The Russian export quotas, confirmed at the end of November for nitrogen fertilizers, have in effect only targeted ammonium nitrate.

On 3 November, the Russian Prime Minister, Mikhail Mishustin, announced on state-owned television that temporary export quotas on nitrogen fertilizers will be introduced for a period of six months. At the time, Mishustin said that the export quota for all nitrogen products would be 5.9m. tonnes in total. The news followed several weeks of rumours about export quotas and unofficial warnings from state officials to Russian producers to prioritise the domestic market over exports.

Indeed, producers did do this with export volumes not increasing significantly (in part due to weak Brazilian demand) in the weeks leading up to the export quotas. However, the wider global concerns about nitrogen fertilizer supply filtered their way into the Russian domestic market and during the second half of October there was in effect panic buying from distributors. This naturally led to supply shortages which only further fuelled worries about supply.

The vast majority of the domestic demand was for ammonium nitrate, by far the main fertilizer used in Russia. Indeed, the Russian domestic market consumes less than 10% of Russia’s nameplate urea output.

When the initial news of the export quotas was announced to much fanfare, the details were unclear. Soon it became known that the export quotas would run from the 1 December 2021 to 31 May 2022.

In the weeks that followed, producers were in a flurry to provide the relevant Russian government departments the information they required. This included average volumes supplied to the domestic market for each product, average volumes exported for each product and nameplate production capacities.

Based on this information, export quotas were allocated for each producer and each product.

In the document, issued by the Ministry of Industry and Trade to producers on 26 November, export quotas are broken down as follows:

- Urea: 4.004m. tonnes. Producer allocations: Eurochem 890,102t, Phosagro 759,632t, SBU 587,945t, Uralchem 551,519t, Togliatti Azot 427,954t, Acron 360,215t, Salavat 310,828t, Kuibyshev Azot 116,695t.

- UAN: 1.146m. tonnes. Producer allocations: Eurochem 487,566t, Acron 465,120t, Kuibyshev Azot 99,461t, SBU 67,988t, Uralchem 22,905t, Bui Chemical Plant 3,386t.

- Ammonium nitrate: 744,000t. Producer allocations: Acron 161,803t, Uralchem 160,235t, Eurochem 147,964t, SBU 142,981t, Phosagro 48,963t, Kuibyshev Azot 41,490t, Rossosh 41,404t.

- Sodium nitrate: 4,000t, all of which allocated to Uralchem.

The impact

Average urea exports between December-May in the last three years were 3.54m. tonnes with 3.33m. tonnes exported during 2018-2019, 3.61m. tonnes during 2019-2020 and 3.69m. tonnes during 2020-2021. The urea export quota of 4.004m. tonnes is clearly well above previous export volumes over the quota period.

Similarly, average UAN exports between December-May in the last three years were 1.10m. tonnes, almost in line with the export quota of 1.146m. tonnes for UAN. However, UAN exports have been declining over the last three years with 1.23m. tonnes of UAN exported during December 2018-May 2019 then 1.15m. tonnes from 2019-2020 and only 927,000t during 2020-2021. As such, similar to urea, the UAN export quota is in theory almost certain to have no major impact on export availability.

Meanwhile, the 744,000t export allocation for AN is well below the average 1.62m. tonnes exported during December-May over the last three years. AN exports were 1.54m. tonnes from December 2018 to May 2019, 1.57m. tonnes in 2019-2020 and 1.76m. tonnes in 2020-2021.

Brazil is the biggest importer of Russian AN with around 30% of the December-May exports (on average) being shipped to Brazil. However, the near-term impact of the quotas on the Brazilian market is likely to be limited given importers secured notable volumes earlier this year for the upcoming season. Indeed, January-October AN imports in Brazil were 1.35m. tonnes, higher than the 1.03-1.24m. tonnes imported throughout the whole year in any of the last three years.

Instead, the biggest impact will be felt by Central Asian (cross border) buyers including Kazakhstan and Kyrgyzstan.

In addition, the low AN quotas remove a potential alternative supplier for European nitrate markets. Despite Russian AN having a €32pt anti-dumping tariff in Europe, European production cutbacks and subsequent price increases opened up the opportunity for Russian AN into Europe for the first time in many years.

In the UK, Russian AN was previously offered down to £610pt delivered farm, around £30pt lower than Polish and Lithuanian AN which was in short supply. However, basis the latest Baltic fob values, Russian AN reflects up to £720pt delivered farm.

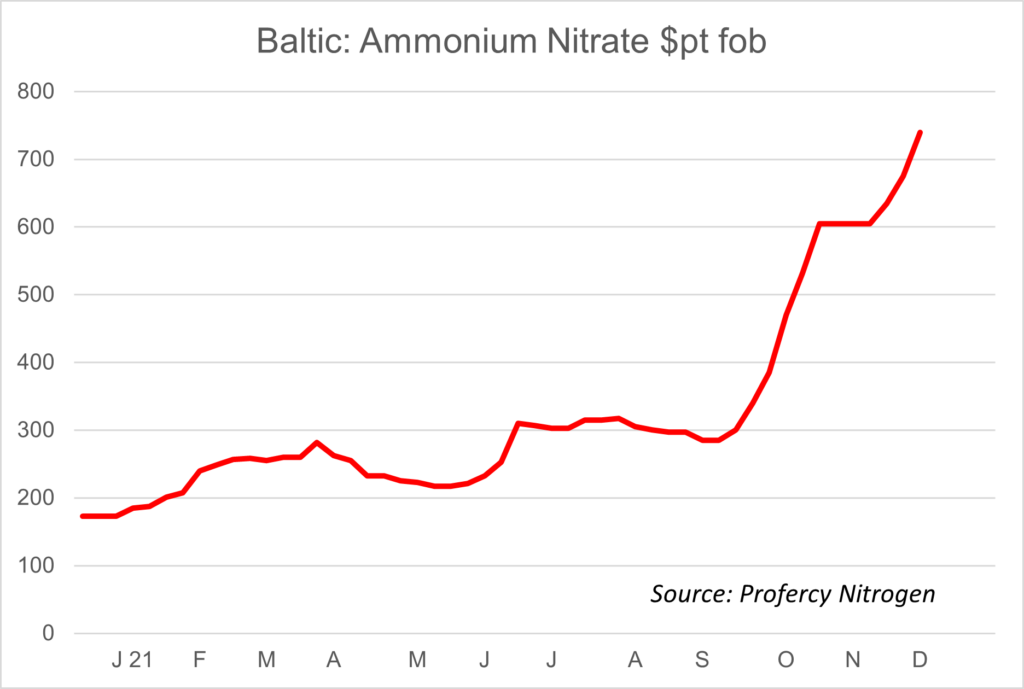

In terms of fob values, urea and UAN values have been unaffected by the export quotas as expected and have moved basis other factors. However, the impact on AN prices has been almost immediate with Acron selling a hold of AN for January shipment at $770pt fob, up $60-70pt on last done business a week earlier which in turn marks a $60-70pt increase on the previous value. As such, over the last two weeks, Baltic AN fob values have increased by an extraordinary $120-140pt, almost solely due to the export quotas.

By Michael Samueli, Head of Nitrates and Sulphates, Profercy Nitrogen