not sufficient to match the rate of decline for Middle East product in recent weeks. As has been the case for much of Q1, the US is the only healthy market with prices there holding.

Of note, ammonia markets remain firm and this will be explored in greater detail in a blog post next week. The gulf between Yuzhnyy prilled urea and Yuzhnyy ammonia is now $200pt.

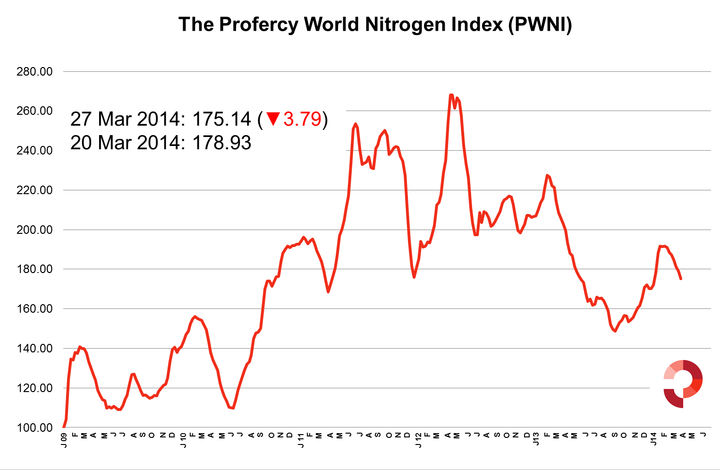

With the low end for Profercy’s price ranges for Yuzhnyy prilled urea, Egyptian and Middle Eastern granular urea falling by $7-10 this week, Profercy’s World Nitrogen Index fell by a further 3.79. The fall was exacerbated by a $30 fall in Black Sea ammonium nitrate prices. The PWNI ended the week at 175.14.

The Profercy World Nitrogen Index is published every week and is based on price ranges provided by the Profercy Nitrogen Service. This includes prilled and granular urea, UAN, AN, ammonium sulphate and ammonia.

Profercy’s Nitrogen Service includes daily news, weekly analysis and monthly forecast reports. For more detailed information on specific products and individual markets, please sign up for a free trial or for more information on the Profercy Nitrogen Service, please click here.

The methodology behind the Profercy World Nitrogen Index can be found here.