Global urea values have soared this week as market participants react to the war in Ukraine. While recent sanctions on Russia have not directly impacted the fertilizer sector, this unprecedented situation has sparked a renewed demand amongst buyers due to significant concern around supply disruptions from Russia.

Many are now willing to accept the higher prices on offer from non-Russian producers, as concerns linger that further sanctions could impact Russian business. Indeed, many traders and importers have been unwilling to consider booking new shipments from Russia, owing to concerns over banking, financing and insurance restrictions which has also impacted shipping from Baltic/Black Sea ports.

Both fob and cfr values rapidly advanced in the west as a result, and this has now pulled up eastern values. The recent escalation in energy prices has also maintained the upwards pressure on urea values.

European traders and distributors have moved quickly to secure small volumes for March and April shipment. This saw North African values rapidly increase, with Egyptian granular urea gaining close to $300pt fob over the space of a week. Latest business has taken at place at $905pt fob, highs that were last seen from the region in early January.

In the US Gulf, distributors were actively buying in the market as they look to secure supplies ahead of the key spring season. Barge values also shot up as a result, with latest March business taking place over $120ps ton fob Nola from trades that took place late last week.

While in Mexico, strong buying interest has emerged with many there now struggling to solicit offers. Quotes from traders offering non-Russian material were heard this week in the low to mid-$800s pt cfr for the west coast, far higher levels compared to a week ago.

The increase in western cfr values has also opened up opportunities for eastern suppliers for shipments to the US and Latin America. Middle East granular urea was sold over $700pt fob for April shipment this week, with bids later rising to just under $800pt fob. In SE Asia, producers have not been actively offering, however, latest bids there have also now advanced to over $700pt fob.

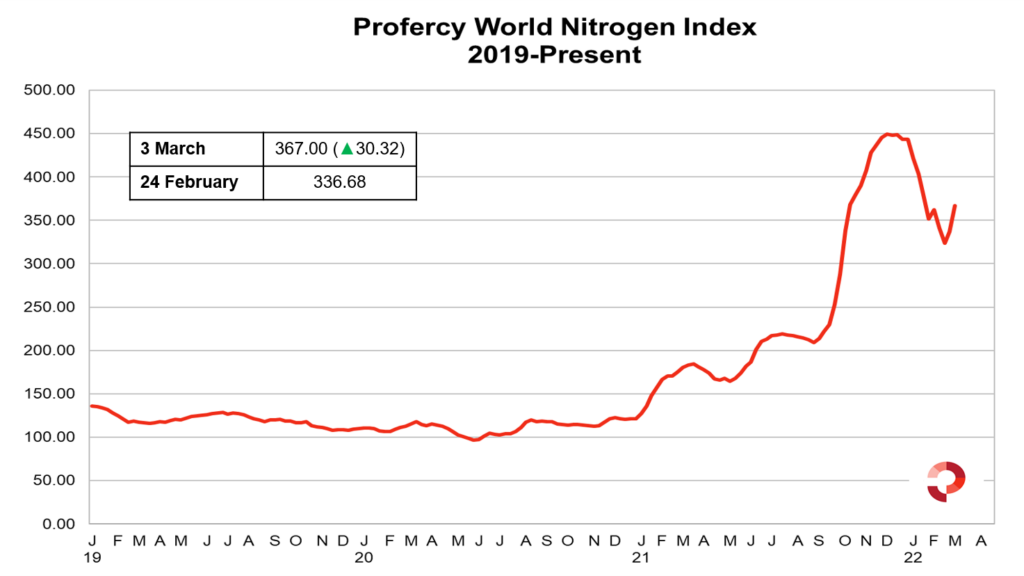

Owing to the rapid increase in urea values in the east and west, the Profercy Word Nitrogen Index has climbed by 30.32 points to 367.00 this week.

By Neha Popat, Nitrogen Market Reporter