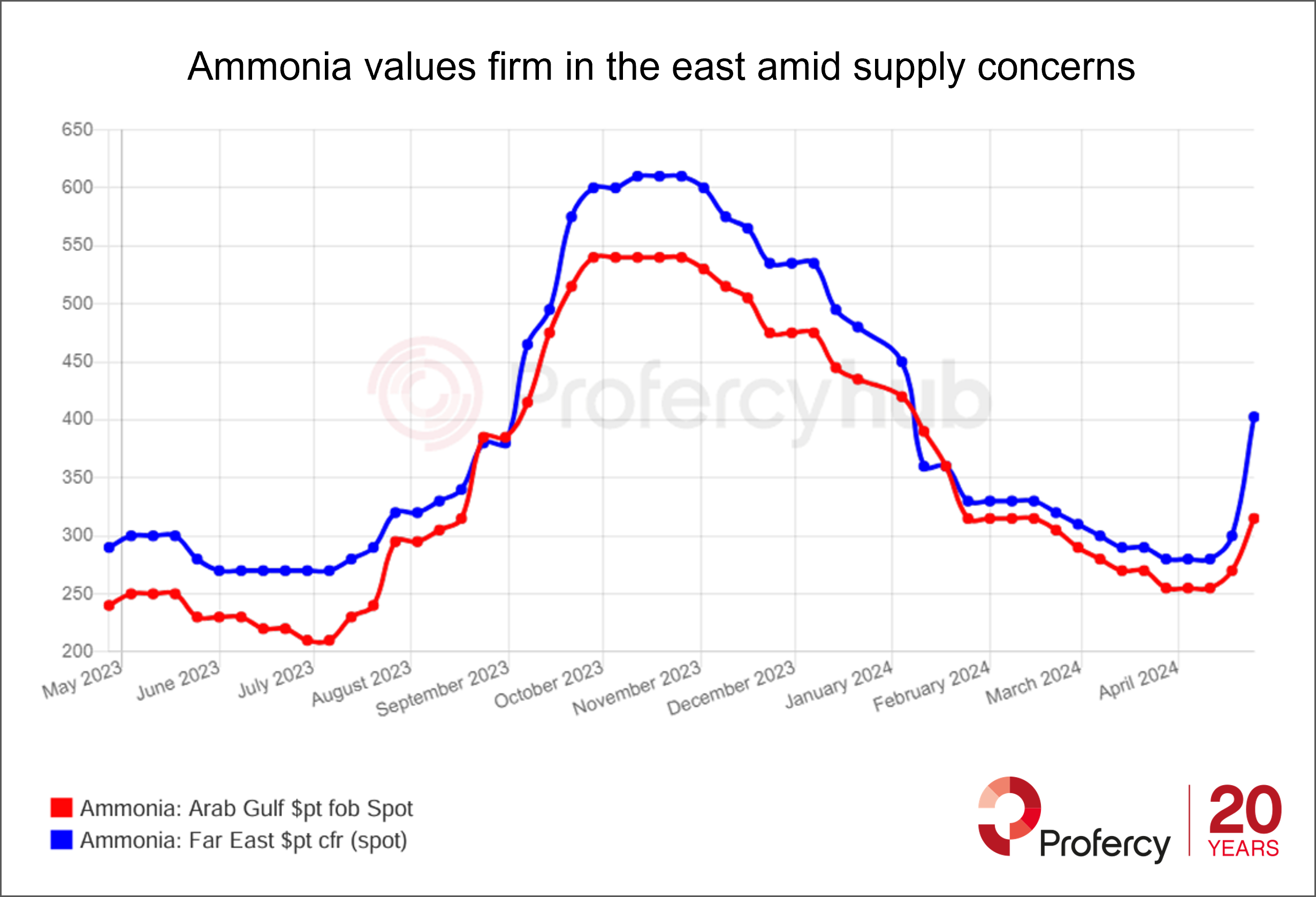

Confusion over the pricing situation East of Suez has been the overwhelming topic of conversation in the merchant ammonia market over the past week, with a series of high-priced sales into China and Taiwan taking many by surprise, as did a discounted deal into India.

Confusion over the pricing situation East of Suez has been the overwhelming topic of conversation in the merchant ammonia market over the past week, with a series of high-priced sales into China and Taiwan taking many by surprise, as did a discounted deal into India.

The three sales by traders into Taiwan and China at $375-430pt cfr for May arrival came against the backdrop of a potential supply squeeze due in the Middle East and Southeast Asia, albeit no unscheduled outages have yet been confirmed.

Export availability in Saudi Arabia looks tight for the next two months – with vessels starting to bunch up in the Kingdom’s waters – and this potential bottleneck may have spooked some participants into digging deep into their pockets to guarantee cargoes.

Saudi majors Ma’aden and Sabic Agri-Nutrients have not declared any capacity curtailments, although a minimum 10-day delay in the start of the one-month turnaround of the Wa’ad Al Shamal Fertilizer Production Complex (MWSPC) has prompted talk another Ma’aden plant could have issues.

Due to the loss of around 130,000t of volume from that planned maintenance, the region’s largest producer only expects to load 110,000t in May, all of which will stay East of Suez.

Ma’aden had expected to load eight cargoes of 25,000t this month – up from 150,000t in March – but as of today (26 April), only four vessels have lifted from key export hub Ras Al-Khair, with several other tankers waiting at anchorage.

Mixed supply picture elsewhere East of Suez

Meanwhile, Iranian cargoes have been heard offered into India at sub-$300pt cfr in a development that is at odds with the supply situation elsewhere in the region. Further east, talk of tightness in Indonesia has not been confirmed, but majors such as Kaltim appear a little light on loadings.

Downstream, while import demand in China is said to be strong, industrial conditions there and in the wider area still appear rather flat, with a Korean importer even selling some spot tonnes for delivery to Vietnam as they were not needed.

In the West, attention is focused on the Tampa contract settlement for May – for April it was agreed at $475pt cfr – that should arrive shortly. Mosaic’s appetite for spot tonnes for Florida has helped support the market for several weeks, but other players appear in no urgent need of non-term material.

Price direction will improve once the US benchmark is agreed. The opportunity for cargoes to flow West to East also appears to be growing for those players with the fleet flexibility and access to fob cargoes in the Americas and North Africa.

By Richard Ewing, Head of Ammonia/Deputy Editor at Profecy