This week saw the market respond to the supply problems seen in North Africa. With significant volumes of North African product not available to the market, buyers were forced elsewhere driving Middle East granular urea prices up by $30pt fob. The increase also supported a rise in Yuzhnyy prilled urea prices – the top end of Profercy’s weekly Yuzhnyy fob price range increased by $15pt on last week.

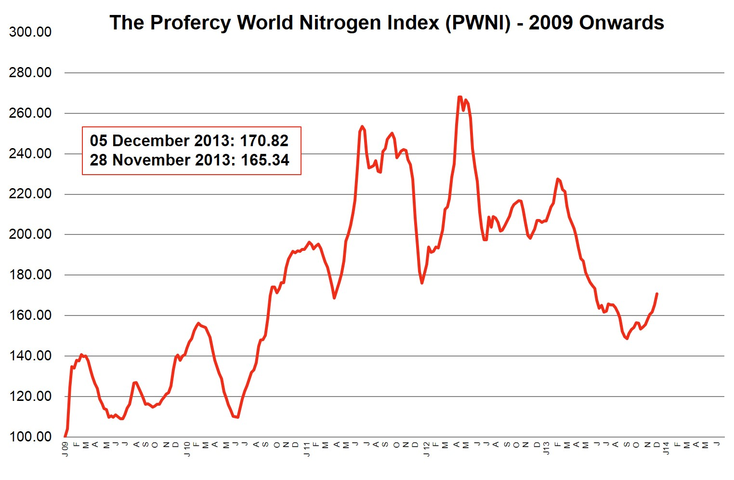

The Profercy World Nitrogen Index rose to over 170 this week, gaining five points on the back of the surge in urea prices. It is worth noting that price gains were witnessed for all other products making up the index, including UAN, AN and ammonium sulphate. The only exception was ammonia with the Yuzhnyy fob price seeing no increase on last week.

While urea prices have risen rapidly in the last two weeks, in part due to the realisation of supply problems, the increase has followed the trend anticipated by Profercy in our recent trade forecasts. The October forecast highlighted the likelihood of price gains in all major markets with the supply and demand analysis suggesting that no major surpluses were likely before January. Our latest forecast, published last week, maintained that the global trade balances support the expectation that prices will move higher with the market tight into Q1.

The Profercy World Nitrogen Index is published every week and is based on price ranges provided by the Profercy Nitrogen Service. This includes prilled and granular urea, UAN, AN, ammonium sulphate and ammonia.

Profercy’s Nitrogen Service includes daily news, weekly analysis and monthly forecast reports. For more detailed information on specific products and individual markets, please sign up for a free trial or for more information on the Profercy Nitrogen Service, please click here.

The methodology behind the Profercy World Nitrogen Index can be found here.