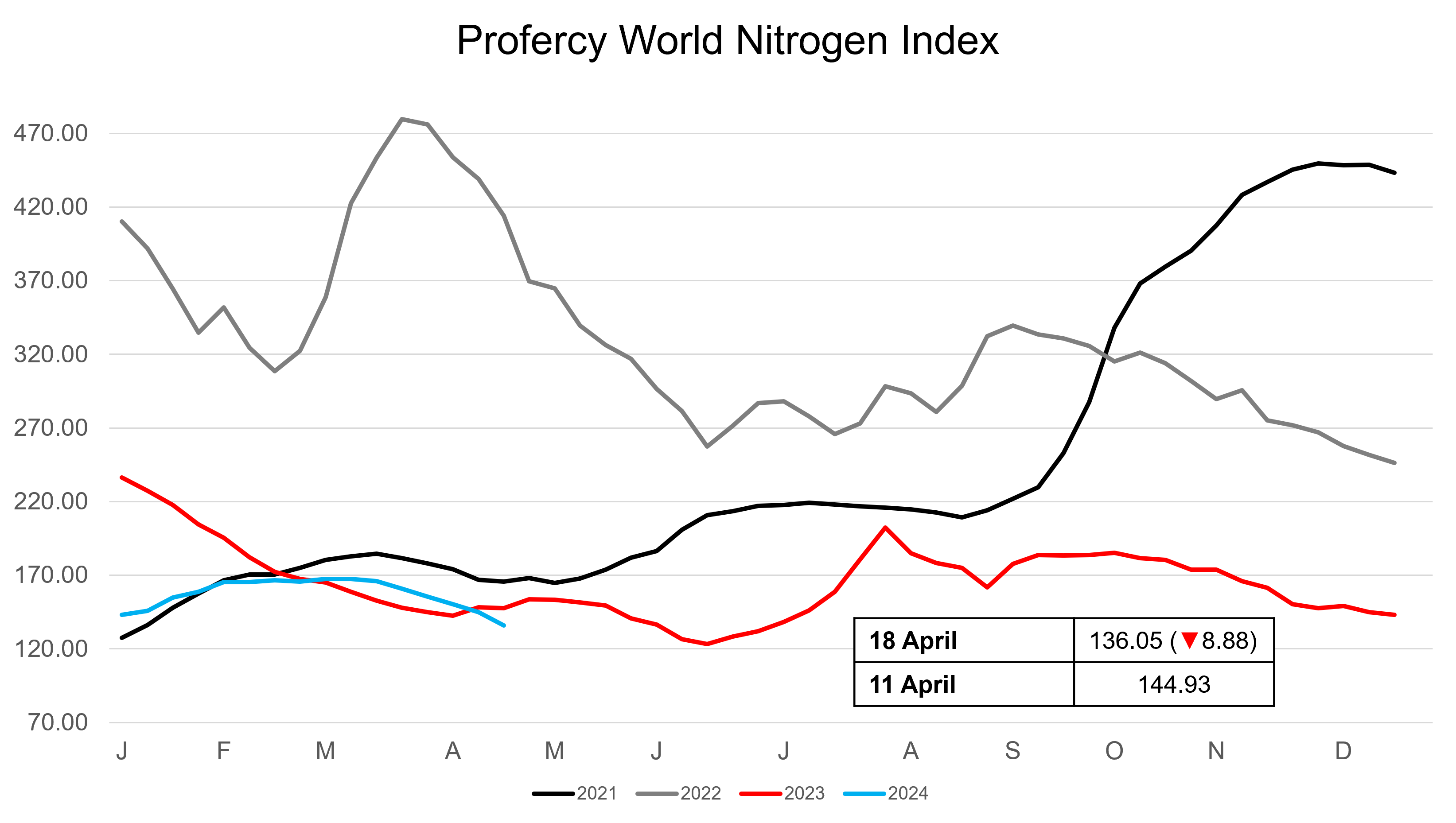

Profercy’s World Nitrogen Index (PWNI) declined for the seventh consecutive week in a row, down 8.88 points week on week to 136.05 points. This is the single biggest week on week decline so far this year. Since early March, the Index has declined by a combined 31.56 points.

Profercy’s World Nitrogen Index (PWNI) declined for the seventh consecutive week in a row, down 8.88 points week on week to 136.05 points. This is the single biggest week on week decline so far this year. Since early March, the Index has declined by a combined 31.56 points.

With April through May shipments available in several regions, global urea prices have been under pressure. Middle East and North African spot values are now sub-$300pt fob for the first time since mid-2023. Since end-February, average spot values have declined by around $100pt.

Geopolitical tensions, which do bring the importance of supply in the Middle East into focus, has cooled negative sentiment at all stages of the supply chain to some degree. Further, in some markets, such as Brazil, there has been a response to lower prices and interest in securing volumes for Q3 shipment.

However, in both the east and west, the impact of India’s low volume purchase is still being felt. Producers in the Middle East have sold in the $280s pt fob for May, some $35-40pt below earlier Indian returns. Russian prilled values have also been under pressure with latest offers into Latin America no better than the mid-$200s pt fob.

This comes as China has been signalling a return to the international market. Notably though, this has been tempered by stable domestic prices and persistent uncertainty over CIQ export guidance. No major business has been heard since the news. Suppliers have been reluctant to offer firm for shipments earlier than end-May.