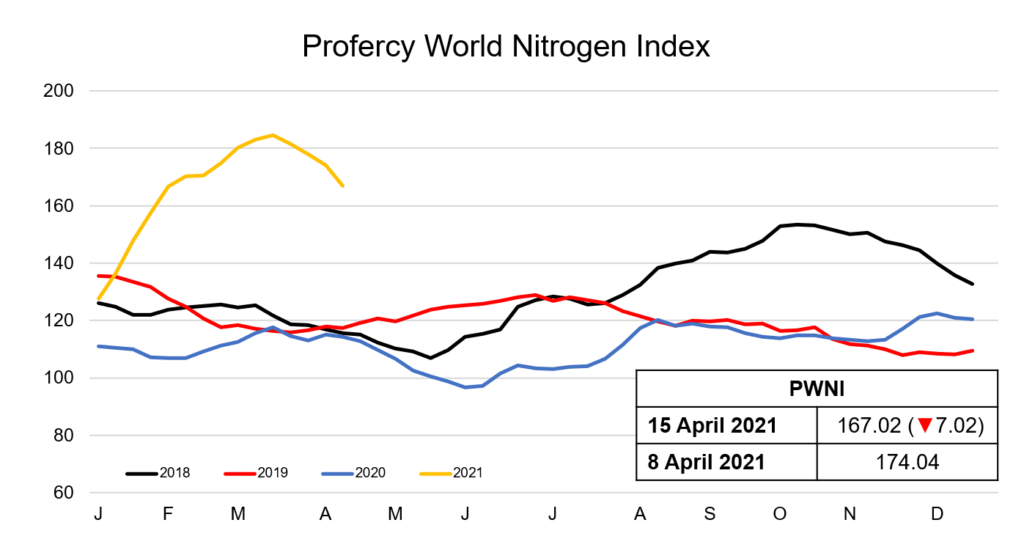

The Profercy World Nitrogen Index has made the biggest loss of the year this week, tumbling by over 7 points as urea values continue to deteriorate across the global market.

With no confirmation regarding when the next Indian tender will take place and for what volume, and with peak seasonal demand from the west over, the bearish cloud continues to hang over all regions.

In China, with significant volumes available for export from producers as well as traders, offers came down further this week. Offers of both grades of urea were reported below $330pt fob, some $30pt below the highs seen at the beginning of February.

In the west, minimal levels of demand continue to be seen from Europe and Turkey, putting further pressure on Egyptian values. Indeed the supply pressure on producers is only increasing with May largely uncommitted and some producers with even second half April product still to commit. While no sales were reported to have taken place, negotiations were heard taking place at sub-$345pt fob, significantly lower than the highs of $400pt fob that traded just over a month ago.

Across the Atlantic, May shipments (and even late April shipments) from North Africa and the Baltic are unlikely to arrive in time for the current US season. In the US Nola urea barge market, the market stalled midweek with demand elusive. April values saw sharp declines with a number of sellers reducing offers in a bid to place volumes. April business was concluded down to $350ps ton fob Nola, down almost $20ps ton from last week. Some support was found at this level and April went on to trade at higher levels later in the week, however May barge values remain significantly lower.

Meanwhile in Brazil, producers and traders scrapped for limited business and buyers remained on the sidelines as offers declined. Offer levels were heard around $25pt cfr lower than last week.

At this stage, there are no supportive influences in the urea market. A new Indian tender with a major volume booked appears to be needed to provide an outlet for the excess May volumes and participants continue to await an announcement. However, there are concerns that with Covid-19 rampant in India, this may be delayed.

Owing to the continued weakness in the nitrogen complex, the Profercy World Nitrogen Index has now lost around 17 points in the past month. The Index declined 7.02 points this week to 167.02.

By Neha Popat, Nitrogen Market Reporter