Nitrogen Fertilizer Markets

Nitrogen (N), an essential element abundant in our atmosphere, plays a fundamental role in various facets of life and industry, with a pivotal role in the growth of healthy crops. Nitrogen is by far the largest of the three primary nutrients required by plants for strong and heathy growth, the others being Phosphorus (P) and Potassium (K).

Nitrogen is widely recognized as the most crucial nutrient for plants, as they absorb more nitrogen than any other element. It plays a fundamental role in ensuring plant health and nutrition, crucial for both growth and post-harvest quality. Nitrogen is essential for chlorophyll production, enabling plants to utilize sunlight for photosynthesis, the process by which they manufacture food. Moreover, nitrogen moves easily in soil and gets taken up by plants through their roots. Insufficient nitrogen leads to chlorophyll deficiency, hindering nutrient absorption and proper sunlight utilization by plants.

Since its development in the early 20th century, the Haber-Bosch process has played a pivotal role in global agriculture by synthesizing Nitrogen fertilizer. This process, named after its inventors Fritz Haber and Carl Bosch, revolutionized food production by enabling the large-scale production of nitrogen-based fertilizers. Today, approximately half of the world’s food production relies on the use of nitrogen fertilizer produced through the Haber-Bosch process, highlighting its critical importance in sustaining the global food supply.

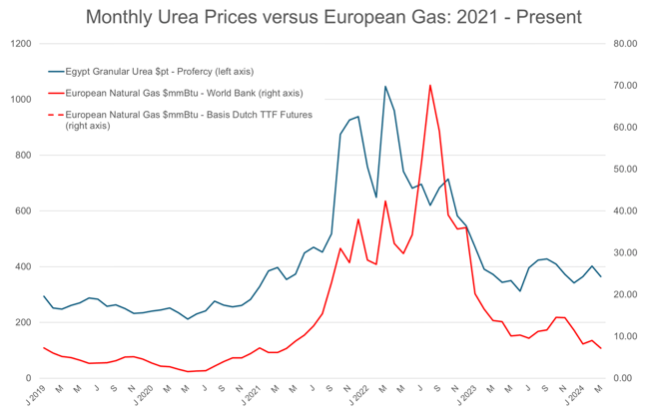

The Haber-Bosch process is the initial step in producing nitrogen fertilizer, starting with hydrogen gas and atmospheric nitrogen. Hydrogen, commonly sourced from natural gas, particularly methane, serves as the primary source. In certain regions, alternative sources such as coal are also utilized for hydrogen production. Under high temperature and pressure conditions, hydrogen and nitrogen react to produce Ammonia. Subsequently, various essential nitrogen-containing fertilizers can be synthesized from this Ammonia.

The main sub-products of nitrogen used as fertilizer include:

- Urea

- UAN – Urea Ammonium Nitrate

- AN – Ammonium Nitrate

- CAN – Calcium Ammonium Nitrate

- Amsul – Ammonium sulphate

- Ammonia

These compounds serve as valuable sources of nitrogen for plants, promoting healthy growth and enhancing crop yields.

Urea is the most widely used nitrogen fertilizer in the world, accounting for some 62% of global demand for this key nutrient.

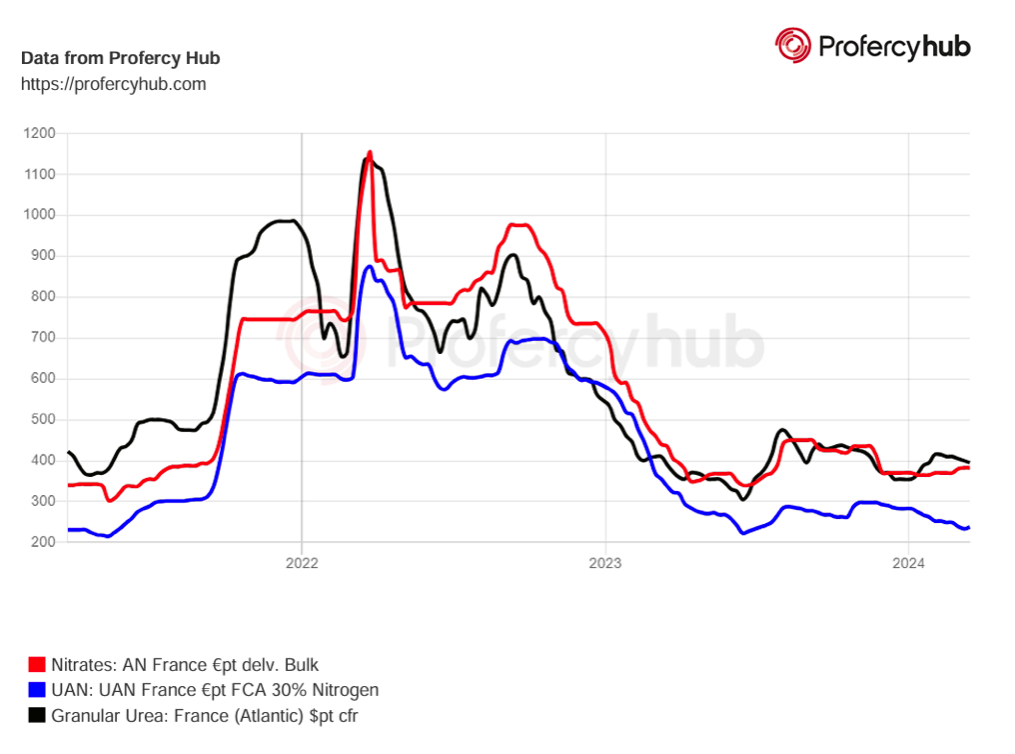

Nitrate fertilizers are, next to Urea, an important nitrogen source for crops around the world. The three main nitrate fertilizers – Urea Ammonium Nitrate (UAN), Ammonium Nitrate (AN) and Calcium Ammonium Nitrate (CAN) – in contrast to urea, contain nitrogen in the nitrate form, which can be directly taken up by plants. Nitrate prices generally move in step with urea as this is the main competition product, although prices can move in different directions on the back of structural or fundamental changes in one of the markets.