Source: Profercy

Just like its famous equine counterpart, the tanker Dancing Brave was first out the gate when it performed the inaugural loading from the long-awaited Gulf Coast Ammonia (GCA) project in Texas a couple of days ago.

The lifting of nearly 15,000t of spot volume for Norwegian major Yara’s operations at its Article Circle fertilizer facility at Glomfjord is expected to be the first of many loadings from the 1.3m. tonne/year project by leading players.

Given up to 100,000t per month of material is understood to have been earmarked for export, GCA’s arrival at a time when the market is already saturated is likely to see persistent downward price pressure continue into the second quarter at least.

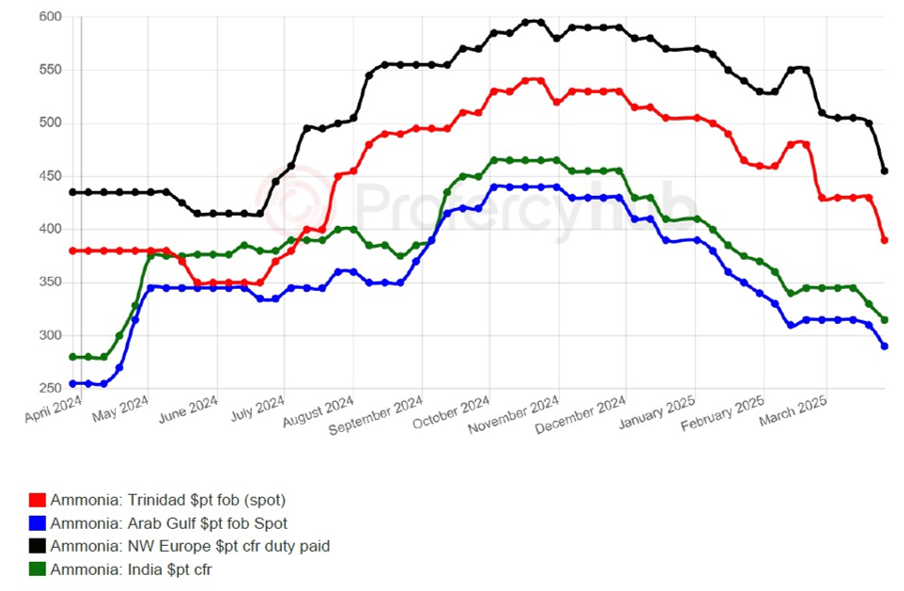

The negative pricing scenario was illustrated by the latest fall in the monthly Tampa contract, with the US benchmark for April loadings for Florida settled at $435pt cfr, down $25pt from this month’s agreement.

With spot sales into Morocco having influenced previous settlements of late, the absence of new business by OCP Group – who will receive most of GCA’s annual output – was a factor in the higher than predicted contract in an increasingly long international market.

The arrival of Texas City merchant material is sure to be welcomed by buyers, especially those in Europe hit hard by high natgas costs and volatile offshore pricing in recent years.

Spot deliveries to fertilizer and chemical consumers in Northwest Europe have gathered pace in recent weeks, with the region becoming a key outlet for large suppliers either side of the Suez Canal who would otherwise have faced hurdles.

Several buyers are understood to have concluded spot deals for April arrival and while further details are elusive for now, information should become available as tankers approach disports.

This left Turkey as the focal point for this week’s spot activity, with one 25,000t cargo sold to Trammo by Gemlik on a fob basis for prompt lifting, and a handful of cfr deals done into the country by traders.

Outlook also glum for manufacturers in the East

In the Middle East and Southeast Asia, producers are heard long due to seasonal soft demand from major importers in India, though the real headache is the poor state of the chemicals market in Northeast Asia.

Despite the closure of the Red Sea to most merchant vessels, arbitrage opportunities have been seen throughout the first quarter, with such a trend likely to continue well into the second quarter given the lack of interest by spot buyers in Asia Pacific.

Phosphates titan OCP has been a regular recipient of term and spot cargoes from the East ever since the loss of Black Sea material in early 2022.

With the world’s largest importer requiring around 150,000t per month of feedstock at its Jorf Lasfar import hub, the company will be keeping its fingers crossed that the ramp-up of GCA goes to plan next month and its first loading does not fall in the final furlong.

By Richard Ewing

Head of Ammonia/Deputy Editor at Profercy

Available Now: The Ammonia Outlook for 2025 and Beyond

The latest ammonia forecast was published on 26 March with this provided to subscribers of the Ammonia Forecast Service. The reports offer expert insight into forward trade balances, market dynamics and movements for the balance of 2025, as well as monthly price forecasts for key benchmarks.

More information can be found here.