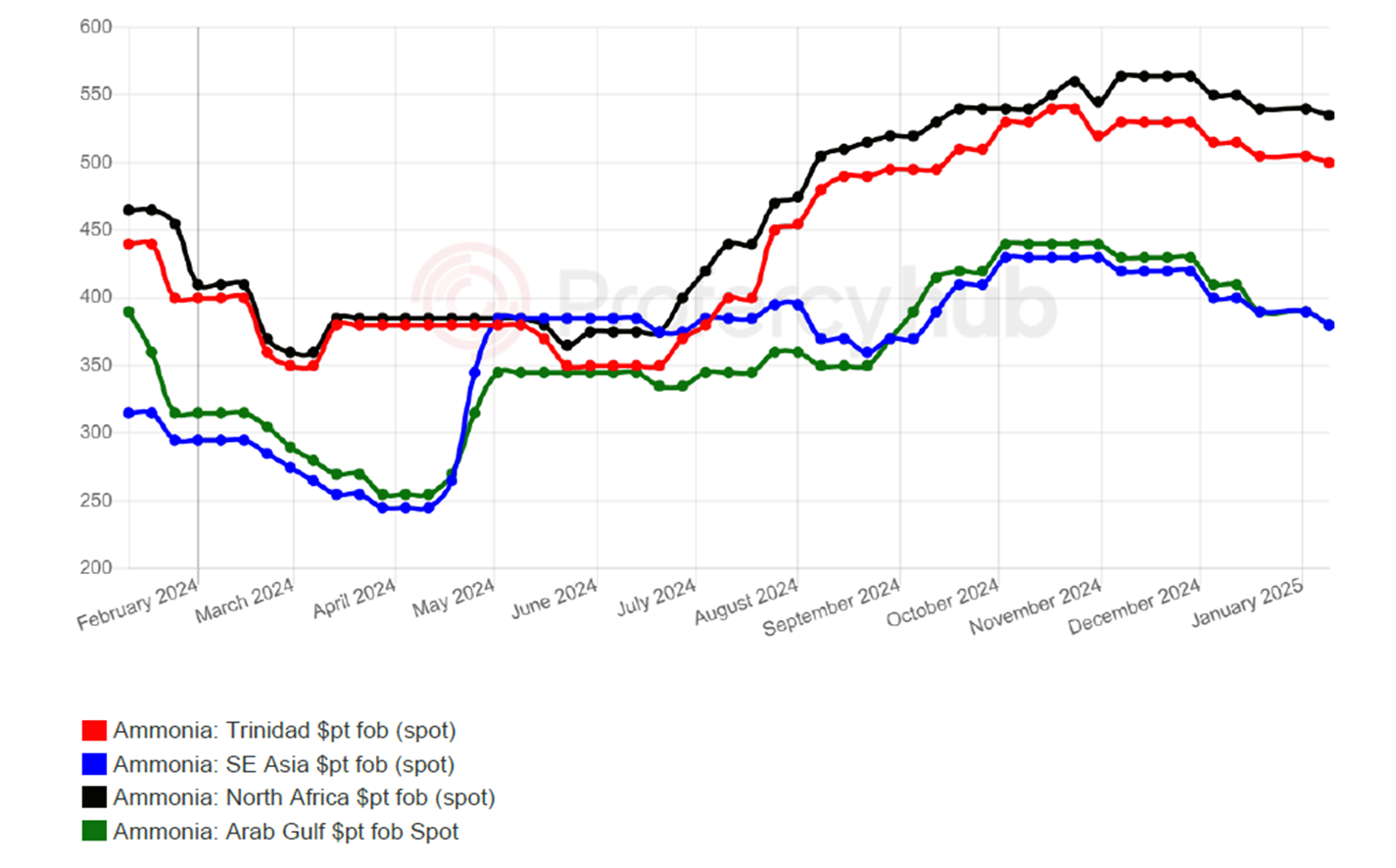

Source: Profercy Ammonia

The international merchant ammonia market has commenced 2025 fundamentally long on a strong supply situation in key export hubs and seasonally weak demand from large industrial buyers in Northwest Europe and Northeast Asia.

With downward price pressure in the Middle East and Southeast Asia gathering pace on sluggish order books, discounted cargoes from the former are understood to have been offered into the West for February arrival.

Even with the closure of the southern end of the Red Sea to most maritime traffic and the higher freight costs and longer delivery times, such volumes are likely to appeal to buyers who have met pockets of resistance to lower prices from suppliers in North Africa.

Although no such East to West spot business has yet been confirmed, the arrival of spot cargoes from the Arabian Gulf and/or Southeast Asia would likely prompt producers in the West – particularly in Algeria and Egypt – to reduce their price targets for next business.

As is often the case when bearish conditions emerge, players keep prices and price targets close to their chests. Indeed, while at least 90,000t of spot volume for January shipment has changed hands of late, lower numbers were heard, but not confirmed.

In recent business, Algeria’s Sorfert sold around 40,000t to Yara for lifting across three shipments this month, while Malaysia’s Petronas sold 10,000t of formula-priced volume into India, and Trammo just under 7,500t into Brazil.

The latter also appears to have secured some Turkish volume in a move that looks to have, in turn, created space for the discharge of a 2024 cargo to the vendor.

Elsewhere in Turkey, EuroChem has been linked to the sale of a 23,400t spot cargo that has just left the Baltic, with buyers in that country heard targeting the low-$500s pt cfr for deliveries this month and next.

While higher prices for urea and other ammonia derivatives such as nitrates may offer some short-term support in Europe – where natgas prices remain well above historical levels – the robust supply outlook both sides of Suez should offset such any such impact.

by Richard Ewing, Head of Ammonia