Global urea markets have cooled in recent weeks, with the US proving to be the only bullish market. As anticipated in our last Forecast, published at the end of January, import purchases in most major markets proved to be limited through February. Buyers have been keen to avoid being left with surplus product in advance of Q2, when demand is expected to drop back.

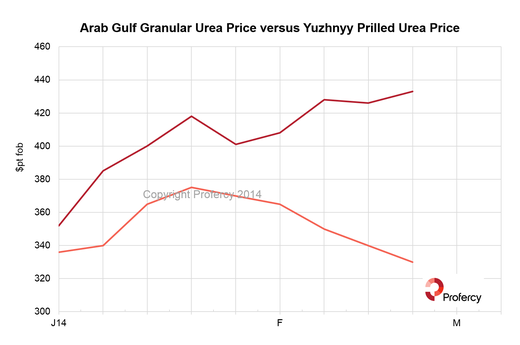

As the graph below notes, prilled urea has fared worse than granular urea. Last week, the high-end of Profercy’s Yuzhnyy prilled urea price was over $100 below the high-end range for Middle East granular urea. This latter primarily reflects the netbacks from US Gulf cargoes, where prices currently remain healthy.

The chart shows the high-end of the quoted price range published by Profercy for both Yuzhnyy prilled urea (bottom line) and Middle East granular urea (top line). Both are basis $pt fob.

Q2: Global surpluses build – pressure on both prills and granular

Published earlier this week, our latest forecast (details below) noted that surpluses are expected to build in the global urea market through Q2 for both prills and granular. This suggests that the gulf between both Yuzhnyy prilled prices and Middle East granular prices is unlikely to last.

A key factor will clearly be the US market. As previously noted, the netbacks currently afforded to Middle East cargoes are well above those for Latin America and Asia, where prices are considerably lower. When the US market cools, as it is expected to during Q2, Middle East product will need to go to markets offering lower returns.

Focusing again on prilled urea, the global market will be heavily influenced by demand and supply in the East, including the level of Indian imports. In fact, India has today announced the first tender since November 2013. While Chinese product is likely to dominate this market, there is the possibility that in a weak granular market, granular producers may compete in India bringing global prices for prills and granular product closer together.

Profercy’s Short Term Forecasts

This blog provides a brief insight into the issues discussed in detail in Profercy’s latest short term forecast. This is provided to subscribers of the Profercy Nitrogen Service – free trials are available.

The latest forecast includes:

- Detailed supply analysis – including an assessment of production and exports by country. Major turnarounds, shutdowns and export constraints are listed and factored into our analysis.

- Forecast import demand – reviewing all major urea import markets.

- Projected market balances for Q2 and global trade balance forecasts – covering both the East and West for prilled and granular urea.

- An assessment of potential price developments – again, this will cover major markets for urea.

A free trial of the Profercy Nitrogen Service is available by clicking here and submitting your details.

About our short term forecasts

Profercy has been publishing forecasts for the urea market for 10 years. These are widely read by those affected by world nitrogen prices, including producers, importers, traders, financial analysts and investors.

If you are interested in receiving Profercy’s reports, which also include daily updates and weekly analysis, alongside a comprehensive overview of prices, please click here.