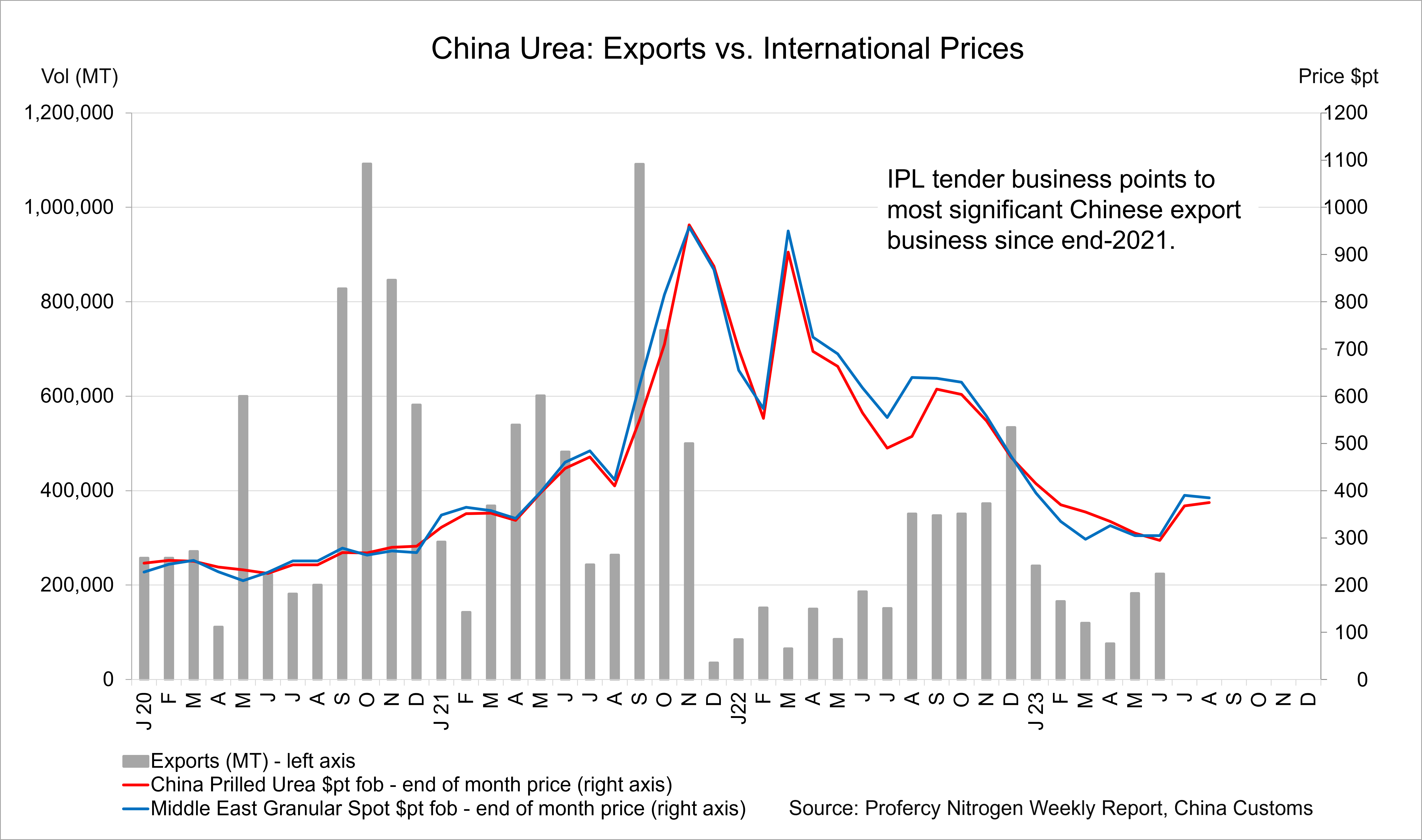

IPL made light work of securing a multi-year record volume through the latest import tender, almost exclusively owing to China’s return to the international stage.

As much as 1.1m. tonnes of urea has been committed to India from China for shipment by 26 September, signaling the most significant export business since September 2021, when over 1m. tonnes were exported in a single month.

