Acron’s net 2020 commercial AN and urea availability jumps following UAN cutbacks

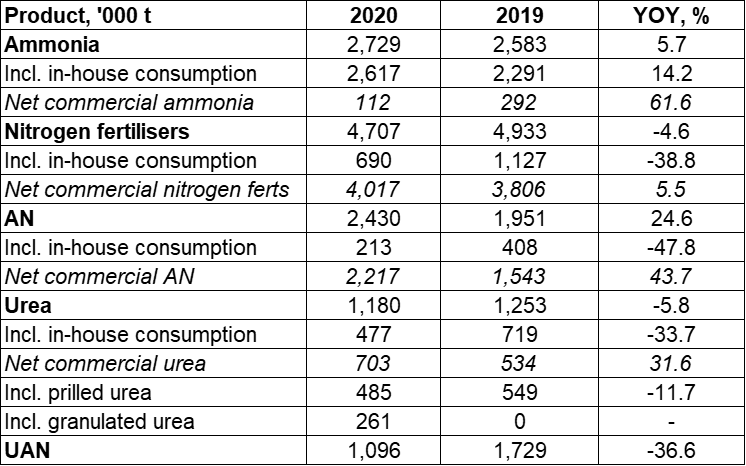

In 2020, overall ammonium nitrate production increased while urea and UAN output declined.

As expected, UAN production fell sharply as the producer faced very poor returns from the USA for much of the year and was effectively blocked out of the European markets due to anti-dumping tariffs. In 2020, UAN output was 1.10m. tonnes, down 37% year-on-year from 1.73m. tonnes.

Overall urea production decreased by 6% from 1.25m. tonnes to 1.18m. tonnes. However, a sharp 34% decline in in-house use of urea, led to commercial availability of urea increasing by 32% to 703,000t. This includes 261,000t of granular urea from the new production line which come on stream in 2020.

Meanwhile, AN output increased by 25% year-on-year to 2.43m. tonnes while in-house consumption of AN declined 48% to 213,000t. As a result, commercial AN availability increased from 1.54m. tonnes to 2.22m. tonnes, up 674,000t or 44%. The bulk of the new availability has been placed domestically with Russian AN demand running 10% higher overall year on year. Russian demand has been increasing substantially over the last few years, albeit from a low base.

Ammonia production also increased to 2.73m. tonnes, up 146,000t or 6%. In-house consumption increased from 2.30m. tonnes to 2.62m. tonnes, meaning commercial ammonia availability decreased from 292,000t to 112,000t.

Overall, nitrogen fertilizer output declined 5% year on year (excluding ammonia) to 4.71m. tonnes with in-house consumption declining by 39%, primarily as a result of the UAN cutbacks, to 690,000t.

Yara – Q4 Results: Fourth quarter net income up 24%

Yara – Q4 Results: Fourth quarter net income up 24%

Yara’s net income during Q4 2020 climbed to $246m, a 24% increase from $199m during the same period of 2019, the company announced in its results today (9 February).

EBITDA excluding special items meanwhile, declined to $511m, from $525m a year earlier, while European gas (TTF) prices rose over the period from $3.70/MMBtu in Q4 2019, to $4.50/MMBtu in Q4 2020. However, the producer notes that its increased deliveries and production have offset the impact of higher energy prices.

Yara estimates its Q1 gas price in Europe at $7.10/MMBtu and $6.40/MMBtu for Q2, compared to last year’s comparable figures of $4.30/MMBtu and $2.80/MMBtu. Q3 gas prices were even lower at $2.60/MMBtu, since which recovering demand for gas and seasonal factors have seen a major recovery in gas prices from the Covid-19 impacted lows of mid-2020.

Deliveries of urea increased from 1.37m. tonnes in Q4 2019 to 1.56m. tonnes in Q4 2020, while deliveries of nitrates also rose from 1.27m. tonnes to 1.35m. tonnes over the same period. Deliveries of UAN, the lower valued nitrogen product, declined from 264,000t to 253,000t in Q4 2020. In the phosphates segment, deliveries of DAP, MAP and SSP also climbed from 167,000t in Q4 2019 to 188,000t in the same quarter of 2020.

Yara’s deliveries of nitrogen-based products all increased in 2020. Its urea deliveries climbed to 6.04m. tonnes from 5.91m. tonnes in 2019, while Nitrate deliveries rose to 5.78m. tonnes from 5.41m. tonnes, and UAN also gained to 1.41m. tonnes from 1.29m. tonnes. Meanwhile, deliveries of DAP, MAP and SSP declined slightly year-on-year to 1.01m. tonnes, from 1.10m. tonnes in 2019.

The firm’s production of urea fell 19% in 2020 to 5.18m. tonnes, from 6.42m. tonnes in 2019. UAN output also declined to 959,000t from 974,000t. While, production of nitrates last year increased to 6.47m. tonnes, from 6.23m. tonnes in 2019.

By Michael Samueli and Neha Popat