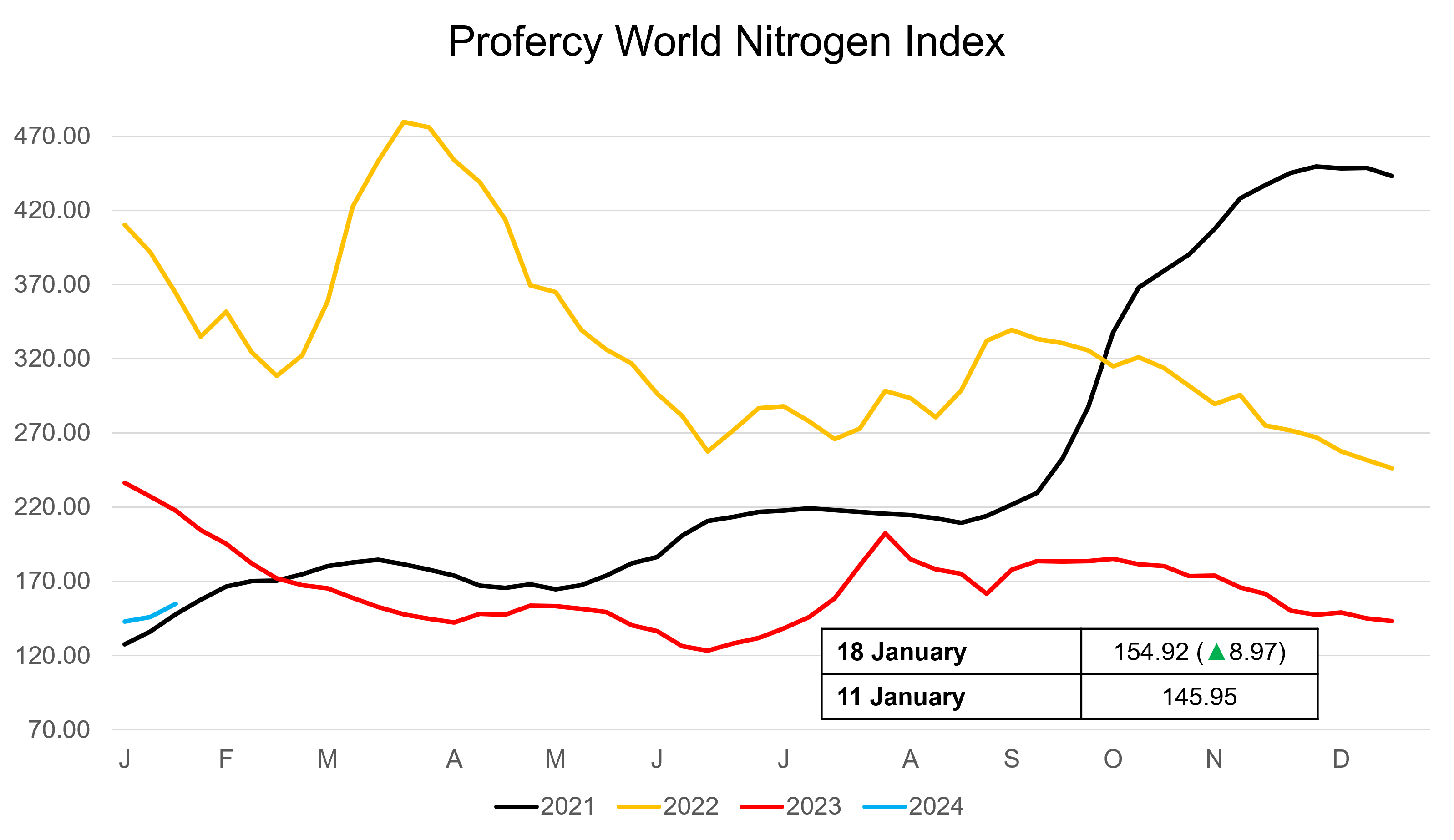

The Profercy Nitrogen Index has made its single biggest weekly gain since the first week of September. The start of 2024 appears reminiscent of early 2021 when the year started with a rally ahead of the Spring application period in many western markets. This is in stark contrast to the last two years (2022-2023) when early Q1 was characterised by price declines and bearish sentiment.

The Profercy Nitrogen Index has made its single biggest weekly gain since the first week of September. The start of 2024 appears reminiscent of early 2021 when the year started with a rally ahead of the Spring application period in many western markets. This is in stark contrast to the last two years (2022-2023) when early Q1 was characterised by price declines and bearish sentiment.

Last week, it was primarily North African markets that were active as fob values made sharp gains. This week, Egypt was largely dormant as traders switched focused to other fob regions in search of product. Indeed, Middle East spot values climbed above $350pt fob with several large cargoes sold.

A major contributory factor has been reduced SE Asian supply and China’s continued absence from the market. Indonesia has not been actively offering for export while Malaysian supply has been reduced by unplanned maintenance at the Petronas Bintulu facility, as well as a planned turnaround at Gurun. These supply cutbacks have been more poignant given the emergence of early Australian import demand.

Last week, the spread between Egypt and the Middle East had widened to as much as $70pt. The latest spread is around $20pt as Egyptian fob prices have held while Middle East values have advanced up to $52pt in the past 10 days.

Elsewhere, cfr values in Brazil and the US Gulf also increased with buyers stepping up to secure product. In the USA, many are closely watching the import line-up ahead of Spring demand emerging in Q2, while buyers in Brazil have been focused on last minute purchases for the current season. In Europe, price levels also increased but strong demand has yet to get going. Only Italy was a major active buyer this week while other regions only improved their pre-season positions with limited volume purchases.

The PWNI increased by 8.97 points week on week to 154.92 points.

By Michael Samueli, Daily Editor