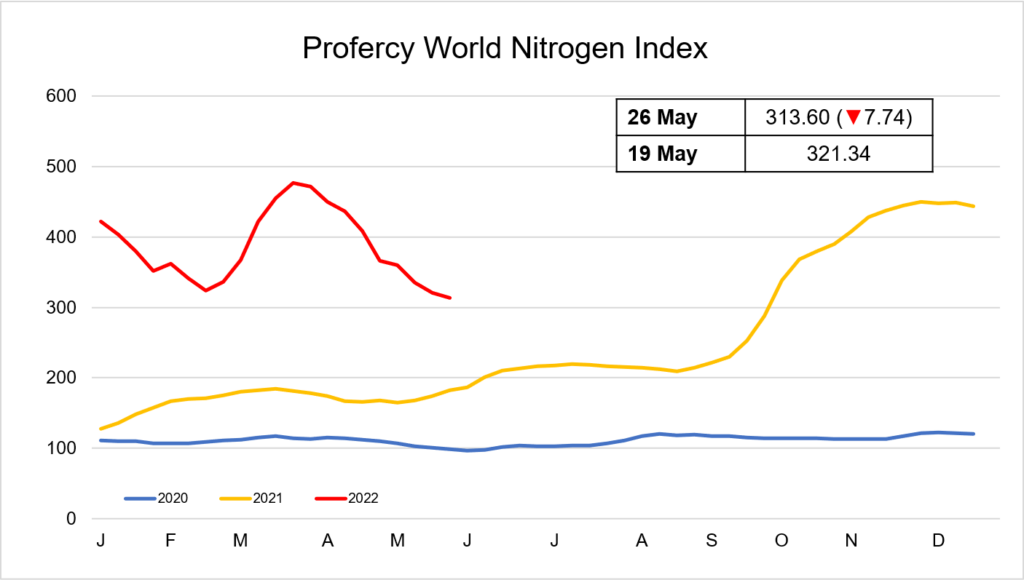

The Profercy World Nitrogen Index (PWNI) has hit the lowest point seen so far this year, as values of nitrogen-based products eroded further this week.

In the urea market, activity slowed down following the conclusion of India’s latest purchasing inquiry. With producers under no significant pressure to place cargoes, and buyers equally content, there was little need for either side to push ahead with discussions this week. Indeed, with a major industry event taking place in Vienna next week, most participants seemed content to wait until then to continue negotiations.

While the market remains quiet, there have been signs of weak sentiment across the east and west. In SE Asia, Indonesian granular urea was sold for June shipment at last done levels. However, producers in the region have conceded that demand for nearby markets is flat, and buyers are now targeting lower prices. In China, small volumes of both prilled and granular urea have been offered at levels well below the recent Indian netbacks.

In the west, Egyptian producers were able to take advantage of the late season demand emerging from the Mediterranean markets, as well as summer demand for western Europe last week. Yet, with producers maintaining price ideas at last done levels, negotiations there have stalled this week and most still have volumes available for June shipment.

In the US, late season import demand has failed to materialise. End-users made large purchases earlier in the season, and with planting progress hindered owing to poor weather conditions, most are currently working through inventories, resulting in minimal demand for fresh volumes. Barge values have now shed over $360ps ton from the all-time highs that were seen from the region in late March and further Nola re-export business to Latin American markets is now increasingly likely.

With values of other products in the nitrogen-based complex also making further losses this week, the PWNI dipped 7.74 points lower to 313.60. The Index has now lost over 160 points in the past two months.

By Neha Popat, Nitrogen Market Reporter