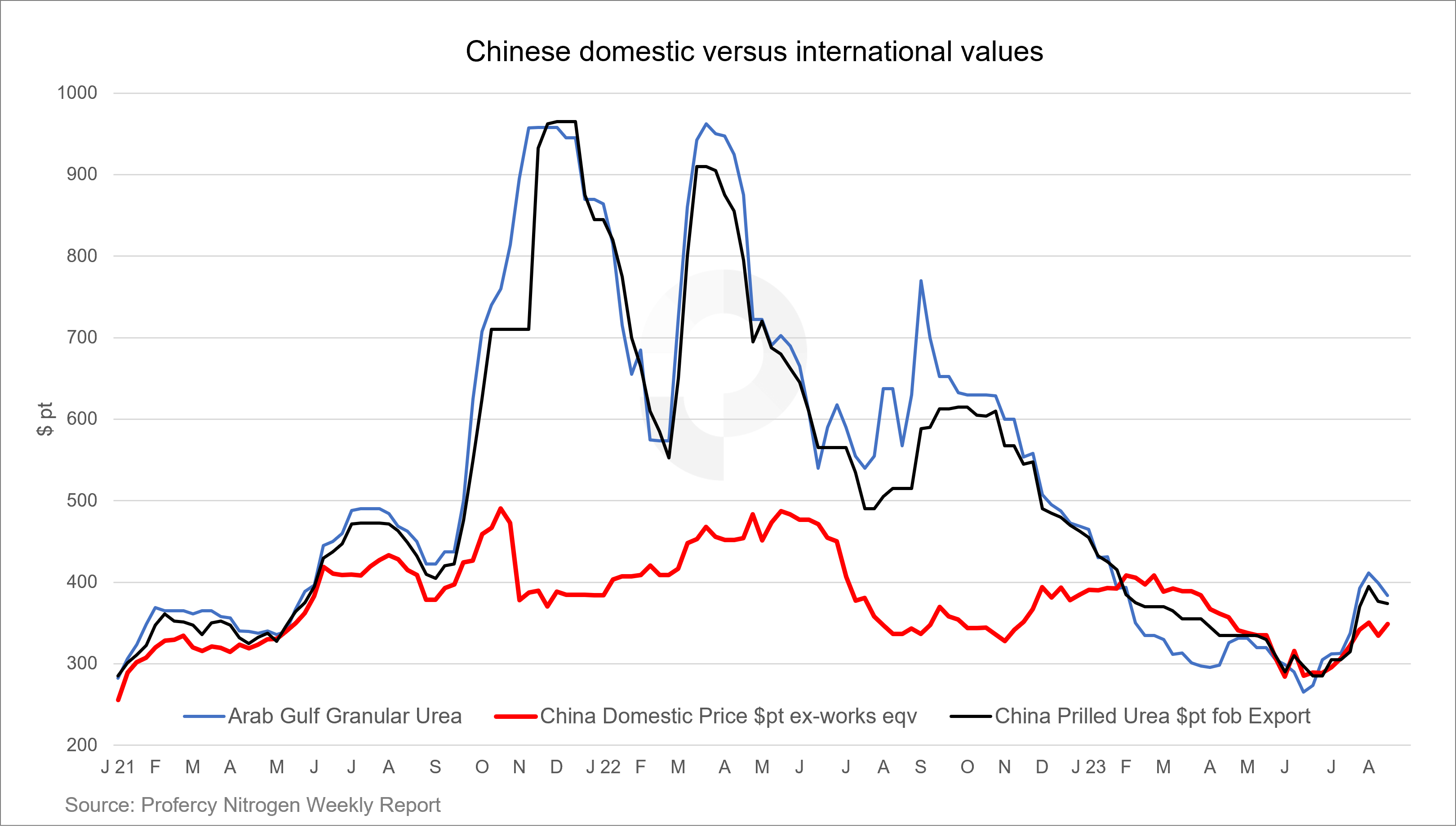

At that time, rallying international and Chinese domestic urea values saw the eventual introduction of onerous China inspection and Quarantine (CIQ) and export inspection controls aimed at securing domestic supplies. In addition to high feedstock costs, this effectively blocked major export business for much of the past two years.

As demonstrated below, this policy was somewhat effective in cooling domestic values, but was a major factor underpinning the firm international markets of end-2021/2022.

Source: Profercy Nitrogen

Export controls ease into the domestic offseason

The latest round of business comes as export controls have eased slightly, while broadly feedstock costs and domestic values have been less volatile. Further, Chinese domestic production rates have been high for some time, as much as 175-177,000t/day, despite the end of the domestic agricultural season.

In recent weeks, domestic values have unsurprisingly lagged international levels, encouraging producers to look to export markets.

Implied netbacks from India of $373-375pt fob (free on board) represented a healthy margin of over $15pt on local values. These domestic values, which have firmed in recent days owing to the extent of Indian business, had been under pressure prior to India emerging as a major export outlet.

Ahead of the tender, the lowest offers into both the east and west coast had backing, or were basis positions. Despite the attractiveness of Indian business, few anticipated this level of participation from Chinese suppliers, in large part due to concerns over export/CIQ restrictions delaying cargo. Indeed, there remain some doubts that all cargoes can be shipped by 26 September.

China’s return ends bull-run and raises questions over Q4 global trade balances

China’s return has clear implications for the international market near-term and into Q4.

Firstly, after a number of challenging tenders, it has aided India in securing an impressive 1.76m. tonnes of product. Despite major advances in domestic operating rates in the past three years, Indian annual import demand is still sizeable, and may remain so given this year’s healthy monsoon.

Nevertheless, the volume committed in this tender, alongside the increased prospect of decent participation from China in any future tender, has reduced India’s reliance on other suppliers. In turn, this at the very least partially removes one major competitor for buyers elsewhere in key Q3/Q4 markets, such as Brazil.

Secondly, the sale of major volumes of Chinese prills has reduced Middle East, SE Asian and Russian producers’ ability to utilise India to limit spot availability for other markets and support prices.

Indeed, Chinese prills struggle to find other markets in any meaningful way and tend to be partially-captive when Indian business is not an option. Baltic prilled urea, albeit not granular, functions in much the same way with outlets limited. This ultimately results in global trade balances largely being dictated by granular urea availability.

If China is inactive, India can find itself competing against Latin America, Oceania, the USA and even Europe for granular product.

Source: Profercy Nitrogen, China Customs

International market stalls, traders and producers struggle to find liquidity

Derivatives values have been volatile in the wake of the tender, but ended the week on a much softer footing. In the physical market, the response has been more subdued, and indeed, fob values and cfr levels had adjusted prior to final volumes being confirmed into India. Nevertheless, negative sentiment prevails.

Importantly, many producers, bar those in SE Asia and North Africa, are committed for much of September. Latam demand, coupled with firm European gas prices, are providing a supportive narrative for producers, but the latest developments in India will have impacted Q4 demand in the east’s largest import market.

The challenge for producers going forward is that those buyers that can defer purchases into Q4, may now look to do so.

By Chris Yearsley, Editor, Profercy Nitrogen