As the urea market heads towards Q2, the week saw little major buying activity. Prilled urea continues to bear the brunt of buyer nervousness. Since 23 January, the high end of Profercy’s price quote for Yuzhnyy prilled urea (fob basis) has fallen by $45pt. In the East, those holding Chinese prilled product are hoping for a major demand boost in the near future from buyers in the Indian sub-continent – India has not tendered since November 2013.

By comparison, the top end of our quote for Middle East granular urea, supported by US netbacks, has actually increased. It is worth noting though that this does not reflect the whole picture for Middle East granular, especially given that the price quoted for spot Middle East cargoes has in fact fallen over the past month, widening the price range quoted. Other export destinations simply do not offer anywhere near the price levels in the US.

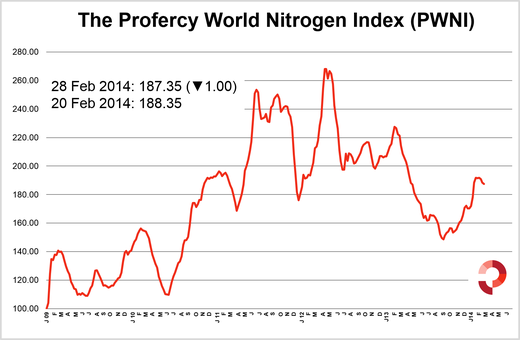

The other nitrogen products that make up the Nitrogen Index have fared better than urea, with little price movement. Indeed, the top-end of our Yuzhnyy ammonia range increased by $10pt. Hence, there has been limited movement on Profercy’s World Nitrogen Index which fell by only one point this week. However, this is the third week in a row that the PWNI has fallen.

The Profercy Nitrogen Service provides daily updates, weekly analysis and monthly forecasting on global nitrogen markets, alongside key prices for all major products and markets. This includes prilled and granular urea, UAN, AN, ammonium sulphate and ammonia.

Free trials of all Profercy’s fertilizer market reports are available here, including Profercy Nitrogen, Profercy Phosphates & NPKs and Profercy Potash.

The methodology behind the Profercy World Nitrogen Index can be found here.