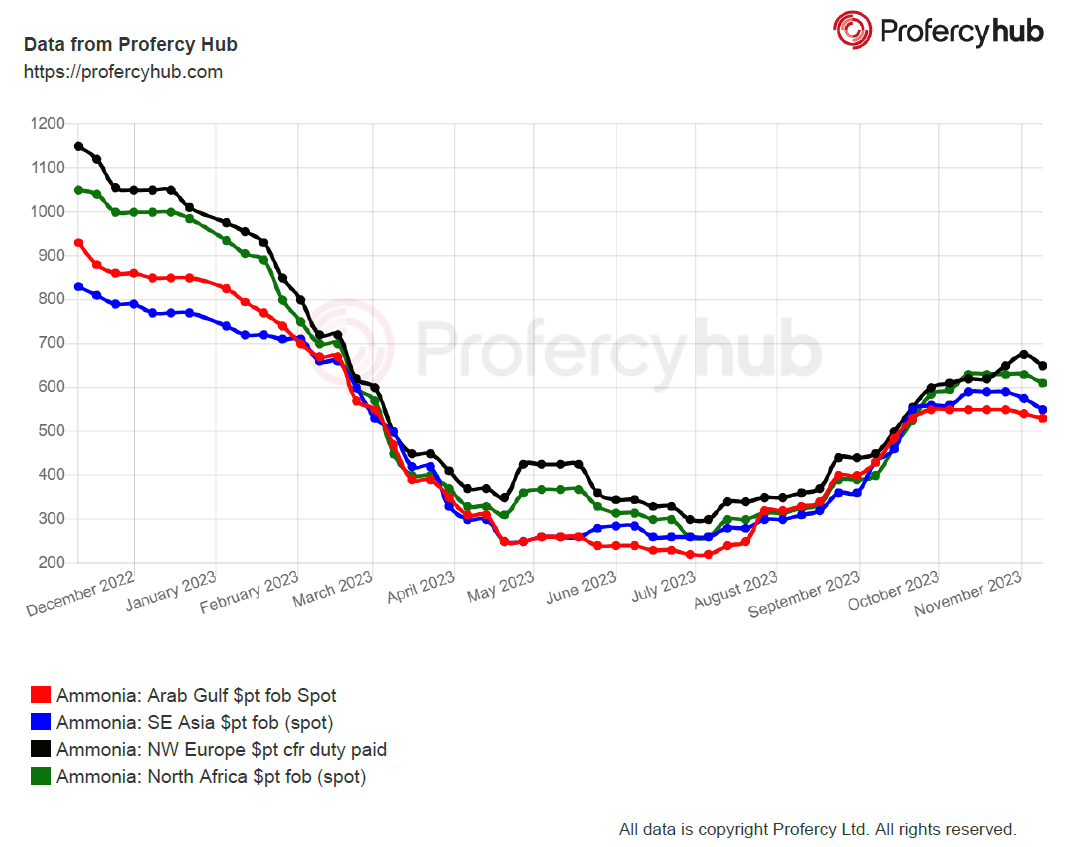

Softening demand and stronger supply have combined to create downward price pressure in the international ammonia market for late 2023/early 2024 business, with a November spot sale in Algeria agreed at a $20-25pt discount to last business.

Softening demand and stronger supply have combined to create downward price pressure in the international ammonia market for late 2023/early 2024 business, with a November spot sale in Algeria agreed at a $20-25pt discount to last business.

The market is far better balanced than previous months on plant restarts and with no sign of major capacity curtailments in Europe or North Africa, Sorfert’s sale at $610pt fob Arzew came as no surprise, although further details about the deal have not been disclosed.

The final few months of the year are traditionally poor ones for ammonia prices as industrial orders weaken and downstream plant turnarounds are performed, particularly in countries throughout Northeast Asia.

This year is in no exception with the firm price trend of recent months driven purely by significant supply constraints in key regions that saw export availability in the Americas (Trinidad and the US Gulf) and the Middle East (Saudi Arabia).

Now the supply situation has returned to some sort of normality, length has returned to the merchant market, with around 100,000t changing hands, albeit most of that volume was sold on a confidential basis and/or priced under formula rather than at a fixed price.

In addition to the aforementioned sale out of Algeria, fob tonnes were purchased in Libya and the US Gulf, while cfr sales of spot parcels were struck into countries including India, South Korea, Turkey and the Philippines.

Buyers are likely to become increasingly aggressive with their price targets for the next round of purchases, but with many having little need for cargoes, such numbers have yet to be shared.

Sentiment is prices will decline for the rest of the year and into 2024, with this negative trend expected to be felt especially East of Suez once export-focused plants in Oman and Indonesia exit turnarounds later this month.

Meanwhile, with nitrogen prices also beginning to fade, some urea producers may switch their focus to ammonia in a move that would throw more tonnes onto the Q4/Q1 market at a time of decent stocks.

By Richard Ewing, Head of Ammonia