Source: Profercy Ammonia

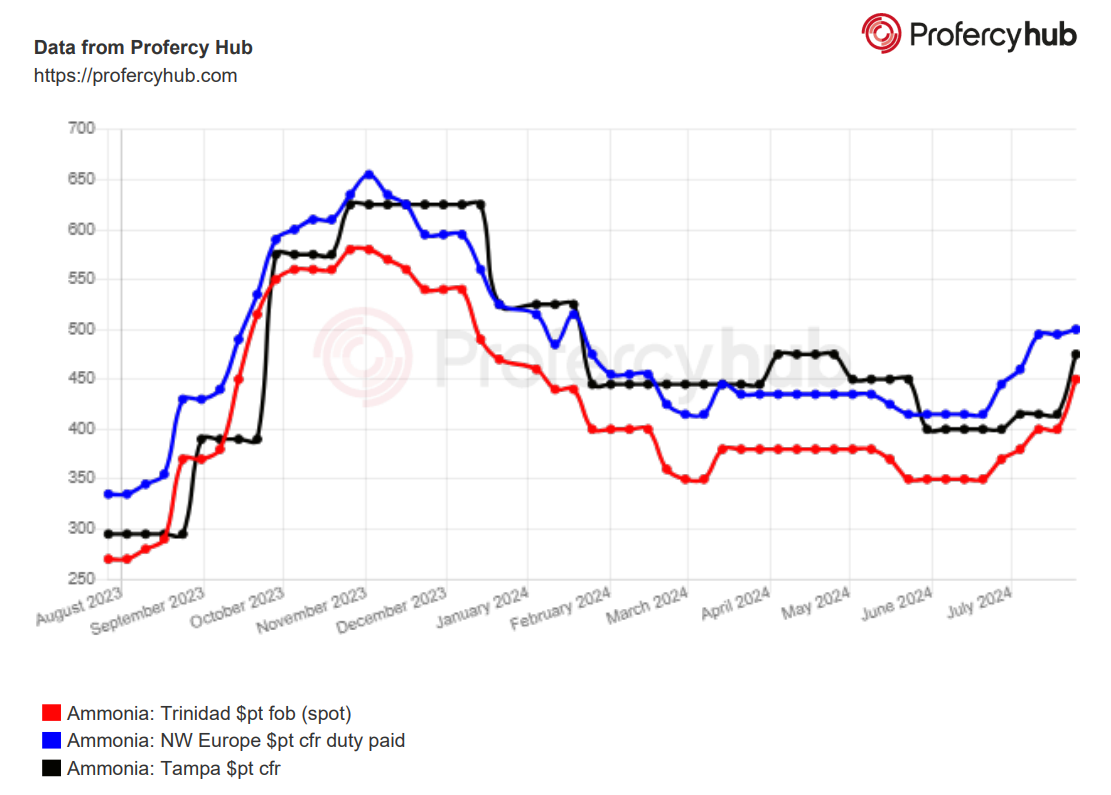

In a busy week in which news of the sale of 100,000t of spot material emerged and supply constraints finally started to ease in Trinidad but persisted in North Africa, the settlement of the Tampa contract for August at a $60pt premium to July was the main talking point.

The significant hike in the US benchmark to $475pt cfr appears to have been driven by low inventories in the Caribbean and unplanned capacity curtailments in Algeria and Egypt that have, in turn, triggered higher prices in Europe amid the ongoing supply squeeze.

While no new numbers for spot sales into Northwest Europe were declared, offers have been heard at around $10pt higher than last done – which involved a Fertiglobe spot delivery of about 4,000t to BASF at around $510pt cfr Antwerp.

Combined with the reduction in exports from North Africa and recent natgas cuts in Trinidad, the upward price pressure meant Tampa had to rise accordingly.

Length finally appears East of Suez on plant restarts, weak demand

The situation is far different in the East, where several cargoes changed hands in deals that highlighted the healthy supply/demand balance.

As in the West, no numbers were confirmed, but several suppliers noted that soft demand from industrial buyers means downward price pressure could arise next month.

Among the deals confirmed were a pair of sales to east coast India by traders and a 23,000t sale into Thailand by Marubeni for Ube.

Recent plant problems in Saudi Arabia have been overcome and loadings are returning to normal levels and frequency across the Middle East.

While some Indonesian tonnes have been lost to plant maintenance, this has been largely offset by the downturn in orders from chemicals producers across Northeast Asia.

The early part of the third quarter is traditionally a quiet period for the global market, with this trend also illustrated by the number of tankers in, or heading to, dry dock.

The Winnipeg, Oceanic Star and Navigator Phoenix are to undergo maintenance in Turkey, the Waregem in the UAE and the Leo Sunrise in China.

Looking ahead to August, some leading suppliers in the East are relatively bearish, while all eyes in the West are now focused on the run rates at key export-oriented units in Algeria and Egypt as their restart/ramp up would help relieve the recent upward price pressure to a significant degree.

By Richard Ewing, Head of Ammonia/Deputy Editor at Profercy