Source: Profercy Ammonia

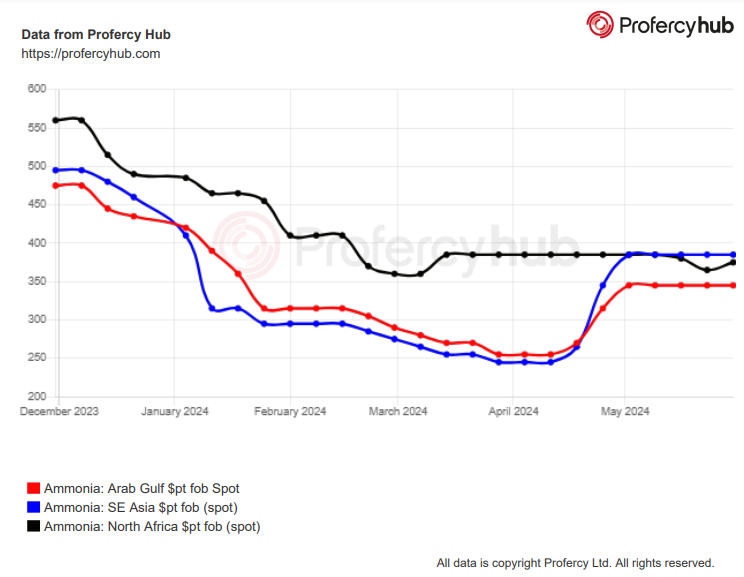

The international ammonia market remains bearish in the West and relatively bullish in the East in a week in which the headline news was the slide in the Tampa contract to $400pt cfr for June loadings.

The $50pt drop in the settlement took some players by surprise as the imminent natgas cuts and subsequent plant shutdowns in Trinidad will remove several cargoes from the merchant market, albeit the US season has now finished.

Norwegian major Yara moved to cover some of the loss from its plants in the Caribbean – where one its two facilities will go offline completely and the other run at lower rates – by securing 30,000t of spot material from Algeria’s Sorfert.

That pair of 15,000t cargoes was acquired at $395pt fob Arzew, down $10pt on an almost identical-sized deal between the duo for May lifting. Despite talk of plant issues at Fertial, nearly 136,000t loaded in the North Africa country this month.

Yara appears to have paid a premium for the material to ensure supply security to its European plants, given the latest buy price exactly matches the cfr level recently achieved by Trammo in its spot sale to Morocco’s OCP.

Black Sea shipments set to resume in June

Market attention is also beginning to focus on the Black Sea as the inaugural cargoes from the new Uralchem/Togliatti export hub of Taman should hit the market next month, albeit only one cargo per month is forecast in the short term.

While full details about availability and price targets are awaited, the producer is expected to utilise some mid-sized tankers that regularly called at the Ukrainian port of Yuzhnyy prior to the outbreak of war in February 2022.

Notably, the Oceanic Breeze, Oceanic Moon and Oceanic Star will all be in the Western Mediterranean in the next few days following deliveries to OCP’s operations at Jorf Lasfar, meaning they could easily reach Taman in first half June.

Unlike Yuzhnyy, Taman does not have an ammonia pipeline, meaning product must be railed to the port, thus limiting export volumes to some degree.

A similar logistics arrangement is seen at the Baltic port of Ust-Luga, where EuroChem loads around 40,000t per month on average for discharge at group operations and for third parties in Europe.

Turkey – which regularly receives discounted material from Iran and Venezuela – is expected to take the majority of ammonia that leaves Taman, with Uralchem/Togliatti having sent marketing teams to the country earlier this year.

Spot business light in Asia Pacific

East of Suez, availability is not as plentiful due to the turnaround at a Ma’aden plant, although despite that maintenance, the Saudi producer managed to sell 7-8,000t at $360pt fob for mid-June loading for the Far East.

Indian import demand is rebounding, and FACT issued its third purchasing tender in as many months, with the July request attracting two offers. Price bids and an award, if any, should emerge early next week.

The state-owned company will receive an 8,000t cargo from the Middle East in June under a previous tender that was awarded at $353pt cfr sight.

Elsewhere on the west coast, a small tanker that regularly loads in Oman/Iran appears to have visited a port in Iraq, according to its AIS, while a larger carrier that has been handling ammonia is also heading there, but details about both loadings are elusive.

By Richard Ewing, Head of Ammonia/Deputy Editor at Profecy