After several weeks of illiquidity, the 20 October Indian Potash Limited (IPL) tender offered suppliers worldwide the first major opportunity to build order books for November.

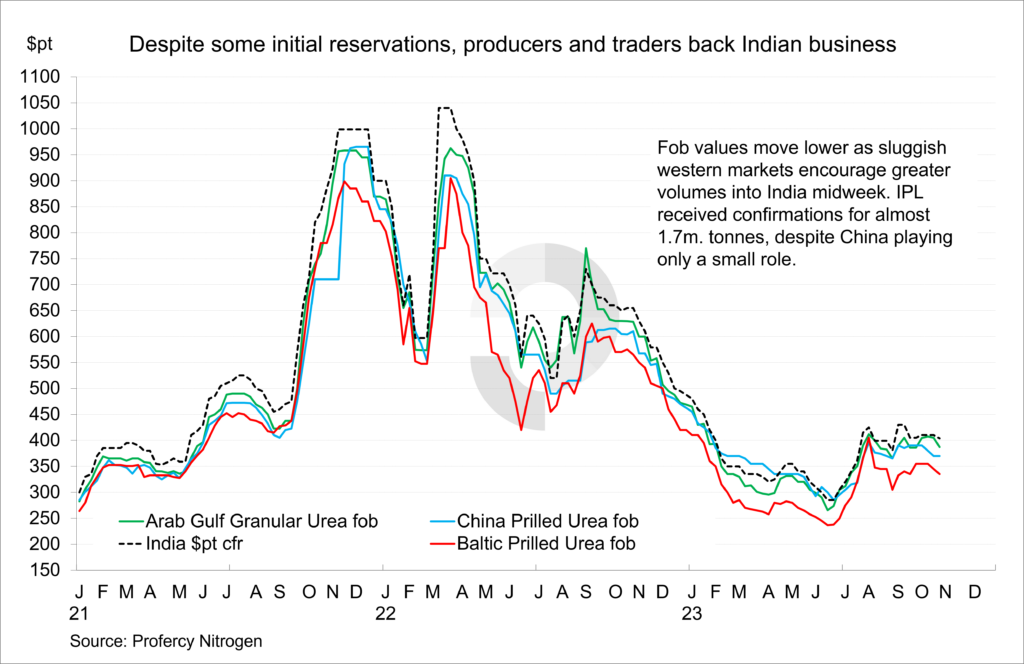

The agency was seeking shipments to India by 10 December with a target volume of over 1.5m. tonnes. After several rounds of counter offers being issued, IPL received confirmations yesterday for just under 1.7m. tonnes of urea at $400-404pt cfr. Letters of Intent are expected to be issued soon.

Unsurprisingly, Middle East material makes up at least one third of total confirmations. While notably below earlier producer price targets of over $400pt fob, netbacks in the mid to high-$380s pt fob compare favourably to those elsewhere.

Similarly, Russian prilled suppliers were quick to accept netbacks no better than $340pt fob in lieu of alternative outlets. With other markets largely indifferent to events in India earlier this week, some granular suppliers subsequently followed after initially declining the business.

In the east, a large portion of supply is set to come from SE Asia, with China only making a cameo appearance.

The emergence of Indonesian export licenses just before the IPL confirmation deadline facilitated close to 200,000t of additional confirmations. Pupuk Holdings rushed out a sales tender midweek and achieved $381.50pt fob for granular urea and marginally lower for a cargo of prilled urea.

Importantly though, suppliers from Africa have been less enthusiastic about Indian business with many opting to try their luck in Latin America and Europe. Only one prilled cargo ex-Egypt has thus far been confirmed for India.

The challenge of late has been that the European market has not been buoyant, forcing some Egyptian product long-haul at lower fob values, down to $385pt fob. For Europe, price targets have been $10-15pt higher.

Nigerian granular has been sold sub-$370pt fob for shipment to Latin America. Algerian producers have not sold significant volumes on a spot basis. All three origins have availability for November.

This said, high gas prices and a period of buyer inactivity has generated optimism regarding a resurgence in European demand. Brazil is also edging closer to a crucial phase of procurement.

The diminished availability of product in the global market for November, coupled with reduced eastern supply heading westward, has instilled a cautious stance among producers, disinclined to compromise on lower fob prices.

Crucially, the sizeable volume secured by India through IPL places numerous producers in a comfortable position for the next 45 days. Yet, it also fortifies India’s import position, particularly in view of recent domestic production levels, which were as high as 2.65m. tonnes in September, 150,000t above the year to August average.

By Chris Yearsley, Editor, Profercy Nitrogen