Urea values in nearly every region declined in the absence of demand. In several regions, especially Europe, demand is expected to emerge soon as the season draws nearer. However, buyers are reluctant to step in having received lower offers with each day.

Beyond Europe, the USA and India are markets closely being followed for any potential signs of demand. In the US, net urea supply is quite low compared to previous years following low imports and higher exports, particularly during Q3 last year. US Gulf barge values dipped to below $400ps ton fob Nola on average, although the market has staged a modest recovery in the past 48 hours.

Meanwhile, an Indian purchasing tender was anticipated as early as the beginning of December, but any return appears to have been delayed.

With demand absent/delayed, stock levels in the hands of producers continues to rise. Indeed, despite it now being the middle of January, several suppliers still have uncommitted January volumes including in Egypt. Values in Egypt are now firmly below $500pt fob.

While demand is also certain to emerge in the coming weeks, including an Indian tender as well as European and US buying, the current delay may mean that it will not be in time to tighten supply.

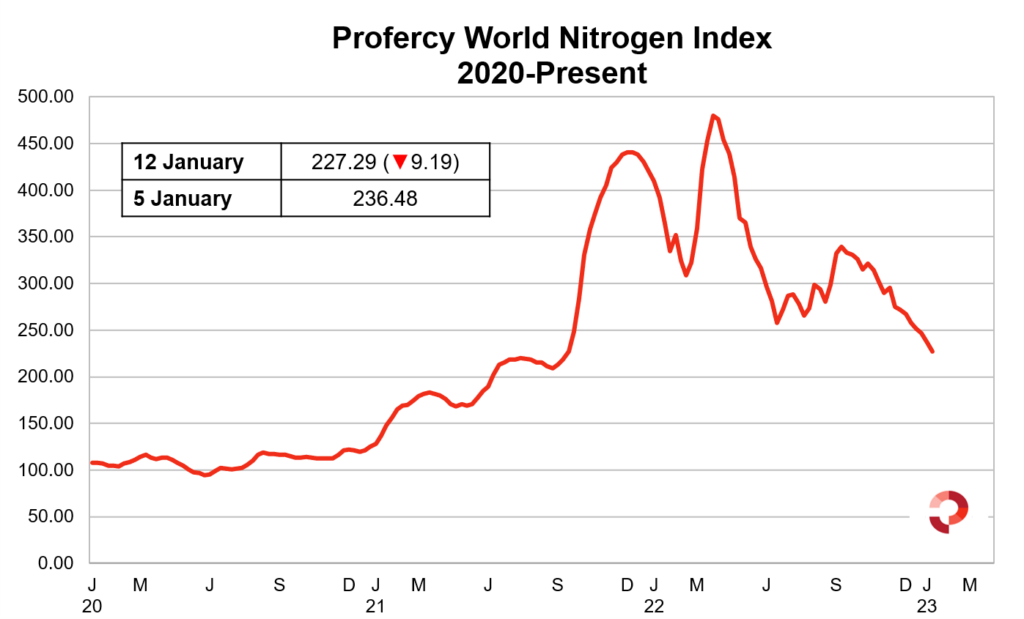

As a result, the Profercy World Nitrogen Index declined by 9.19 points to 227.29 points. Urea values in several regions, as well as the PWNI, are either close to or have dipped below Q3 2021 levels. Of note, the first event of the recent crisis occurred in September 2021 when European gas prices made sharp increases and the first production shutdowns occurred.

By Michael Samueli, Nitrogen Daily Editor