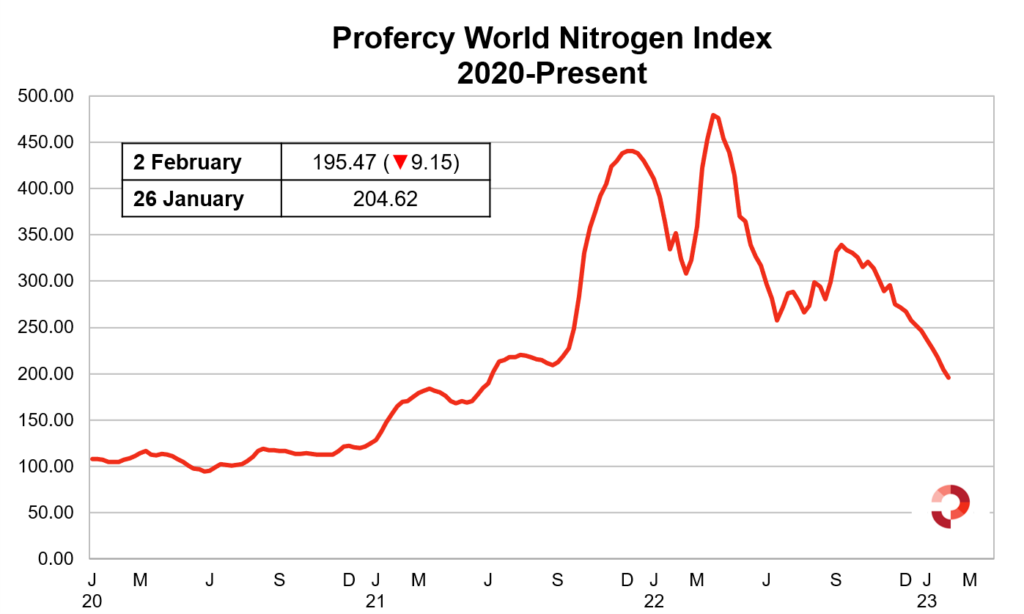

Despite a round of short covering of earlier urea sales in Egypt and amsul in China, the overall nitrogen dynamics continue to be weak. Indeed, the Profercy World Nitrogen Index declined by 9.15 points to 195.47 this week, the lowest levels seen since June 2021.

A big part of the decline is due to the length in the ammonia markets. There is a growing sense of nervousness among suppliers on either side of the Suez due to the sheer amount of material that is available. Ammonia prices in NW Europe declined by $40-50pt week-on-week to below $800pt cfr duty free/duty paid.

In a clear sign that manufacturers and traders are having a hard time placing product, vessels in major export hubs like the Middle East and Southeast Asia are spending increasing amounts of time at anchorage.

The weak demand has largely been replicated across other nitrogen products. A round of urea short covering in Egypt saw over 120,000t of prilled and granular urea committed in spot sales, as well as 200,000t committed by Fertiglobe to Ethiopia ex-Egypt under earlier awards.

These sales sustained and moderately lifted prices from earlier lows of below-$400pt fob this week but did little to change the overall supply and demand dynamics, even if near-term pressure on producers has been reduced.

Indeed, the US Gulf continues to be used as an outlet for cargoes unable to find a home elsewhere. This trend has come hand-in-hand with increased levels of formula priced business by offshore producers. With the cargoes arriving without much effort, US importers have taken a relaxed approach just ahead of the spring season despite urea supply being at a net deficit for this season. Market participants are willing to wait and see if the unsolicited cargoes being shipped to the USA will be enough to cover the deficit in the coming months. Without competition from any other markets, this is certainly possible.

Elsewhere, Chinese capro amsul prices registered its first price uptick since October with domestic sales concluded at or above $170pt fob equivalent. Similar to the Egyptian urea sales, buyers of the amsul stepped in to cover earlier short positions. However once again, the overall supply is still outpacing demand.

By Michael Samueli, Nitrogen Daily Editor