With Iran frozen out of the 5 October tender due to US sanctions, India turned to Chinese and Arab Gulf suppliers to meet its import demand despite significantly higher prices on the previous tender.

India moved quickly to issue LOIs and book 560,000t of urea in the few days immediately following the tender. Shortly thereafter, MMTC (the tendering agency), was able to secure an additional 190,000t, bringing the total awarded to 750,000t.

Up to six cargoes, or over 250,000t, are expected to be supplied out of the Arab Gulf. In addition, up to two 50,000t cargos have been lined up from Egypt while a cargo of Indonesian urea remains a possibility. The remainder of the volume will be made up with product from China.

With shipment due by 19 November, shipments for western markets from the Arab Gulf will be limited. Meanwhile, the large volumes to have come out of China are likely to mean that further exports are doubtful as producers focus on the domestic market.

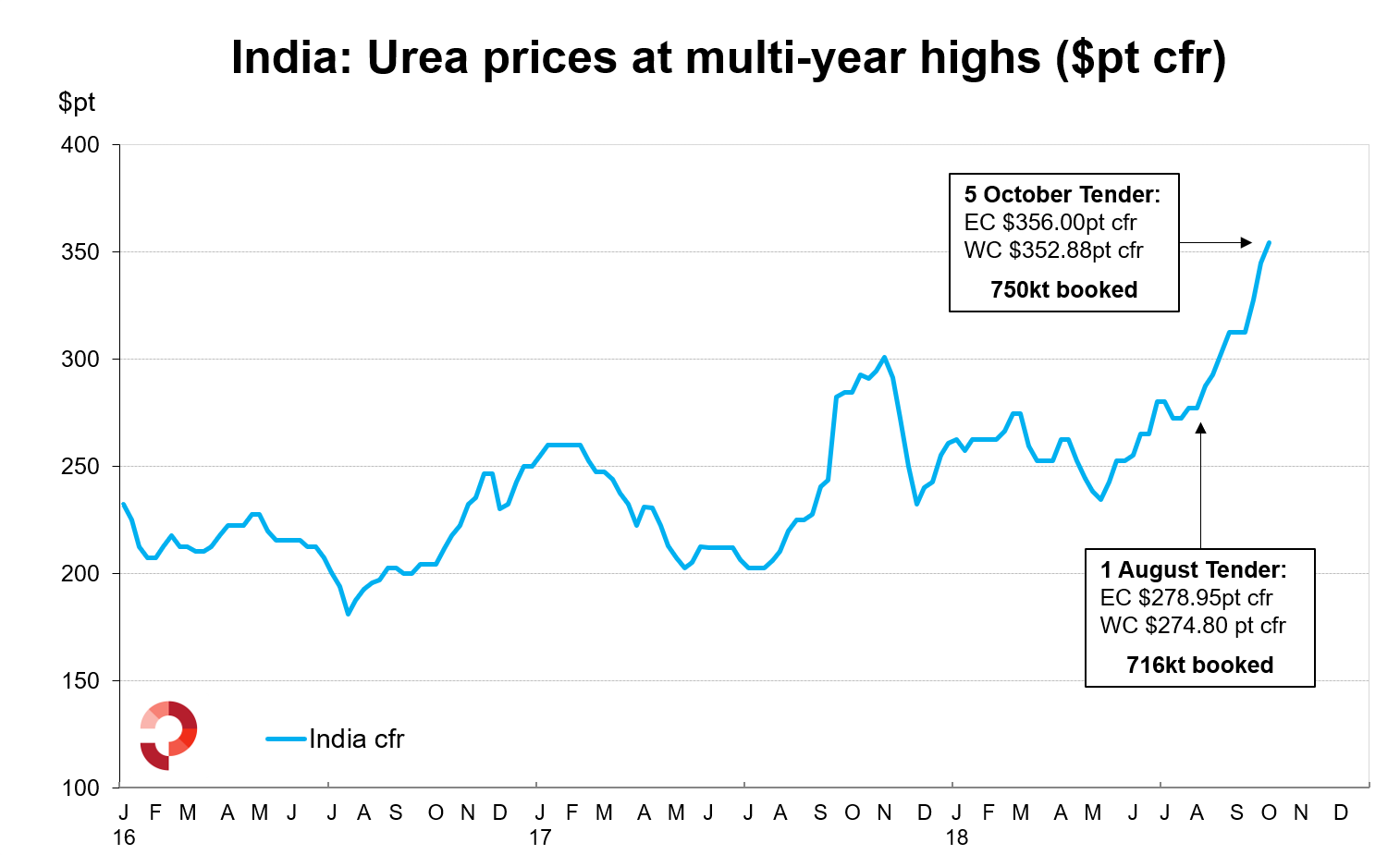

Despite the volumes booked in this tender being comparable to the previous 1 August tender, India had to accept four-and-a-half year high prices to secure volumes.

The lowest offer for the west coast was $352.88pt cfr and $356.00pt cfr for the east coast. The prices are $77-78pt above those in the 1 August tender where almost all the volume was secured from Iran.

Indeed, the higher prices meant that netbacks to China were above returns in the domestic market and at levels not workable in other export markets. Arab Gulf suppliers also sold above levels previously achieved in other markets.

The latest awards bring the total bought via tender since 1 April to almost 2.5m. tonnes versus 3.65m. tonnes bought via tenders in April-December 2017 (covering shipments to 20 January 2018). Consequently, a further tender is expected in November.

by Michael Samueli, Market Reporter

Email: Michael.Samueli@profercy.com